Which stocks are either a fan favorite or a must-avoid? Penny stocks. These tickers going for less than $5 apiece are particularly divisive on Wall Street, with those in favor as well as the naysayers laying out strong arguments.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

These names are too appealing for the risk-tolerant investor to ignore. Given the low prices, you get more for your money. On top of this, even minor share price appreciation can translate to massive percentage gains, and thus, major returns for investors.

However, there is a but here. The critics point out that there could be a reason for the bargain price tag, whether it be poor fundamentals or overpowering headwinds.

So, how are investors supposed to determine which penny stocks are poised to make it big? Following the activity of the investing titans is one strategy.

Enter billionaire Steven Cohen. The legendary stock picker, who began his investing career at Gruntal & Co. where he managed proprietary capital for 14 years, founded S.A.C Capital Advisors in 1992. In 2014, his investment operations were converted to Point72 Asset Management, a 1,500-plus person registered investment advising firm. Throughout his career, Cohen has consistently delivered huge returns to clients, giving the Point72 Chairman, CEO and President guru-like status on the Street.

Turning to Cohen for inspiration, we took a closer look at three penny stocks Cohen’s Point72 made moves on recently. Using TipRanks’ database to find out what the analyst community has to say, we learned that each ticker boasts Buy ratings and massive upside potential.

Cocrystal Pharma (COCP)

Working to bring targeted solutions to market, Cocrystal Pharma develops antiviral therapeutics for the treatment of serious or chronic viral diseases including influenza, hepatitis C, gastroenteritis caused by norovirus, as well as COVID-19. Based on the progress of its pipeline and $0.84 share price, some see significant gains in COCP’s future.

Cohen is among those that have high hopes for this healthcare name. Pulling the trigger on COCP for the first time, Point72 purchased more than 2.8 million shares. The value of the firm’s new holding comes in at over $2.5 million.

Meanwhile, 5-star analyst Raghuram Selvaraju, of H.C. Wainwright, tells clients to focus on COCP’s achievements over the last few months. In August, preclinical animal studies of coronavirus antiviral compounds, which constituted possible development candidates for the company, were published in the medical journal, Science Translational Medicine.

It should be noted that as per license agreements with Kansas State University Research Foundation (KSURF), COCP has an exclusive, royalty-bearing right and license to certain antiviral compounds for humans and small molecule inhibitors against coronaviruses, picornaviruses and caliciviruses covered by patent rights controlled by KSURF. According to Selvaraju, the company wants to continue developing these compounds as treatments for coronavirus-related infections.

On top of this, last month, Cocrystal released promising in vitro and seven-day toxicity data for its influenza A preclinical lead molecule, CC-42344, which is being evaluated in (IND)-enabling studies as a possible treatment for seasonal and pandemic influenza strain A. Management expects to wrap up the IND-enabling studies and the candidate to enter clinical trials in 2021.

Looking more closely at CC-42344, Selvaraju points out that it is a “potent, broad spectrum inhibitor of the influenza replication enzyme targeting the PB2 subunit, and has strong synergistic effects when combined with approved influenza antiviral drugs including Tamiflu (oseltamivir) and Xofluza (baloxavir).” He argues that as recent data demonstrates the drug retained single-digit nanomolar potency against baloxavir-resistant influenza A strain, it could “facilitate demonstration of CC-42344’s superiority when seeking FDA approval.”

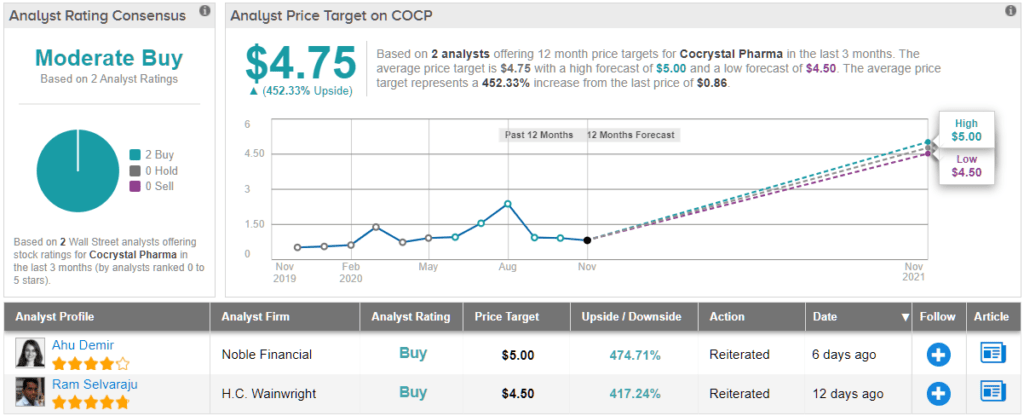

To this end, Selvaraju rates COCP a Buy along with a $4.50 price target. Should this target be met, a 417% upside potential could be in store. (To watch Selvaraju’s track record, click here)

Overall, 2 Buys and no Holds or Sells have been assigned in the last three months. Therefore, the analyst consensus is a Moderate Buy. At $4.75, the average price target puts the upside potential at 452%. (See COCP stock analysis on TipRanks)

DiaMedica Therapeutics (DMAC)

Using its patented and licensed technologies, DiaMedica Therapeutics develops novel recombinant proteins to treat kidney and neurological diseases. Currently going for $4.3 apiece, this name has scored significant praise recently.

Also reflecting a new position for Cohen’s firm, Point72 bought up 800,000 shares in the third quarter, with the value of the holding landing at $3.4 million.

Writing for Guggenheim, 5-star analyst Etzer Darout points out that company’s lead drug, DM199, a synthetic Kallikrein-1 (KLK1) replacement therapy designed for patients with chronic kidney disease (CKD) and acute ischemic stroke (AIS), is a key component of his bullish thesis. According to the analyst, early clinical data on DM199 in U.S. patients as well as porcine and human urinary-derived KLK1 in Asia serve as “clinical evidence of the role of KLK1 therapy and the potential for DM199 as a potentially differentiated therapy in CKD and stroke.”

Going forward, the analyst believes the next clinical milestone for the therapy is proof-of-concept data in three CKD populations: patients with Immunoglobulin A Nephropathy (IgAN), hypertensive African Americans with APOL1 gene mutations (APOL1 HT AAs) and patients with diabetic kidney disease (DKD). That said, the main value driver is IgAN, in Darout’s opinion.

“Competitor programs advancing in IgAN have demonstrated improvements in proteinuria with stable eGFR, two key markers of kidney function. However, early clinical experience suggests that DM199 has the potential to improve both eGFR and proteinuria which would be a significant upside case to our assumptions. If DM199 can demonstrate a ~25%-plus decrease in proteinuria and increase in eGFR (which early data suggests is achievable), it would increase our confidence that DM199 could become the standard of care across CKD indications beyond what we currently model,” Darout explained.

Looking at the market opportunity, there are roughly 690,000 strokes in the U.S. per year (1.1 million strokes in the EU), of which, 87% are deemed ischemic strokes, says the American Heart Association (AHA). Additionally, in the U.S., 90% of acute ischemic stroke patients receive palliative care.

Based on Darout’s estimates, if half of patients on palliative care are treated with DM199, AIS could be a $3-$5 billion opportunity for DMAC in the U.S.

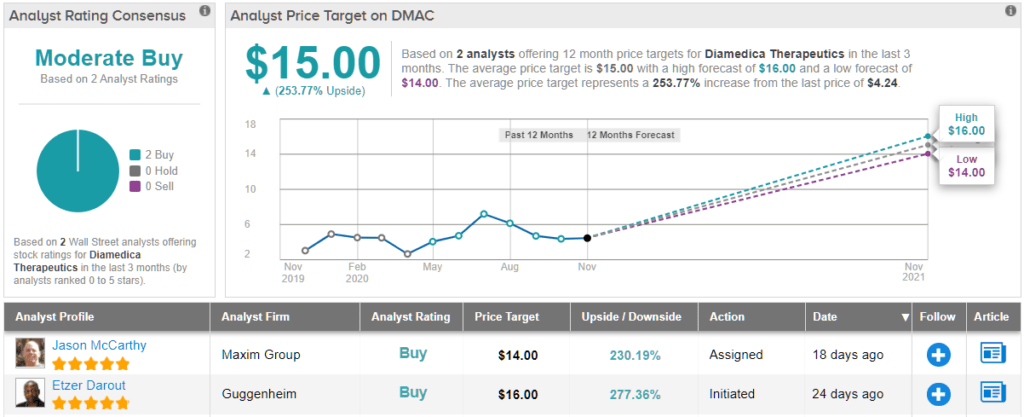

It should come as no surprise, then, that Darout stayed with the bulls. In addition to a Buy rating, he left a $16 price target on the stock. Investors could be pocketing a gain of 277%, should this target be met in the twelve months ahead. (To watch Darout’s track record, click here)

What do other analysts have to say? 2 Buys and no Holds or Sells add up to a Moderate Buy analyst consensus. Given the $15 average price target, shares could soar 253% in the next year. (See DMAC stock analysis on TipRanks)

To find good ideas for penny stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.