Apple (AAPL), a leader in the global smartphone industry, is tipped by analysts to become an AI success despite not being a frontrunner in publicly embracing AI technology. The company’s approach to AI is unique and sets it apart from many of its rivals, which is one of the reasons analysts are bullish on Apple’s prospects. A closer look at Apple’s strategic investments in AI and recent analyst remarks points to the possibility of Apple enjoying competitive advantages in the AI sector. I am neutral on the prospects for Apple stock, as I believe the company is fairly valued in the market.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Apple’s Unique AI Strategy

Microsoft Corporation (MSFT) and Alphabet Inc. (GOOGL) are currently seen as leaders in the AI space, having gained a head start with their investments in generative AI. Apple, on the other hand, took time to develop a strategy that aligns with its ecosystem and publicly announced its AI strategy during the Apple Worldwide Developers Conference a couple of months ago.

Apple’s AI strategy, collectively referred to as Apple Intelligence, differs from that of its rivals in several ways.

Apple focuses on integrating AI features into its existing products, such as iPhones, iPads, and Mac computers. In contrast, Microsoft and Google are more focused on creating standalone AI applications that empower third-party hardware manufacturers. Arguably, Apple emphasizes offering AI as a feature to its customers, while other tech giants concentrate on providing AI as a service to external parties.

By this fall, Apple will roll out AI features on iOS 18, iPadOS 18, and macOS Sequoia. Notable features include AI-assisted writing, enhanced Siri capabilities, custom image and emoji creation, and AI-powered communication and focus settings.

Apple’s Focus on Protecting User Privacy

Apple’s focus on protecting user privacy also distinguishes its AI strategy from that of its competitors. As Tim Cook revealed at the WWDC event, Apple will process most AI queries on-device, eliminating the need to send data to cloud servers. This approach results in minimal data collection and, consequently, enhanced user privacy. In contrast, competitors like Microsoft and Google rely on cloud-based servers to handle AI queries, which raises concerns about user data privacy.

Apple Is Developing AI-Optimized Chips

Another distinct feature of Apple’s AI strategy is how the company is focused on controlling both the hardware and software components. Apple is developing in-house chips such as the M1 and M2 series optimized for AI. By using these advanced chips in its devices, the company will have control over the optimization process of AI features, which should lead to a smooth rollout of advanced AI features.

Why This Strategy Is Winning Big on Wall Street

This strategy is already winning fans on Wall Street. Rosenblatt analysts, in a note to clients, claimed that Apple will gain market share in the AI sector with its unwavering focus on user privacy, especially as many big tech companies face scrutiny over questionable data protection practices.

Moreover, Wedbush Securities analyst Daniel Ives claims that Apple’s strategy of controlling both hardware and software components of AI will help the company gain an edge over its competitors.

According to Morgan Stanley analyst Erik Woodring, integrating AI features into iPhones will trigger a new smartphone upgrade cycle, leading to stellar revenue growth. Woodring predicts Apple will ship around 500 million iPhones over the next two years, surpassing the previous record set during the 2021-22 cycle. He also expects the average selling price of iPhones to rise by 5%, driven higher by AI integration’s impact on demand for new devices. Based on these expectations, Erik Woodring raised his Apple price target to $273 from $216 last week.

Additionally, Loop Capital analyst Ananda Baruah also raised his price target, from $170 to $300 last week, after noting that the tech giant is poised to emerge as the leader in the consumer AI space in the coming years.

Smartphone Upgrade Cycle May Boost Apple

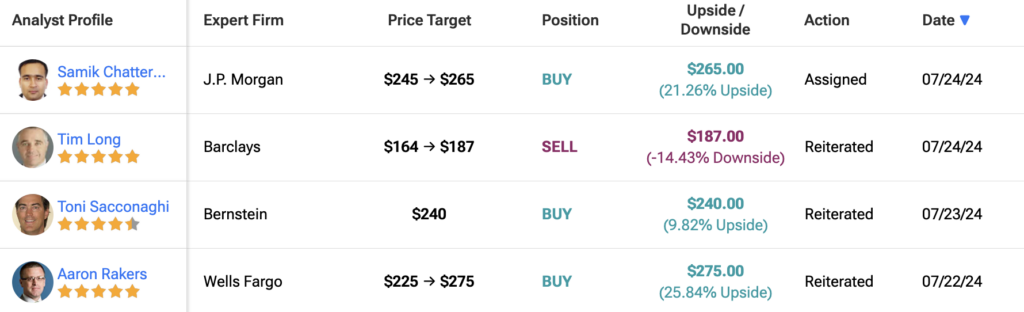

After digesting the Q2 earnings of Verizon Communications (VZ), Wells Fargo analyst Aaron Rakers wrote in a note to clients that Verizon management’s upbeat outlook for an AI-driven smartphone upgrade cycle is a signal of strength for Apple. On Monday, the analyst raised his Apple price target to $275 from $225 based on a confirmation that a new smartphone upgrade cycle will begin this September when Apple launches its latest iPhones.

Verizon, as a major telecom carrier, has a significant insight into smartphone market trends, including upgrade cycles. When Verizon’s management projects a strong AI-driven smartphone upgrade cycle, it suggests that they expect increased consumer demand for new smartphones, likely due to advancements and new features.

Apple, being a leading smartphone manufacturer, is directly affected by these upgrade cycles. An anticipated surge in smartphone upgrades typically benefits Apple, especially if the upgrades are driven by new technology and features, such as those related to AI.

Is Apple a Buy, According to Wall Street Analysts?

Earlier this month, Wedbush analyst Daniel Ives noted that Apple may ship as much as 90 million iPhone 16 devices initially, beating the Wall Street estimates for around 82 million unit shipments at the midpoint of the guidance.

Based on the ratings of 35 Wall Street analysts, the average Apple price target is $234.79, which implies upside of just 4% from the current market price.

Why Apple May Be Fairly Valued

After rising 17% this year, Apple stock is currently valued at a forward P/E of 34, reflecting a meaningful premium over the information technology sector median P/E of 25. The recent strength in Apple stock, therefore, has pushed the company into fairly valued territory, leaving a negligible margin of safety for investors.

Key Takeaway

Apple seems well-positioned to become an AI powerhouse with its unique strategy that differentiates it from other big tech companies. Apple is likely to benefit from a new smartphone upgrade supercycle induced by the launch of AI-enabled devices, and analysts are increasingly bullish on Apple’s prospects. However, Apple appears fairly valued after a strong first-half market performance.