The AI boom has opened up new opportunities in tech, and investors have not been shy about buying in. But – some due diligence is needed, because not all of the openings in AI-related tech will bring the strongest returns.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

One area that does stand out is NAND chips – the non-volatile, high-density memory storage technology that powers everything from smartphones to data centers. These chips are not only essential to solid-state drives but are also increasingly critical to the infrastructure supporting AI and cloud applications. With global demand rising – driven by orders for high-capacity AI servers, expanding cloud services, and the growing footprint of IoT – NAND looks like a compelling investment play.

Recognizing this trend, Bank of America is pounding the table on select NAND chip stocks. Its analysts are especially bullish on mid-cap names in the space, seeing them as well-positioned to capture gains as the AI tailwinds grow stronger.

With that in mind, we turned to the TipRanks database to check the broader Wall Street sentiment on two of BofA’s top picks. Let’s take a closer look.

Silicon Motion (SIMO)

Silicon Motion, the first stock that we’ll look at here, is one of the chip industry’s smaller players, with a market cap of $2.36 billion and $803 million in total revenue last year. The American-Taiwanese company focuses on designing and producing NAND chips for SSD controllers, and it leads the market in SSDs for servers, PCs, and other client devices. Silicon Motion also supplies the customized high-performance SSD solutions required by hyperscale data center and industrial customers, and its enterprise customers include a wide range of OEMs, NAND flash vendors, and storage device module providers.

This past May, Silicon Motion highlighted some of its latest SSD controllers at the COMPUTEX 2025 expo in Taipei. The controllers were the SM2504XT and the SM2324; the first is an ultra-low-power PCIe Gen5 DRAM-less unit that offers industry-leading efficiency, and the second is the world’s first true single-chip portable SSD controller capable of supporting USB4. In addition, earlier in May, Silicon Motion secured a partnership with Nvidia for its MonTitan SSD. This is a strategic move that puts Silicon Motion’s MonTitan SSD line in the pipeline for Nvidia’s AI products. Silicon Motion is aiming for a $1 billion revenue run-rate by the end of this year.

Silicon Motion is also looking at a potential resolution of a legal matter later this year. The company was the target of a merger attempt by MaxLinear several years ago, a deal that was abandoned in 2023. The case is headed for arbitration in Singapore, and Silicon Motion may be awarded up to $160 million in payments from MaxLinear.

In its 1Q25 results, Silicon Motion reported total revenues of $166.5 million, for a 12% decline year-over-year. The company’s earnings per American Depository Share came in at 60 cents by non-GAAP measures, down 27 cents per share from the same period in 2024.

Despite the year-over-year decline in revenue and earnings, Bank of America’s Simon Woo is still standing squarely in the bull camp. Woo cites several reasons to support his optimistic stance: “(1) gradually increasing enterprise solution sales (leveraging well its partnerships with major NAND chipmakers and US Big Tech companies, including NVIDIA); (2) resilient top-line growth with high GM (low impact of US tariff given strong bargaining power and well-managed foundry sourcing from TSMC); and (3) potential event (US$160mn+ deal break-up fees to be paid by MaxLinear if SIMO wins its Singapore arbitration case in late-4Q25). We believe MaxLinear’s payments will be used mostly for special cash dividends, but this event is not yet confirmed. Similar to memory chipmakers, SIMO could also benefit from strongly growing sovereign AI investments by selling eSSD controllers / boot-drivers (known as MonTitan series).”

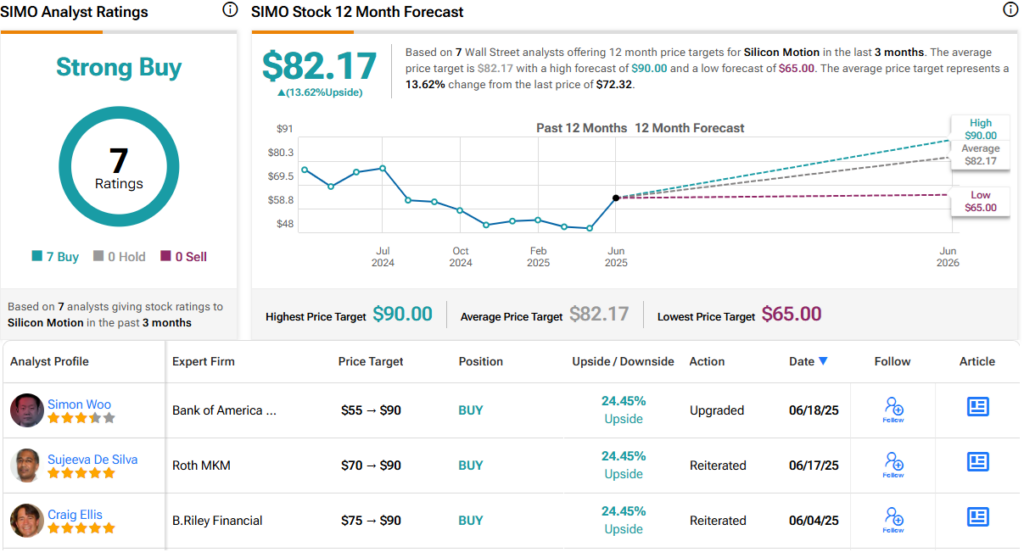

These comments back up Woo’s Buy rating on SIMO, and his $90 price target suggests a one-year upside potential of 24.5%. (To watch Woo’s track record, click here)

Overall, Silicon Motion gets a Strong Buy from the Street’s consensus, based on 7 unanimous Buys. The shares are priced at $72.32, and their $82.17 average price target implies a gain of 13.5% in the next 12 months. (See SIMO stock forecast)

SanDisk Corporation (SNDK)

Next on our list is SanDisk, a company known for its portable memory products. The company’s roots go back to 1988, and it was an early developer of flash storage technology. In 2016, SanDisk was acquired by Western Digital, and in February of this year, the company was spun off from Western and became an independent entity again, with shares trading on the NASDAQ exchange.

Most consumers probably know SanDisk from its line of USB thumb drives. These products are somewhat ubiquitous and have proven to be useful for customers and successful and profitable for the company. SanDisk makes and distributes thumb drives for USB-A, USB-C, and micro USB in a wide range of capacities, from small 16-gig units to larger 128-gig devices. In addition, the company manufactures memory cards: SD and microSD, CF, CFast, and CFexpress. The company’s USB drives and memory cards have found uses with gaming, digital cameras, drones, and in smartphones and tablets. Finally, SanDisk’s flagship product line is its array of SSDs, designed for internal, external, or portable uses, as well as to enterprise performance standards. Supporting all of this, SanDisk also markets a wide variety of accessories and peripherals, including card readers, docks, phone adapters, and wire chargers.

Some basic numbers will show the scale of SanDisk’s operations. The company has more than 10,000 employees working in over 30 countries around the world and protects its intellectual properties with more than 11,000 patents in various global jurisdictions. The company has a $6.8 billion market cap, and its revenues are trending upward. In its fiscal year 2024, which ended on June 28 last year, SanDisk generated $6.66 billion at the top line; for the 12 months ending on March 28 of this year, the company’s revenue was up to $7.21 billion.

In its last quarterly report, for fiscal 3Q25, SanDisk reported $1.7 billion at the top line, beating the forecast by $73.1 million. Looking at earnings, we find that the company had a non-GAAP EPS for the quarter of 30 cents, 9 cents per share ahead of the forecast.

This stock caught the attention of BofA’s Wamsi Mohan, who kicks off his coverage with a bullish stance. The 5-star analyst writes, “Given the near-term supply-demand balance (1Q saw supply curtailment), the pricing environment for NAND is increasingly positive over the next few quarters. Although the industry remains relatively fragmented (6+ players), we view the longer-term outlook favorable with some potential for consolidation over time. With aspirations to drive better pricing in a capex heavy, historically low returns industry, Sandisk plans to pave a path for more disciplined pricing. Longer term, if pricing trends improve structurally for the industry, there could be much higher valuation re-rating potential but we are wary of normalization of such trends especially given pricing competition in China… We see upside to Sandisk operating margin driven by better mix, demand growth and cost control, with long-term target being 20%.”

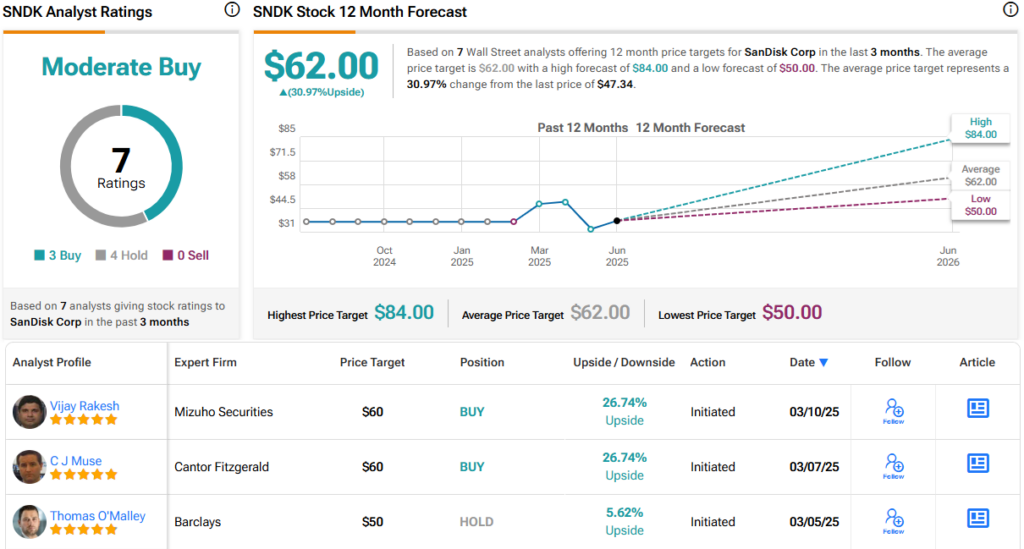

Mohan puts a Buy rating on the shares, complementing that with a $61 price target that points toward a 29% upside on the one-year horizon. (To watch Mohan’s track record, click here)

The 7 recent analyst reviews on SNDK shares split to 3 Buys and 4 Holds for a Moderate Buy consensus rating. The stock is currently trading for $47.34, and its $62 average price target implies an upside of 31% for the year ahead. (See SNDK stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.