There are two sides to every coin. For penny stocks, or tickers that trade for less than $5 per share, this rings especially true. As some of the most divisive names on the Street, they are either met with resounding praise or forceful discontent.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Going beyond the argument that you get more for your money, even minor price appreciation can result in massive percentage gains. However, some investors prefer to avoid these stocks entirely, as the fact that shares are trading at such depressed levels could signal insurmountable headwinds or weak fundamentals.

Given the risk involved with penny stocks, due diligence is essential. It also doesn’t hurt to follow the activity of the best players in the stock picking game.

Billionaire Steven Cohen is among these Wall Street greats. Kicking off his investing career at Gruntal & Co., where he managed proprietary capital for 14 years, he went on to found S.A.C. Capital Advisors in 1992. These investment operations were then converted to Point72 Asset Management in 2014. Serving as Point72’s Chairman, CEO and President, Cohen has continued to deliver wins for his clients, with his reputation as one of Wall Street’s best-performers preceding him.

Turning to Cohen for inspiration, we took a closer look at three penny stocks Cohen’s Point72 made moves on recently. Using TipRanks’ database to find out what the analyst community has to say, we learned that each ticker boasts Buy ratings and massive upside potential.

Otonomy (OTIC)

First up we have Otonomy, which is focused on providing new treatment options for patients living with the debilitating impacts of disorders of the ear. Its strong pipeline and $3.51 share price have scored it substantial praise from the pros on Wall Street.

This is the stance taken by Cohen. Increasing its stake in the company by a whopping 388%, Point72 snapped up 774,259 shares in Q2. With the total size of the holding now landing at 974,259 shares, the position is valued at $3,527,000.

5-star analyst Charles Duncan, of Cantor, also counts himself as a fan. The analyst believes there are numerous clinical catalysts on the horizon that should be significant value drivers for the stock if successful.

“In addition to the positive topline data for OTO-313 in tinnitus that was PR’d in early 3Q20, we anticipate additional data reads over the next ~9 months. These potential value creation milestones include topline data from the pivotal P3 OTIVIDEX study, which we believe may lead to an NDA filing in 2021E, as well as data from the signal-seeking P1/2 study of OTO-413 in hearing loss(4Q20E). We believe these readouts could re-affirm Otonomy’s leadership position in the emerging field of high unmet need neuro-otology, as well as reinvigorate investor interest,” Duncan opined.

That said, Duncan remains focused on the Phase 3 study of OTIVIDEX in Ménière’s disease, the enrollment for which should wrap up in Q3 2020. The analyst is “encouraged that despite the challenges to trial conduct during this time, the company has noted that patient compliance remains high for reporting vertigo symptoms and that the integrity of efficacy data being collected via a daily telephone diary is intact.”

To this end, the top analyst rates OTIC an Overweight (i.e. Buy) along with an $11 price target. This target implies shares could climb 212% higher in the next twelve months. (To watch Duncan’s track record, click here)

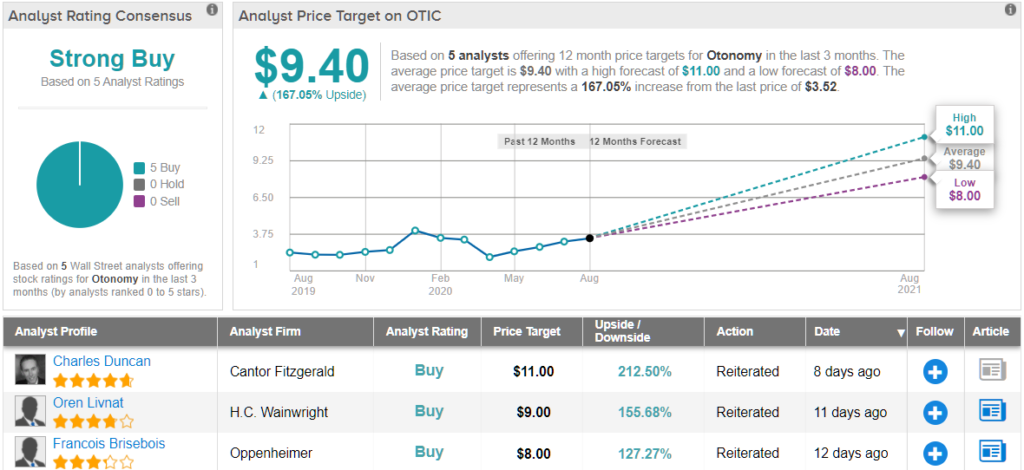

It’s not often that the analysts all agree on a stock, so when it does happen, take note. OTIC’s Strong Buy consensus rating is based on a unanimous 5 Buys. The stock’s $9.40 average price target suggests a 167% upside from current levels. (See Otonomy stock analysis on TipRanks)

Affimed (AFMD)

Using an innovative approach that involves actualizing the potential of the innate immune system, Affimed is working to advance immuno-oncology. With shares changing hands for $3.53, some on the Street believe that now is the time to pull the trigger.

AFMD has impressed the likes of Steven Cohen, with his firm adding 2,795,066 shares in Q2, increasing the position by 104%. The purchase brings the total holding to 3,461,093 shares, the value of which is $15,973,000.

Turning to the analyst community, SVB Leerink’s Daina Graybosch believes the company’s impressive pipeline makes it a stand-out.

Enrollment for cohort 2 of the first-in-human Phase 1/2a trial of AFM24, an EGFR/CD16A targeted innate cell engager for relapsed/refractory patients with advanced EGFR-expressing solid tumors, is on track. According to data presented at AACR, the candidate is distinct from “standard EGFR targeted antibodies and tyrosine kinase inhibitors (TKIs).”

Expounding on the results, Graybosch stated, “Though the assertions are not new, the updated preclinical dataset deepens support for AFM24’s potential differentiation from anti-EGFR mAbs and TKIs, which work primarily by inhibiting EGFR-pathway signaling… Importantly, the cytotoxicity of AFM24 is independent of EGFR density and presence of EGFR-pathway (EGFR, KRAS, BRAF) mutations, indicating that the program could have efficacy in patients across EGFR expression levels and regardless of mutation status. Its breadth and safety should enable use of AMF24 in a variety of indications.”

Data on RO-7297089, formerly AFM26, was also revealed at AACR. The cutting-edge BCMA-targeted innate cell engager for the treatment of multiple myeloma is being developed as part of a partnership with Genentech, with it now progressing through a Phase 1 global dose-escalation study. As the data demonstrated the therapy had activity across a wide range of BCMA target expression levels, Graybosch argues the results “shine a spotlight on Affimed’s collaboration with Genentech, which could deliver upside value to investors.” It should also be noted that milestone payments from Genentech have been triggered.

All of this keeps Graybosch with the bulls. As a result, the analyst continues to assign an Outperform (i.e. Buy) rating and $8 price target to the stock. Should her thesis play out, a potential twelve-month jump of 133% could be in the cards. (To watch Graybosch’s track record, click here)

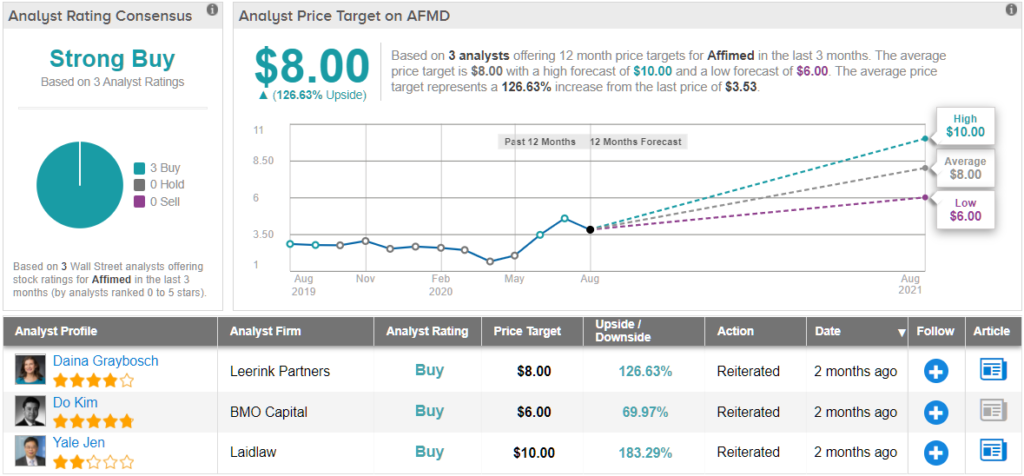

Overall, out of 3 total reviews published in the last three months, all 3 analysts rated the stock a Buy. So, the message is clear: AFMD is a Strong Buy. The $8 average price target matches Graybosch’s. (See Affimed stock analysis on TipRanks)

Mereo Biopharma (MREO)

Hoping to provide better therapies for patients with chronically debilitating and life-limiting rare diseases, Mereo Biopharma advances assets from other companies that were not progressed for strategic reasons to late-stage development. Based on its vast potential, some think that its $2.83 share price looks like a steal.

Cohen recently took the opportunity to get in on the action. Reflecting a new position, Point72 bought up 375,000 shares in Q2, with the value of the new holding landing at $1,148,000.

Writing for SVB Leerink, 5-star analyst Joseph Schwartz has high hopes for the company. Along with 2020 fundraising which removed the financial overhang and extended its cash runway into early 2022, he believes the news that etigilimab rejoined the development pipeline will “put this under-the-radar company on the map.”

Etigilimab, which was acquired during MREO’s reverse merger with OncoMed back in April, generated encouraging results as both a monotherapy and combination in Phase 1a and Phase 1b, respectively. Based on this data, MREO moved the candidate into a larger Phase 1b trial, which is slated to kick off in Q4 2020. Due to recent developments with other anti-TIGIT programs, the company plans to evaluate multiple tumor types in the Phase 1b trial of etigilimab in combination with an anti-PD1/PDL1.

“We believe MREO’s more deliberate venture into oncology could pay off handsomely for the company: Not only can MREO leverage the previous work and expertise of OncoMed, but investors interested in anti-TIGIT assets could bring new eyes to MREO’s rare disease pipeline which we believe merits a deeper look by the Street,” Schwartz explained.

On top of this, MREO plans to initiate a Phase 3 pediatric study of lead asset setrusumab (anti-sclerostin) for osteogenesis imperfecta (OI) in 2H20, with COVID-19 not expected to cause any delays. Schwartz points out that MREO received positive feedback from a Type B End-of-Phase 2 meeting with the FDA, after encouraging data from setrusumab’s Phase 2b ASTEROID study in adults with OI was released. “While the Phase 3 pediatric study design had prior alignment from the EMA, last month’s announcement removed a significant unknown on the path towards a global pivotal trial for setrusumab,” the analyst noted.

To this end, Schwartz rates MREO an Outperform (i.e. Buy) along with an $8 price target. This target conveys his confidence in MREO’s ability to soar 182% higher in the next twelve months. (To watch Schwartz’s track record, click here)

To find good ideas for penny stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.