The ARK Next Generation Internet ETF (NYSEARCA:ARKW) is enjoying a banner year in 2023, with a 94.4% gain year-to-date. Its strong performance granted ARK founder and CIO Cathie Wood the right to run a much-needed victory lap against her doubters following a tough 2022 for ARKW and several other ARK funds.

However, after its substantial gains, investors would likely do well to pump the brakes and not chase the ETF’s performance. While 2023 has been rewarding for ARKW’s holders, the fund lacks diversification, has a lackluster track record over the longer term, and charges a sky-high expense ratio.

What is the ARKW ETF’s Strategy?

ARKW is an actively-managed ETF that invests in the theme of next-generation internet.

ARK defines next-generation internet companies as those that “are focused on and expected to benefit from shifting the bases of technology infrastructure to the cloud, enabling mobile, new and local services, such as companies that rely on or benefit from the increased use of shared technology, infrastructure and services, internet-based products and services, new payment methods, big data, the internet of things, and social distribution and media.”

These companies can include those involved in cloud computing and cybersecurity, e-commerce, big data and artificial intelligence (AI), mobile technology and the Internet of Things, social platforms, and blockchain technology.

Technology stocks, cryptocurrency, and AI have been some of the market’s big winners in 2023, driving ARKW’s stellar 2023 performance.

What Does ARKW’s Portfolio Look Like?

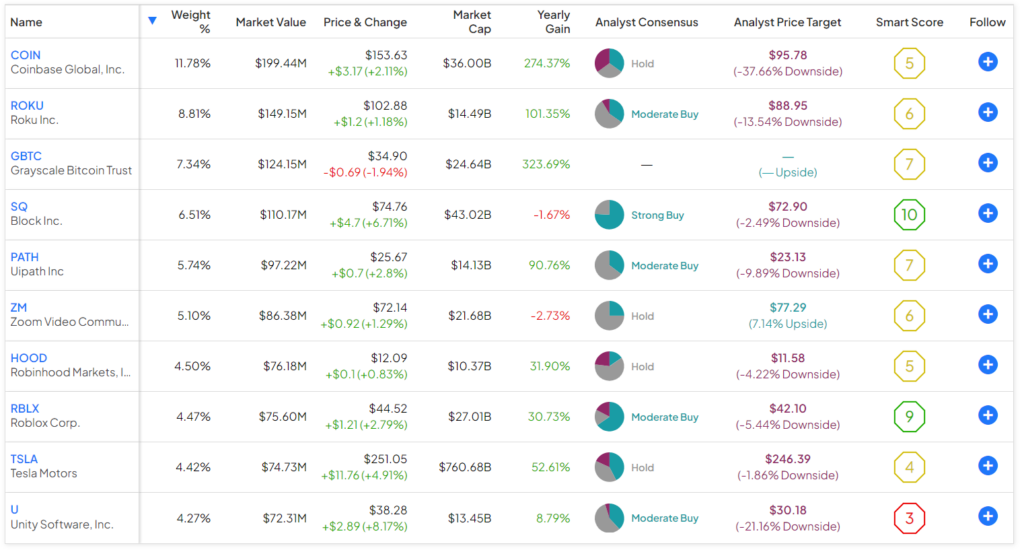

ARKW holds 35 stocks, and its top 10 holdings make up 63% of the fund. This isn’t a very diversified ETF, and it is fairly top-heavy when it comes to its top few holdings.

Below, you’ll find an overview of ARKW’s top 10 holdings using TipRanks’ holdings tool.

As you can see, Coinbase Global (NASDAQ:COIN) is ARKW’s largest position, with a large 11.8% weighting.

Coinbase has posted an incredible 357% gain year-to-date, doing much of the heavy lifting to propel ARKW higher in the process.

However, as we have seen in the past, Coinbase can be extremely volatile, and when the price of Bitcoin (BTC-USD) and other cryptocurrencies go down, shares of Coinbase often fall rapidly. So, just as the large Coinbase position has benefited ARKW in 2023, it has the potential to drag ARKW down, going forward.

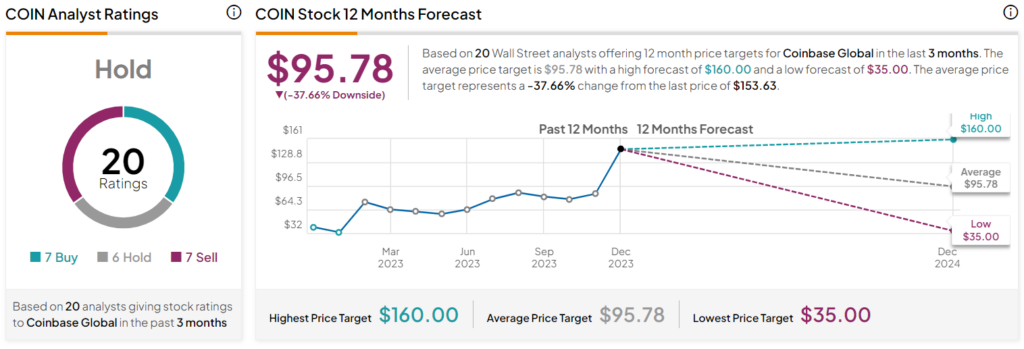

The average COIN stock price target of $95.78 implies 37.7% downside potential from here, so this is something that investors should be aware of.

In addition to this large position in Coinbase, ARKW also has a large position in the Grayscale Bitcoin Trust (OTC:GBTC). Thus, ARKW gives investors a lot of exposure to the potential volatility of the crypto market through these two concentrated positions.

Additionally, TipRanks’ Smart Score isn’t very enthusiastic about ARKW’s top holdings. The Smart Score is a proprietary quantitative stock scoring system created by TipRanks. It gives stocks a score from 1 to 10 based on eight market key factors. A score of 8 or above is equivalent to an Outperform rating.

Only two of ARKW’s top 10 holdings, Block (NYSE:SQ) and Roblox (NYSE:RBLX), feature Outperform-equivalent Smart Scores of 8 or higher. Seven of these top holdings feature Neutral-equivalent Smart Scores, and Unity Software (NYSE:U) fares particularly poorly, with the lowest possible Underperform-equivalent Smart Score.

In summary, while some of ARKW’s top positions have done very well this year, driving ARKW’s strong performance, there is plenty of potential for volatility from here, and the portfolio receives a fairly lackluster rating from the Smart Score.

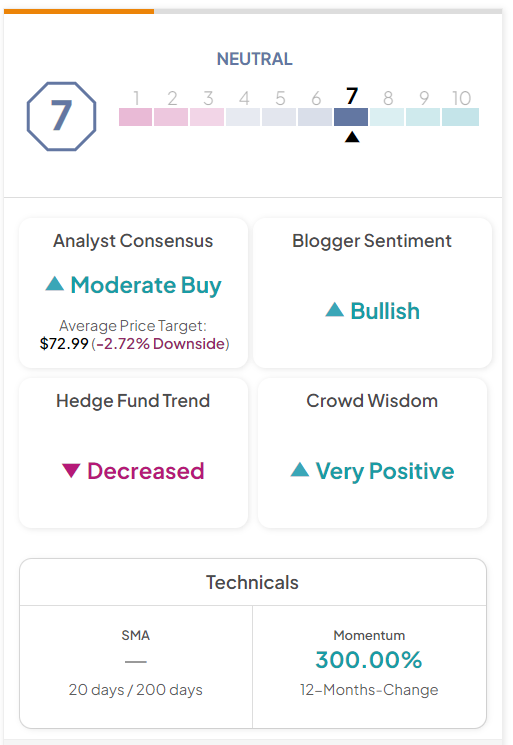

ARKW has a Neutral-equivalent ETF Smart Score of 7 out of 10.

Underwhelming Performance

While ARKW has been a strong performer this year, this hasn’t always been the case.

The fund struggled mightily in 2022, with a loss of 67.5% for the year. The year before was also a challenging one for the fund, as it lost 16.7%.

I give ARKW credit for bouncing back in 2023, but this has not been a consistent long-term winner. In fact, as of November 30th, the fund has lost 20.1% on an annualized basis over the past three years (as of November 30th). Over the past five years, it has gained a more respectable 7.8% on an annualized basis.

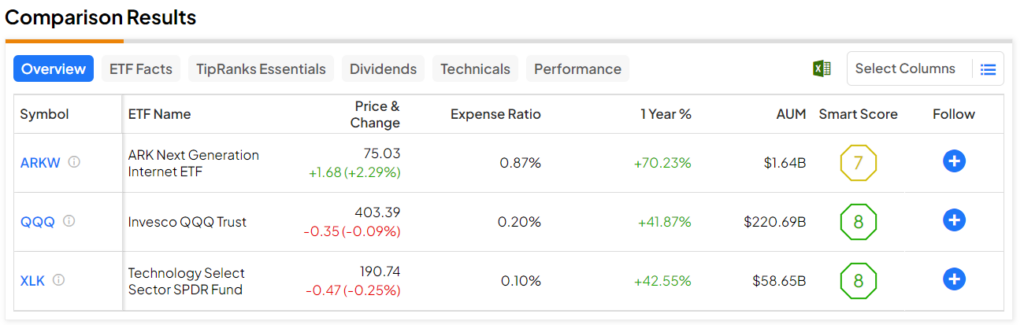

Based on this performance, ARKW has badly lagged behind other popular technology-focused ETFs like the Invesco QQQ Trust (NASDAQ:QQQ) and the Technology Select Sector SPDR ETF (NYSEARCA:XLK).

As of November 30th, QQQ has returned 9.7% on an annualized basis over the past three years and 18.9% over the past five years, both of which are far superior to ARKW’s returns.

Similarly, as of the same date, XLK has posted an even better 15.4% annualized return over the past three years and 18.9% over the past five.

Exorbitant Expense Ratio

This brings us to the final concern about ARKW. While ARKW has underperformed these popular technology ETFs, it is also much more expensive than both of them. ARKW charges a sky-high expense ratio of 0.87%. QQQ charges 0.20%, while XLK charges an even lower 0.10%.

This means that ARKW charges $87 in annual fees on an investment of $10,000, while QQQ charges $20 and XLK charges just $10.

The disparity in these fees adds up to make a significant difference over time. Assuming that each fund returns 5% per year, the investor that put $10,000 into ARKW will pay an incredibly steep $1,072 in fees after 10 years. Meanwhile, the QQQ investor and the XLK investor will have paid just $255 and $128 in fees, respectively.

While ARKW is actively managed and thus inherently more expensive than these index funds, it has underperformed them by a significant margin, so it hasn’t generated the type of track record to credibly justify these higher fees.

Below, you’ll find a comparison between ARKW, QQQ, and XLK created using TipRanks’ ETF Comparison Tool, which enables users to compare up to 20 ETFs at a time based on a variety of factors.

Is ARKW Stock a Buy, According to Analysts?

Turning to Wall Street, ARKW earns a Moderate Buy consensus rating based on 26 Buys, 10 Holds, and zero Sell ratings assigned in the past three months. The average ARKW stock price target of $72.99 implies 2.7% downside potential.

Pump the Brakes

In conclusion, 2023 has been a great year for ARKW, and its holders deserve to celebrate a bit after trying times in 2021 and 2022. However, I would not chase the fund from here and would advise caution due to its lack of diversification, high concentration in several volatile names, underwhelming performance track record, and steep expense ratio.

Investors interested in themes like technology, AI, and the internet can alternatively consider popular tech ETFs, like QQQ and XLK, which give exposure to many of these same themes. These ETFs come with a lower price point and have superior track records of long-term performance.

I am a fan of Wood and admire her investing style, ability to go against the grain, zeal for finding disruptive technology companies, and the conviction that she has in her ideas. Nevertheless, for the reasons mentioned earlier, this ETF is a pass for me.