New public stock offerings – IPOs – are among the most exciting aspects of the stock markets. They are the face of the market’s dynamism, and rightly so. Nothing better expresses the opportunity and potential of the markets than the entry of a new stock into the listings. Recent data from the SEC shows that filings for new listings are high, even this early in the year, suggesting that the IPO market is heading for a rebound.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

This indicates that investors should conduct some due diligence. IPOs may all be new, but they are not created equal – and some represent better opportunities than others. Some companies barely make a splash when they debut on the exchange, while others attract plenty of attention from both investors and analysts.

So, let’s take a closer look at two new IPO stocks. These are stocks that started trading just last month, and while their share prices are down since then, according to TipRanks, some early analyst reviews are predicting upsides starting at near 80% for the year ahead. Let’s examine both the stocks and the comments from the Street’s analysts.

Alto Neuroscience (ANRO)

The first stock we’ll look at is ANRO, the shares of Alto Neuroscience. This company is a biopharmaceutical research firm with a focus on psychiatry, and it is engaged in clinical-stage work on new psychotropic drugs for the treatment of serious mental health disorders. Alto currently has multiple pipeline tracks undergoing clinical trials, mainly for the treatment of major depressive disorder (MDD) but also with applications in PTSD and schizophrenia.

Alto has built its research program around some basic insights. First, mental health conditions can progress faster than the ability of psychiatric experts to combat them, and next that different patients frequently have very different responses to the same drug. The result is a trial-and-error, hit-and-miss approach to prescribing medications – and the errors and misses are frequent and dangerous. Alto is working with an AI-driven biomarker platform, informed by the data from more than 10 years of testing, an approach designed to identify the right medication for each patient.

Turning to the pipeline, we find that Alto has four drug candidates that are attracting attention, and have trial data releases on the calendar over the next year and a half. These drug candidates are ALTO-100, a potential treatment for MDD and PTSD; ALTO-101, under investigation as a treatment for schizophrenia; ALTO-203, an experimental treatment for MDD; and ALTO-300, another drug targeting MDD.

These clinical trials cost plenty – and Alto held its IPO this month to raise new capital. The company put more than 9.2 million shares on the market, at an offering price of $16 each. The event was upsized; the original filing had called for 8.04 million shares, and the event saw the stock open at $22. Alto realized aggregate gross proceeds totaling $147.9 million. ANRO shares are now down some 32% from their opening price.

Turning to the Street’s analysts, we find Andrew Tsai, from Jefferies, outlining an upbeat path for this stock, based in large part on the upcoming catalysts of the various Phase II data releases.

“We see several value inflection points, driven by 4 placebo-controlled Phase II datasets in H2:24/2025. We also think ANRO could move up +100-200% (vs down -50%) on the first readout in H2:24: (1) In H2:24, Phase IIb data of ALTO-100 (oral BDNF) for mono/adjunct MDD with poor cognition is powered to show a meaningful d=0.40 effect size vs placebo within biomarker (+) patients (vs d=0.2-0.3 for approved MDD drugs), (2) In H1:25, Phase IIb data of ALTO-300 (oral melatonin/5-HT2C) in adjunctive MDD with certain EEG features (brain waves) is powered to similarly show a large d=0.45 effect size, (3) ALTO-203 (oral histamine H3) for MDD with anhedonia will initiate Phase II in H1:24, with topline data in H1:25. (4) ALTO-101 (PDE4) is a transdermal patch starting Phase II CIAS in H1:24, with topline data in 2025,” Tsai opined.

Tsai goes on to give ANRO shares a Buy rating in his initiation-of-coverage note and sets a price target of $33, implying an upside potential of ~122% in the next 12 months. (To watch Tsai’s track record, click here)

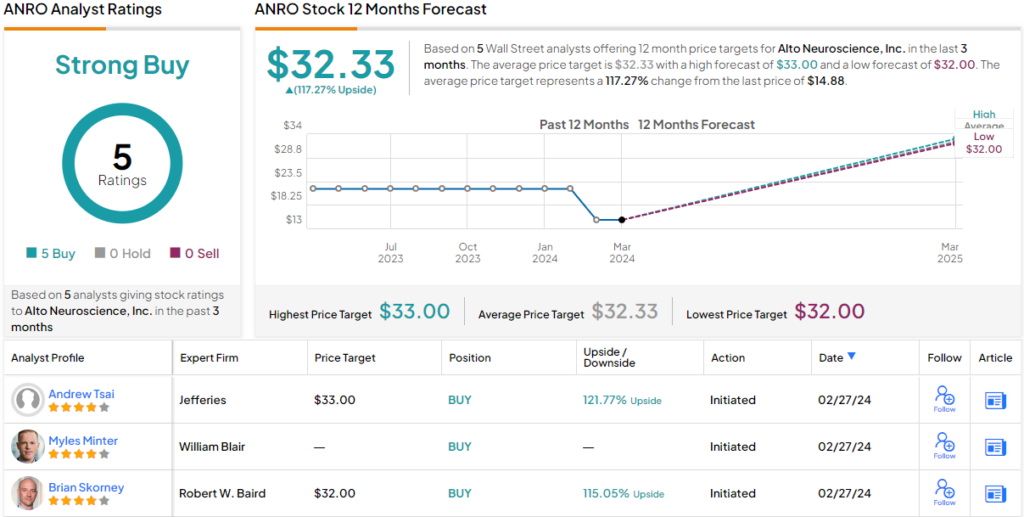

The Jefferies take is one of five recent analyst reviews here, that include 5 positive recommendations for a unanimous Strong Buy consensus rating. The shares are priced at $14.88 and the $32.33 average price target indicates room for 117% share growth in the year ahead. (See Alto stock forecast)

Fractyl Health (GUTS)

The second IPO stock on our list is working on new treatments for metabolic conditions – specifically, Fractyl is developing various ways to treat Type 2 diabetes, a serious disease that is becoming more common, and obesity, a condition that has gained attention for its increasing occurrence. Both T2D and obesity impose heavy costs on patients, the healthcare system, and society in general. Fractyl’s work aims to reduce those costs.

Fractyl is pursuing this goal through two main tracks: encouraging prevention of both conditions and promoting remission wherever possible. The company has two treatments under investigation. These include Revita, a tech platform and medical device used for treating damage to the duodenum. Dysfunction in this upper part of the small bowel, where the intestine connects to the stomach, has been implicated in the course of both T2D and obesity. The Revita system, utilizing a control system, software, and a catheter device, is designed for a treatment session of an hour or less, addressing early-stage duodenal dysfunction and preventing later complications.

The company’s second treatment, Rejuva, is a modular physiologic gene therapy designed to treat pancreatic malfunction through a local, low dose, viral injection directly into the pancreas. The aim is to restore insulin production, thereby preventing the onset or worsening of Type 2 diabetes.

These treatment tracks are currently in the trial stage, with Rejuva in the preclinical stage and Revita under study in the clinic. In January of this year, Fractyl announced that it has nominated RJVA-001 as the first clinical candidate for testing on the Rejuva gene therapy platform.

Turning to the IPO, we find that Fractyl’s shares started trading on Friday, February 2, with an opening price of $13.75, below the expected $15. The company raised $110 million in the IPO, and the shares have fallen ~22% from their first day’s closing price of $12.85.

This gives the background to the comments from Morgan Stanley analyst Michael Ulz, who sees strong potential in the quality of Fractyl’s two prospective treatment regimens. He writes, “We are Overweight Fractyl Health as we believe Revita (endoscopic procedure) represents a differentiated, disease modifying approach (directly modifies the gut) to the treatment of type 2 diabetes (T2D) and obesity (specifically weight maintenance), both of which represent large market opportunities. Additionally, we believe Rejuva, a pancreatic gene therapy (PGTx), could emerge as longer-term value driver, with promising pre-clinical data supporting potential in T2D and obesity.”

The analyst’s Overweight (i.e. Buy) rating comes with a price target of $18, indicating room for a one-year price gain of ~79%. (To watch Ulz’s track record, click here)

Overall, Fractyl Health stock has 2 recent analyst reviews on file, and both are positive, making the Moderate Buy consensus rating unanimous. The shares are priced at $10.07, and the average price target of $18 matches Ulz’s view. (See Fractyl’s stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.