Gold is likely to remain a key investment theme in a dynamic global environment with several fundamental and macroeconomic challenges. One way to gain gold exposure is through investing in gold mining stocks.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Barrick Gold (GOLD) seems like an attractive investment option among gold miners. In April 2022, GOLD stock surged to highs of around $25.90. However, the stock has subsequently corrected and currently trades at around $17 per share.

I believe that the correction is a good opportunity to consider fresh exposure to GOLD stock. I am bullish on the gold miner from a medium-to-long-term investment perspective. This 2.3%-yielding stock is a potential value creator.

Let’s discuss the reasons for this bullish view.

Gold Likely to Trend Higher

Some may wonder why they should be bullish on gold when policymakers are pursuing an aggressive contractionary monetary policy.

The first point to note is that inflation in the United States is at a 40-year high. Even with multiple rate hikes, real interest rates remain negative. As long as real rates are negative, gold is likely to remain resilient. Gold has traditionally been a good inflation hedge, and with the big correction in bitcoin (BTC-USD), more fund allocation toward gold is likely.

Another point to note is that there is a possibility of a recession in the U.S. in 2023. This might also imply a global slowdown or recession. In a recessionary scenario, the “risk-off trade” is dominant, and gold is expected to outperform. At the same time, if there is a sharp economic slowdown, policymakers will hold back on aggressive rate hikes. This will be positive for gold.

The rise in geopolitical tensions is another factor that will support the price of gold. There are several friction points globally, and investors will seek refuge in hard assets like gold.

It’s therefore not surprising that gold has held up slightly better than the overall market. Given the macroeconomic factors, the precious metal is likely to trend higher in the next 12-24 months.

Barrick Gold Has a Strong Credit Profile

If we consider factors specific to the company, a robust balance sheet is the first reason to like Barrick Gold.

As of March 2022, Barrick Gold reported cash and equivalents of just under $5.9 billion. This provides ample cash buffer for capital investments. Further, the company’s debt has remained stable in the last 12 months, at $5.1 billion. Clearly, internal cash flows have been sufficient for capital investments and dividends.

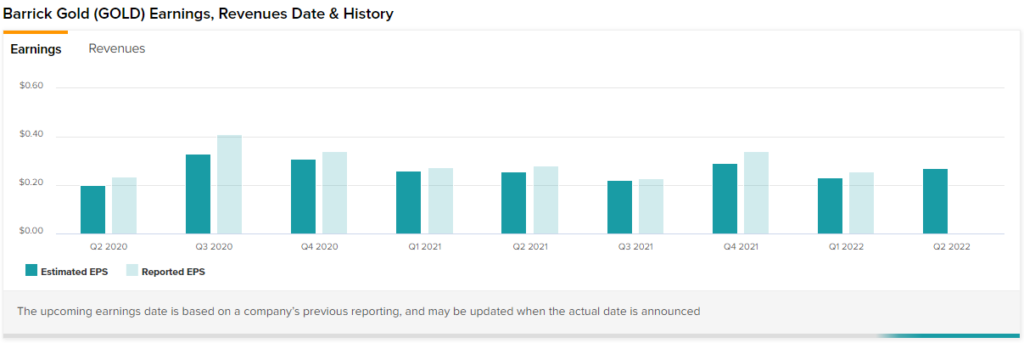

It’s also worth noting that for Q1 2022, Barrick Gold reported operating cash flow of $1.0 billion and free cash flow of $393 million. Earnings per share have also been strong, as shown below.

There are two positives to consider as cash flows remain robust. First, Barrick Gold can sustain dividends and has the headroom to increase dividends if gold trends higher. Any potential increase in dividends will translate into a stock re-rating.

Further, with a free cash flow run rate of $1.57 billion, Barrick Gold can deleverage. Also, the company has enough financial muscles to pursue acquisitions.

S&P Global (SPGI) recently upgraded the company’s credit rating to BBB+ with a stable outlook. If gold breaches $2,000 an ounce in the next few quarters, a further rating upgrade seems likely.

Quality Assets for Long-Term Cash Flow Stability

Barrick Gold also has quality assets that provide clear cash flow visibility. To put things into perspective, the company reported 69 million ounces of proven and probable gold reserves as of December 2021.

Additionally, the company has 160 million ounces of measured and indicated gold resources. Given its financial profile, the company is well-positioned to invest in converting resources to proven reserves. As a base-case scenario, the current assets provide stable production visibility through the next decade.

The company’s assets are also attractive from a cost perspective. For Q1 2022, Barrick reported a cash cost of $832 per ounce and an all-in-sustaining cost of $1,164 per ounce. Even if gold trades around $1,700-$1,800 per ounce, free cash flows should remain robust.

In an optimistic scenario, the company expects attributable free cash flows to increase by $1.5 billion for every $100 change in the gold price. Therefore, the visibility for dividend growth is robust if gold reaches $2,000 an ounce.

Overall, even without any asset addition in the medium term, Barrick Gold has clear production visibility.

Wall Street’s Take on Barrick Gold

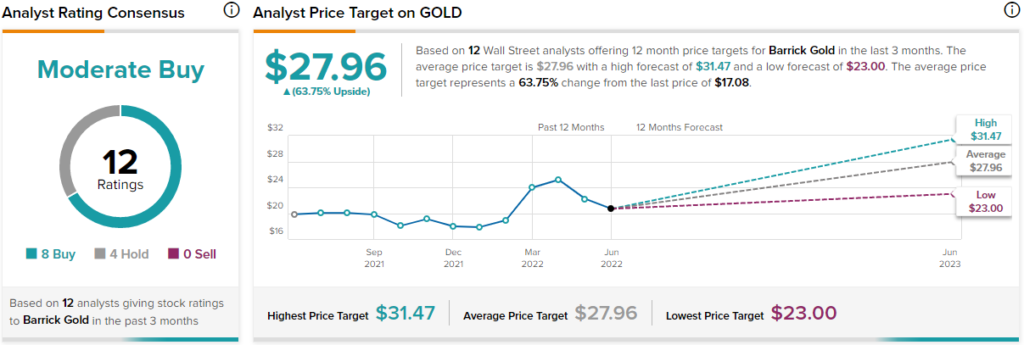

Turning to Wall Street, Barrick Gold has a Moderate Buy consensus rating based on eight Buys and four Hold ratings assigned in the past three months. The average Barrick Gold price target of $27.96 implies 63.8% upside potential.

Concluding Views – Barrick Gold Can Benefit During Tough Times

Given the macroeconomic and geopolitical scenario, funds are likely to flow into precious metals. Barrick Gold seems to be trading at an attractive valuation and is worth considering. The visibility for dividend growth also makes GOLD stock attractive.

In terms of risk, if inflation is curbed and a recession is prevented, the “risk-on trade” will gain traction. However, there is a low probability of this scenario panning out. With a strong balance sheet, Barrick Gold has relatively low financial risk.

Overall, Barrick Gold has positive tailwinds, and the company seems well-positioned for long-term value creation.