The Canadian Banks earning season is among the most anticipated in the country. Why? Canada’s Big Six banks are among the most widely held stocks. From retail investors to pension plans, Canadians nationwide count on strong performance from their bank holdings.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Secondly, they were all poised to raise dividends since the Feds lifted the freeze a few weeks ago.

Unfortunately, the Bank of Nova Scotia (BNS) has lagged its peers over the past number of years. While it is likely the bank with the highest upside, I remain neutral on the stock. (See Analysts’ Top Stocks on TipRanks)

Mixed Q3 Results

On November 30, the Bank of Nova Scotia released mixed quarterly results. Earnings of C$2.10 per share beat estimates by C$0.20, while revenue of C$7.69 billion missed by C$260 million.

Predictably, the markets didn’t exactly embrace these results as the stock dropped by 2.2% on the day of earnings. Not only were quarterly results mixed but the markets are once again becoming spooked by COVID-19 variables.

Provision for credit losses, a key industry metric, featured a net reversal of $50 million. This follows a net reversal of $27 million from last quarter, and the PCL ratio dropped by seven basis points.

After being reduced due to the pandemic, the Canadian domestic stability buffer returned to normal as of October 31. This means, that the full CET1 ratio of 10.5% is now in effect (up from 9% previously).

Is this a concern for the Bank of Nova Scotia? Not in the slightest. The bank’s CET1 ratio came in at 12.3%, which is an increase of 50 basis points from the prior year. Canada’s banks are among the best capitalized in the world, and Scotiabank is no exception.

Signs of a Turnaround

The biggest headwind facing the bank is its exposure to Latin America. This segment has taken longer to rebound from the pandemic as it was more severely impacted.

The good news on this front: International Banking segment earnings improved throughout 2021 and generated adjusted earnings of $1.86 billion, an increase of 62% compared to the prior year. This is a good sign.

The bad news? If the Omicron COVID-19 variant finds its way to Latin America, the segment may once again begin to weigh on financials. However, if this segment can realize its full potential, this will drive significant earnings growth for the company.

It is for this reason that the Bank of Nova Scotia has the highest upside. Since the International Banking segment has taken longer to rebound, it has more upside.

Unfortunately, it has not materialized yet and has had the opposite effect. It is the main reason why the Bank of Nova Scotia has been the worst performing Big Six bank of the past decade. Until it can show sustained improvement in this area, it’ll continue to trail its peers.

Strong Dividend Growth

On the bright side, the bank did announce a higher-than-expected dividend raise. When compared against historical payout ratios, the Bank of Nova Scotia was largely expected to announce a lower dividend raise than its peers.

However, the company announced a C$0.10 increase in the quarterly dividend to C$1.00 per common share, an 11% raise. This was certainly welcom news for investors and as a result, the Bank of Nova Scotia will maintain its Canadian Dividend Aristocrat status.

Not that the dividend was ever in jeopardy, but the higher raise puts the company’s payout ratio above historical averages. This is a sign that management is confident in its ability to deliver strong growth.

“As we look forward to 2022, we expect to deliver strong growth across all our business lines, with optionality and multiple avenues to grow,”

CEO, Brian Porter

Time will tell if Scotiabank can finally deliver on this promise, but this quarter was a small step in the right direction.

Wall Street’s Take

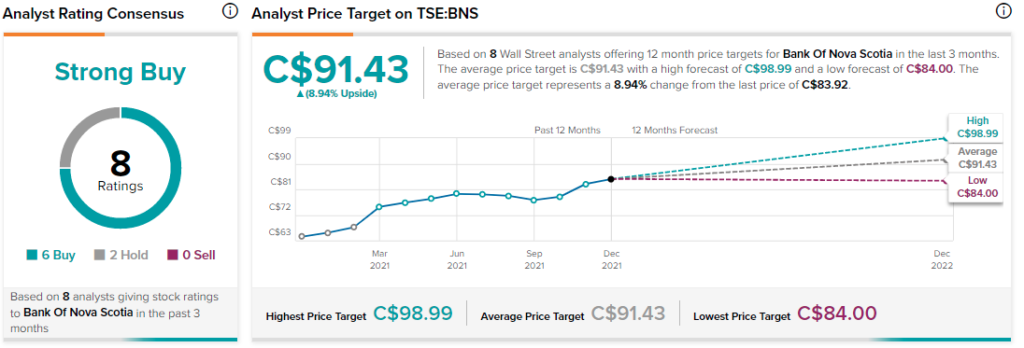

From Wall Street analysts, the Bank of Nova Scotia earns a Strong Buy analyst consensus based on six Buy ratings, two Hold ratings, and no Sell ratings.

The average Bank of Nova Scotia price target of C$91.43 puts the upside potential at 8.9%.

Disclosure: At the time of publication, Mat Litalien did not have a position in any of the securities mentioned in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates Read full disclaimer >