Bank of America Corporation (NYSE:BAC), U.S. Bancorp (NYSE:USB), and Wells Fargo & Co. (NYSE: WFC) are some of the bank stocks that deserve investors’ attention as the current market dynamics could prove to be beneficial for the U.S. banking industry. While Federal Reserve’s latest super hawkish stance on interest rate hikes could help U.S. banks improve their bottom line, the improving economic conditions in the U.S. should enable them to witness rising loan demand, enhancing their top line.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

After sell-offs induced by recessionary fears, bank stocks appear to be currently trading at attractive discounts to their long-term historical averages. This offers some great buying opportunities for taking long-term positions, despite the probability of the U.S. economy facing a recession.

Against this current backdrop, let’s take a look at three bank stocks that Wall Street analysts are bullish on:

Bank of America Corporation (NYSE:BAC)

With a market cap of $273.92 billion, Bank of America witnessed a surge in net interest income (NII) in the second quarter of 2022 on the back of solid growth in loans and rising interest rates. NII on a fully taxable-equivalent basis jumped 21.3% year-over-year to $12.55 billion in the last reported quarter. It also gained from rising consumer spending that helped improve the company’s consumer banking business, along with an upside in both credit and debit card spending.

On the back of projections for higher interest rates and improving loan demand, BAC predicts a rise in NII over the next few quarters. In fact, it projects NII in the third quarter of 2022 to surge a minimum of $900 million or $1 billion over the year-ago period.

Is Bank of America a Good Stock to Buy?

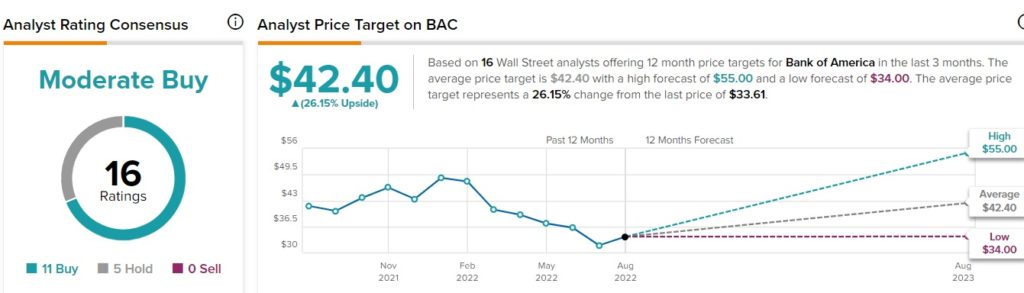

Turning to Wall Street, analysts look cautious but optimistic about BAC stock, which has a Moderate Buy consensus rating based on 11 Buys and five Holds. BAC’s average price target of $4.40 implies 26.2% upside potential. Shares of the company have lost about 26.4% year-to-date.

On the contrary, financial bloggers are 87% Bullish on BAC, compared to the sector average of 68%. As per TipRanks, hedge funds, too, look bullish on the stock, as they increased their holdings in Bank of America by 2.8 million shares in the last quarter.

U.S. Bancorp (NYSE:USB)

The Minneapolis-based company’s tax-equivalent NII jumped 9.5% year-over-year to $3.46 billion in the second quarter of 2022. The upside can be attributed to rising benchmark interest rates, and growing loan and investment securities balances.

Further, the bank projects a 5-6% year-over-year jump in total net revenues in 2022, given the revised interest rate assumptions. The fully taxable equivalent NII is also projected to rise in the low to mid-teen range in the full-year 2022.

Is U.S. Bancorp a Good Stock to Buy?

Analysts on TipRanks are cautiously optimistic about the stock. Based on six Buys and 11 Holds, U.S. Bancorp carries a Moderate Buy consensus rating. However, USB’s average price forecast of $55.74 implies 22.2% upside potential.

On TipRanks, financial bloggers are 95% Bullish on USB, compared to the sector average of 68%.

Wells Fargo & Co. (NYSE:WFC)

In the second quarter, the American multinational financial services company registered a 16% year-over-year rise in its NII. On the dual forces of rising interest rates supporting the net interest income growth and falling expenses, the management is expecting to see improved performance in the quarters ahead.

Also, Wells Fargo is taking the initiative to boost its loan and deposit balances and consumer card portfolios. Further, Wells Fargo projects a 20% rise over the previous year in NII in 2022, driven by rising interest rates.

Is Wells Fargo a Good Company to Invest In?

As of now, Wells Fargo stock could prove to be a good investment option. This is because analysts tracked by TipRanks have a Strong Buy consensus rating on WFC stock, which has 22.5% upside potential. WFC’s average price target stands at $53.54.

Even though Wells Fargo stock has lost 12.4% so far this year, financial bloggers on TipRanks are 79% Bullish on WFC, compared to the sector average of 68%.

Is Recessionary Pain in the Cards for Banking Stocks?

Federal Reserve’s latest super hawkish stance has increased concerns regarding the U.S. economy slipping into a recession. Other hurdles like a sluggish investment banking environment and slowing U.S. housing market pose threats to the upside in banking stocks. Meanwhile, analysts believe that enhanced capital levels, underwriting standards and a strict regulatory environment will help banks deal with recessionary headwinds.

Read full Disclosure