Snap (SNAP) has been a fascinating yet eyebrow-raising company. On the one hand, it has delivered encouraging top-line growth metrics, including pulse-raising increases in daily active users (DAUs). On the other hand, Snap’s stubborn reliance on stock-based compensation has restrained the company from achieving substantial revenues, earnings, and profitability. It would seem deeper issues are lurking under the surface of SNAP’s positive revenues and free cash flow.

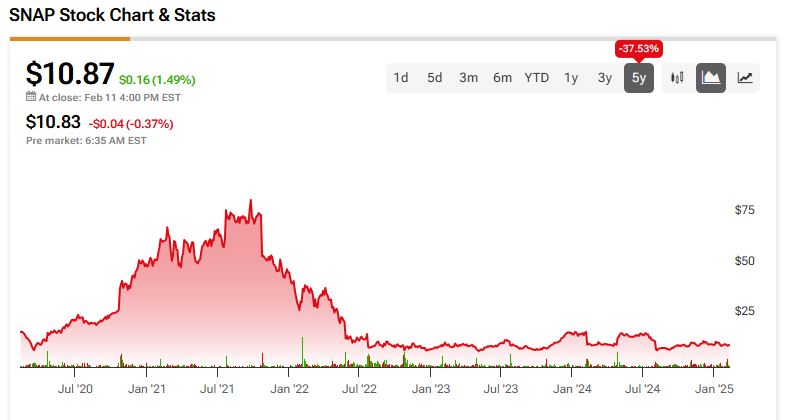

I’m specifically referring to ongoing share dilution, which continues to erode equity value and is reflected in SNAP’s prolonged underwhelming stock performance. A closer look at Snap’s latest financial results reveals that headline metrics don’t tell the whole story about this plucky social media tech stock.

Revenue Growth Reaccelerates, but Margins Remain Frail

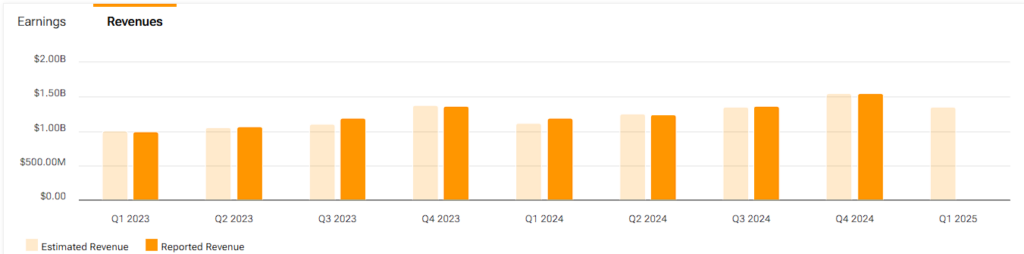

At first glance, when you look at Snap’s latest numbers, you might feel somewhat encouraged. In Q4 2024, the social media giant posted $1.56 billion in revenue, reflecting a 14% year-over-year increase. Significantly, this marked an acceleration in revenue growth compared to the 4.7% growth posted last year. Much of that momentum stemmed from direct-response (DR) advertising, which surged 16% for the full year.

Meanwhile, Snap’s Daily Active Users hit 453 million, a 9% uptick compared to Q4 of 2023. There’s no denying that despite failing to compete at the level of Meta Platfroms’ apps, there is some appeal for Snap’s app that keeps attracting and retaining a broad user base.

Still, despite these bright spots, SNAP’s market position remains shaky, to say the least. The company posted an operating loss of $26.9 million, an improvement compared to the $248.7 million loss last year, but still very much in negative territory. Despite Snap’s progress over the past decade, it’s still not turning a GAAP profit.

Therefore, much of Snap’s communication focuses on adjusted EBITDA and free cash flow—which, on the surface, might give investors reason to be optimistic. Snap reported $276 million in adjusted EBITDA and $182 million in free cash flow for the quarter. However, these are far from suitable profitability indicators, especially when stock-based compensation figures are heavily involved.

SNAP’s Stock-Based Compensation Problem

One of the most glaring issues that continues to weigh on my evaluation of Snap is its reliance on stock-based compensation (SBC). In Q4 alone, Snap shelled out a hefty $257.7 million in SBC expenses. While the company highlighted that this figure is 23% lower than last year, the absolute amount remains hefty.

More importantly, SBC exceeded free cash flow, meaning Snap’s free cash flow ex-SBC was negative. Paying employees such massive portions of their compensation in stock has two main effects: it restrains free cash flow (the company’s cash goes down over time, excluding extra financing) and dilutes existing shareholders. For context, Snap’s share count has increased 47% since 2017, which may seem like a slap in the face for many long-term shareholders looking for value.

As if that wasn’t enough, SNAP’s insiders have also undermined investor confidence by their recent transactions. According to insider transactions, as reported to the SEC, SNAP’s management has sold more stock than the sector average. On TipRanks, SNAP’s insider confidence signal is Very Negative, based on six informative insider transactions over the past three months.

Valuation Doesn’t Reflect Persistent Weakness

Share dilution aside, Snap’s valuation is still too high when you factor in the company’s persistent losses. Today, the stock trades roughly 30x this year’s expected adjusted EPS. But the key word here is “adjusted,” which excludes a good chunk of the stock-based compensation that skews Snap’s bottom line. So, in reality, shareholders are forced to pay more when you include the dilutive effects of SBC.

Analysts forecast brighter days ahead, anticipating that Snap’s earnings (even if adjusted) will rise significantly in the coming years. Yet, the prolonged track record of losses and disrespectful equity and capital management since the IPO leaves me unconvinced. This is particularly true when more prudent alternatives, such as Meta Platforms (META), are available at a much cheaper forward P/E of 28x while carrying less risk.

Is SNAP a Good Stock to Buy?

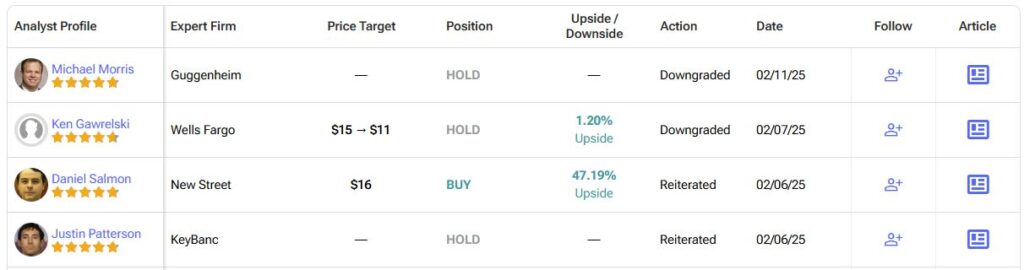

Following three years of flatlining stock prices, Wall Street appears to have mixed feelings about the stock. SNAP stock features a Hold consensus rating based on six Buy, 24 Hold, and one Sell ratings obtained over the past three months. SNAP’s average price target of $13.27 per share implies a 22% upside potential compared to current levels.

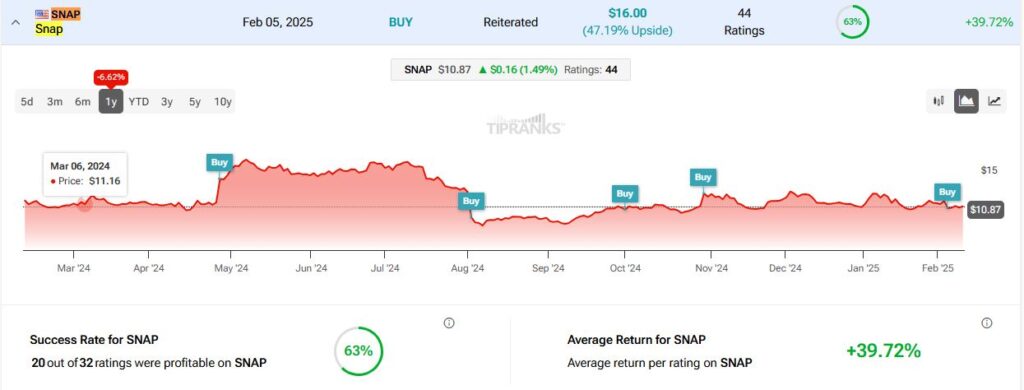

On TipRanks, currently, the most accurate and most profitable analyst covering the stock (on a one-year timeframe) is Ross Sandler from Barclays, with an average return of 39.72% and a success rate of 63% on SNAP stock over the past year.

SNAP’s Conversion Ability Will Decide Its Fate

Snap’s latest earnings report showed some positive trends, mainly in revenue growth and DAU expansion. Still, the company remains unprofitable, and its free cash flow continues to be inflated by stock-based compensation.

With no well-communicated roadway to sustainable profitability despite Wall Street’s optimistic medium-term EPS estimates, I believe that SNAP remains a high-risk investment considering the relentless dilution and the stock’s extended valuation. The fact that the stock is somewhat overvalued yet has been plateauing for three years straight should raise eyebrows. It also offers very little in upward share price catalysts or long-term value projects to bolster performance.

My verdict on SNAP remains pessimistic until the company can convert its revenue and user base into meaningful, consistently positive bottom-line results. For those already invested in SNAP, keep a close eye on whether management follows through on reducing SBC and delivering GAAP profits. A failure to remedy these two corporate flies in SNAP’s financial ointment could cost the social media stock dearly in the long term. A stitch in time saves nine.