BELLUS Health (BLU) is a clinical-stage biopharmaceutical company developing novel therapeutics for the treatment of refractory chronic cough (RCC) and other hypersensitization-related disorders. The company’s lead product candidate is BLU-5937, an investigational candidate that inhibits the P2X3 receptor, a target linked to hypersensitivity.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

I am neutral on BELLUS Health.

The company is developing BLU-5937 for the treatment of chronic itch and cough. Recently, Bellus announced positive results from a pre-planned administrative interim analysis of the ongoing Phase 2b SOOTHE trial of BLU-5937.

The SOOTHE trial is a multicenter, randomized, double-blind, four-week, placebo-controlled Phase 2b trial that was conducted among 300 participants with RCC. It evaluated BLU-5937 in three doses: 12.5 mg, 50 mg, and 200 mg.

The interim analysis met the high probability of clinical efficacy threshold.

Robert Bellini, President, and CEO of BELLUS Health commented, “We believe the encouraging SOOTHE Phase 2b trial interim analysis will enable us to accelerate the planning for our Phase 3 program while awaiting SOOTHE final results. With trial enrollment progressing as planned, we anticipate announcing topline data in the fourth quarter of 2021.” (See Bellus Health stock chart on TipRanks)

H.C. Wainwright analyst Andrew Fein said that his “sentiment toward BLU-5937 remains firm, and we reiterate that regardless of gefapixant being first to market, we still view BLU-5937 as highly differentiated based on safety alone, with interim analysis supporting limited taste related adverse events with no serious AEs[adverse effects].”

Gefapixant is Merck’s (MRK) orally administered drug for RCC. A New Drug Application (NDA) for that drug was accepted for review by the U.S. Food and Drug Administration (FDA) in March this year.

Following the positive data for BLU-5937, analyst Fein reiterated a Buy and raised the price target from C$10 to C$14 (98.7% upside) on the stock. Yesterday, following the Phase 2b trial results for BLU-5937, the stock shot up by 16.5% to close at $5.57.

Analyst Fein also believes that the company “has another shot at a positive stock inflection point stemming from the top-line data from the Phase 2 BLUEPRINT study of BLU-5937 in chronic pruritus due to atopic dermatitis (AD).”

The company said in its Q2 press release that as of August 2021, 90% of its enrollment target of 128 patients were enrolled in the BLUEPRINT trial. BLUEPRINT is a Phase 2 proof-of-concept trial, looking at the efficacy and safety of BLU-5937 in patients with chronic pruritus associated with AD.

Fein is of the opinion that while Regeneron’s (REGN) Dupixent was newly approved for AD, “it comes at high cost to patients’ lives and wallets and does not directly address chronic pruritus.”

Furthermore, the analyst pointed out that while Eli Lilly’s (LLY) lebrikizumab has shown promise when it comes to the treatment of AD, “the efficacy of the treatments remains imperfect and does not address the impact on quality-of-life, which BLU-5937 aims to address.”

Fein added that when it comes to the valuation of the company, “The recent interim clinical data from SOOTHE further de-risks BLU-5937, while competitor data further de-risks the P2X3 class as a whole. As such, we are increasing our PoS [point-of-sale] of BLU-5937 in RCC from 35% to 45%, representative of a substantial premium to comparative Phase 2 programs.”

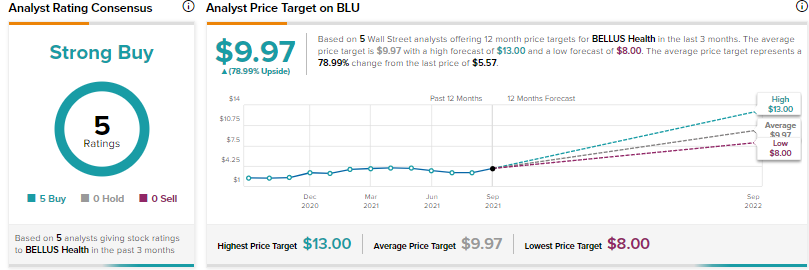

Turning to the rest of the Street, analysts are bullish about BELLUS Health, with a Strong Buy consensus rating, based on 5 Buys.

The average BELLUS Health price target of $9.97 implies approximately 79% upside potential from current levels.

Disclosure: At the time of publication, Shrilekha Pethe did not have a position in any of the securities mentioned in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of Tipranks or its affiliates, and should be considered for informational purposes only. Tipranks makes no warranties about the completeness, accuracy or reliability of such information. Nothing in this article should be taken as a recommendation or solicitation to purchase or sell securities. Nothing in the article constitutes legal, professional, investment and/or financial advice and/or takes into account the specific needs and/or requirements of an individual, nor does any information in the article constitute a comprehensive or complete statement of the matters or subject discussed therein. Tipranks and its affiliates disclaim all liability or responsibility with respect to the content of the article, and any action taken upon the information in the article is at your own and sole risk. The link to this article does not constitute an endorsement or recommendation by Tipranks or its affiliates. Past performance is not indicative of future results, prices or performance.