We’re nearly a full month into 4Q24, and that means that we can no longer ignore winter here in the northern hemisphere. The back end of the year brings with it the holidays, of course, but also cooler weather – and in many places, downright cold. Usually, this will boost both demand and pricing for natural gas, the fuel of choice for home heating, but this year appears to be different.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

To start with, the weather outlook is predicting mild temperatures for the rest of the year – and that has natural gas futures pricing running lower. In addition, supplies are up – another key factor that will push prices down. And finally, on the geopolitical front, Israel surprised us all to the upside with a limited retaliatory strike against Iran – and hydrocarbon prices fell again. The result? A natural gas market featuring high supply and lower pricing, and winter storage that is fuller than usual.

It might seem counterintuitive to buy into a market like this, but Bank of America is saying to do just that. Watching the energy sector, the bank is recommending two energy stocks, both in the natural gas segment, as buys right now. One potential reason for going bullish on gas: demand is increasing from the utility sector, as the expanding data center sector has a voracious appetite for power.

We ran these tickers through the TipRanks database to see what other Street experts make of their chances. Let’s give them a closer look.

EQT Corporation (EQT)

First up is EQT, a natural gas company with extensive operations in the Appalachian region of the US. The company has land holdings in Marcellus and Utica shale formations, in the states of Pennsylvania, West Virginia, and Ohio. These formations are known for their rich natural gas deposits – and EQT is known for its long expertise in fracking and horizontal drilling techniques that have significantly increased production levels in the US gas sector.

EQT is the largest natural gas producer working in the US. The company’s size is a direct result of its growth policies; EQT earlier this year completed its acquisition of Equitrans Midstream, and is in the process of realizing up to $425 million in synergies from the combination. Those synergies will come from the link between EQT’s 4,000-plus drilling locations with the Equitrans network of midstream assets.

In addition, EQT is working for the future by making a strong commitment to the development of ‘green’ energy resources. The company is part of the Appalachian Regional Clean Hydrogen Hub (ARCH2), a hydrogen energy development project, and in July of this year ARCH2 advanced to Phase 1 status, an award from the US Department of Energy that unlocked $30 million in funding. Future phases may unlock up to $925 million. These funds are part of the $7 billion initiative in clean hydrogen under the 2021 Bipartisan Infrastructure Law.

In the meantime, EQT is increasing its operations and output in the natural gas sector. The company generated $1.28 billion in total revenues during the third quarter of this year – a figure that was up 8.5% from 3Q23 yet missed the forecast by $110 million. At the bottom line, EQT reported non-GAAP EPS of $0.12, beating the Street’s forecast by $0.05.

We should note here that EQT’s sales volumes in Q3 beat the high-end of guidance, coming in at 581 Bcfe. The company credited that strong performance result to continued high production from the wells and to gains from improved operational efficiency.

For Bank of America’s analyst Kalei Akamine, this stock represents all that investors should be looking for in a gas producer. In a recent note, he says of the stock, “We believe EQT is a compelling investment opportunity for investors looking to capitalize on the structural shift taking place in natural gas markets. The often discussed LNG buildout that could add 16% to domestic demand and tether US fundamentals to the global market is finally here and evident in a contango sloped forward curve… At $3.20 baked in, EQT is below fair value versus our $3.75 base case, and there’s room for appreciation from deleveraging that opens a path to a lower cost of capital. Separately, a strong balance sheet likely allows EQT to cut hedges and opt for more commodity exposure, making it a preferred name for gas exposure.”

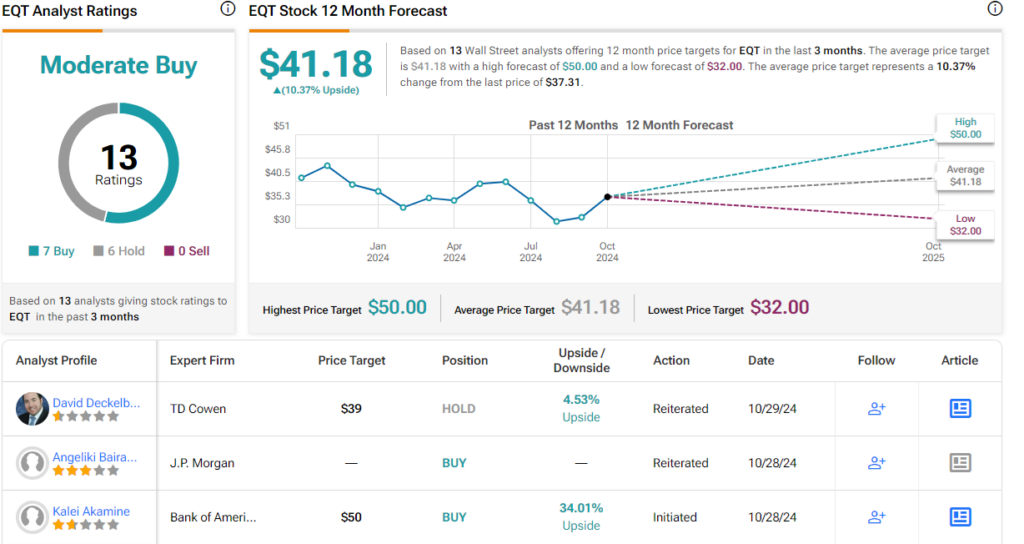

Akamine follows up that stance with a Buy rating here, and a $50 price target that suggests a one-year gain of 34% for EQT. (To watch Akamine’s track record, click here)

Overall, this stock’s Moderate Buy consensus rating is based on 13 recent reviews that include a 7 to 6 split favoring Buy over Hold. The shares are trading for $37.31 and the average price target of $41.18 implies an upside of 10% for the coming months. (See EQT stock forecast)

Antero Resources (AR)

Next on the list is Antero Resources, another of the US hydrocarbon sector’s natural gas specialists. Antero, like EQT, operates in the Marcellus and Utica formations of Appalachia, and its holdings are located in West Virginia and contiguous areas of Ohio, along the upper parts of the Ohio River. The company boasts over 500,000 net acres in its operating area.

The bulk of Antero’s holdings, some 440,000 net acres, are located in the northern part of West Virginia. The company has 1,200 productive horizontal wells operating in this region. In Ohio, Antero has some 200 wells operating in the Utica Shale, on holdings that total 75,000 net acres. Antero is positioned to expand both its West Virginia and Ohio operations, as it has more than 1,600 undeveloped drilling locations in the former state and over 250 in the latter. Antero’s extensive holdings and production make the company one of the largest suppliers for the US liquified natural gas (LNG) sector.

What this means on the financial side is that even during a period of relatively soft demand, Antero posted over $978 million in quarterly revenues during 2Q24. That figure was up a modest 2.7% from the prior year period yet beat the forecast by $8.65 million. At the bottom line, Antero’s EPS, at a loss of 21 cents per share, was 6 cents per share lower than expected. During Q2, the company increased its net production averages by 1% year-over-year, to 3.4 Bcfe/d.

Checking in again with BofA’s Akamine, we find the analyst is optimistic here. He says of the company, “We believe Antero is an investment case that has the luxury of time on its side, afforded by one of the deepest inventories of drilling locations of any US E&P, at 30 years. We forecast Antero generating ~$1.3-1.4bn in cash flow, and $600-700mn of free cash flow, for the duration of its drilling inventory, and would expect Antero to transition to net cash by 2027. When leverage falls into the 0.5x to 1.0x range in 2025, we believe it’s likely to see the company install a meaningful maiden dividend to reward shareholders.”

The analyst sums up his view of this company’s forward prospects, suggesting it as a long-term asset for investors and writing, “Wrapped together, we see Antero as a name in transition, from over-levered to rightsized, from growth to harvest, and with long dated option value afforded by inventory depth to see continued improvement long-term.”

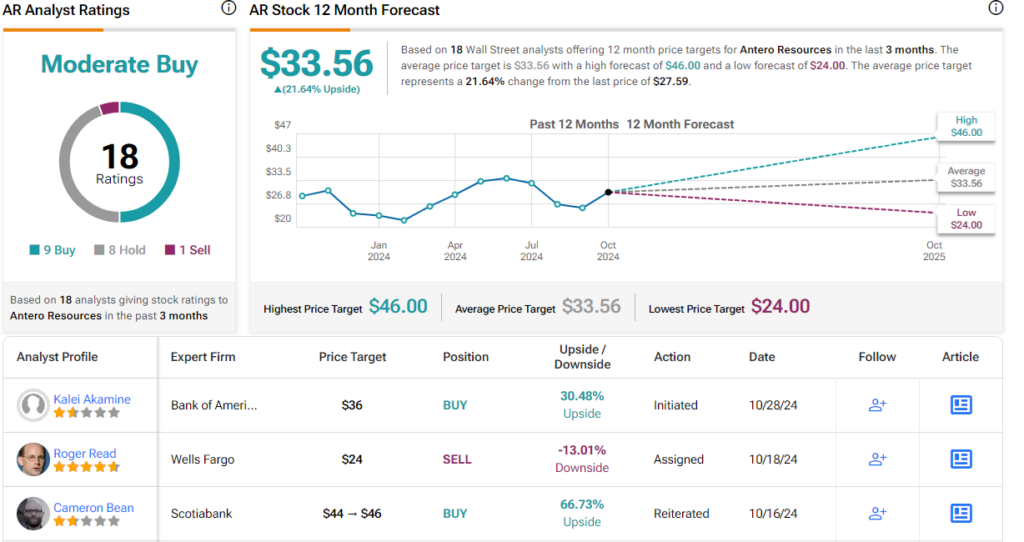

At bottom, Akamine puts a Buy rating here, with a $36 price target that indicates potential for a 31.5% upside on the one-year horizon.

Antero’s stock holds a Moderate Buy rating from the Street’s consensus after receiving 18 reviews from the analysts, including 9 Buys, 8 Holds, and 1 Sell. The shares are trading for $27.59 and have a $33.56 average price target, implying that they will gain 21.5% by this time next year. (See Antero’s stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.