In this piece, I evaluated two of the Magnificent Seven stocks, Amazon (NASDAQ:AMZN) and Meta Platforms (NASDAQ:META), using TipRanks’ Comparison Tool below to see which is better. A closer look suggests a bullish view for Amazon and a neutral view for Meta.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Of course, neither company needs an introduction, but Amazon is an e-commerce and cloud-computing giant, while Meta Platforms owns and operates several social networks, including Facebook, Instagram, WhatsApp, and others.

Shares of Amazon are up 15% year-to-date and have soared 69% over the last year, while Meta Platforms stock is up 22% year-to-date and 80% over the last 12 months.

Although their year-to-date performances are somewhat similar, that’s where the similarities between these two companies end. While both are part of the so-called “Magnificent Seven” stocks, they operate in totally different businesses despite both having a technology bent.

However, a closer look at their latest earnings results and the market’s reactions to those reports reveals something very interesting. In short, investors initially rewarded one for spending more on artificial intelligence technology and punished the other for the same thing.

It seems clear that both Amazon and Meta Platforms could benefit from improved AI technology, but unfortunately, this sort of manic-depressive behavior is commonplace on Wall Street right now. Let’s see if those totally opposite reactions were warranted.

Amazon (NASDAQ:AMZN)

At a P/E of 50.9x, Amazon is trading at a discount to its five-year mean price-to-earnings (P/E) ratio of 72.2x. Its forward P/E of about 36.4x is also quite attractive and suggests analysts are projecting significant increases in earnings over the next 12 months. Thus, a bullish view seems appropriate, especially considering the cloud computing results in Amazon’s latest earnings report.

For the first quarter, Amazon reported adjusted earnings of 98 cents per share on $143.3 billion in revenue versus the consensus estimates of 84 cents per share on $142.5 billion in revenue. Sales in North America rose 12% year-over-year to $86.3 billion, while international sales grew 10% year-over-year to $31.9 billion. Revenues in the cloud computing segment, Amazon Web Services (AWS), surged 17% year-over-year to reach $25 billion.

Amazon’s management guided for second-quarter revenue of $144 billion to $149 billion, which came up short of the consensus estimate of $150.1 billion, and operating income to be between $10 billion and $14 billion. Analysts are also projecting adjusted earnings of $1.02 per share for the second quarter.

Although Amazon stock initially dropped after the April 30 earnings release, it recovered quickly, soaring from about $179 before the release to around $185 now. This action is particularly interesting in light of the company’s disappointing guidance, as the Street has typically been punishing companies that come up short of expectations in their outlooks.

However, the initial post-earnings drop could have been due to the press release with the disappointing guidance, with the rebound coming after the earnings call. On that call, Amazon CEO Andy Jassy attributed the recently achieved $100 billion annual revenue run rate for AWS to their AI-related enhancements.

Evercore ISI analyst Mark Mahaney also told clients in a note on Tuesday that it was the first quarter since Q3 2022 in which AWS’s total-dollar revenue growth surpassed that of Microsoft’s (NASDAQ:MSFT) Azure. In fact, AWS is becoming more profitable as well, with its operating income jumping 84% to $9.4 billion and its operating margin expanding to 37.6% from 24% in the year-ago quarter.

All of this adds up to a bright future for Amazon, which suggests that it’s meaningfully undervalued at current multiples.

What Is the Price Target for AMZN Stock?

Amazon has a Strong Buy consensus rating based on 42 Buys, zero Holds, and zero Sell ratings assigned over the last three months. At $213.74, the average Amazon stock price target implies upside potential of 18.65%.

Meta Platforms (NASDAQ:META)

At its current P/E of about 25.1x, Meta Platforms is trading roughly in line with its five-year mean P/E of about 26.5x. Its forward P/E of 21.6x suggests analysts are looking for a relatively small earnings increase over the next 12 months, but it’s not a significant drop between the current and forward P/E, suggesting a bit more stability rather than soaring earnings to come. Thus, a neutral view seems appropriate, especially considering a key piece of the latest earnings report.

Meta Platforms posted its latest earnings results on April 24, reporting adjusted earnings of $4.71 per share on $36.45 billion in revenue versus the consensus numbers of $4.32 per share on $36.15 billion in revenue. However, investors were displeased with the company’s revised outlook, which boosted its expected capital expenditures.

Meta now expects to spend between $35 billion and $40 billion on capital expenditures (capex) this year, up from the previous guidance of $30 billion to $37 billion. The company said those increased capex will enable it to speed up its infrastructure investments in support of its AI roadmap.

Meta stock plunged $50 following that release, as investors actually penalized the company for its increased AI spending. However, a key difference from Amazon is that Amazon is already showing results from its AI investments, while Meta is merely planning for future AI enhancements. Of course, Meta has already rolled out some AI enhancements, like its AI chatbot, but it clearly is planning much more with that sizable increase in capex.

Additionally, Meta’s Reality Labs division continues to report sizable losses, so investors may be concerned about the company’s ability to transform new technologies into profits. In the first quarter, Reality Labs posted a loss of $3.85 billion, bringing its losses to more than $45 billion since the end of 2020.

What Is the Price Target for META Stock?

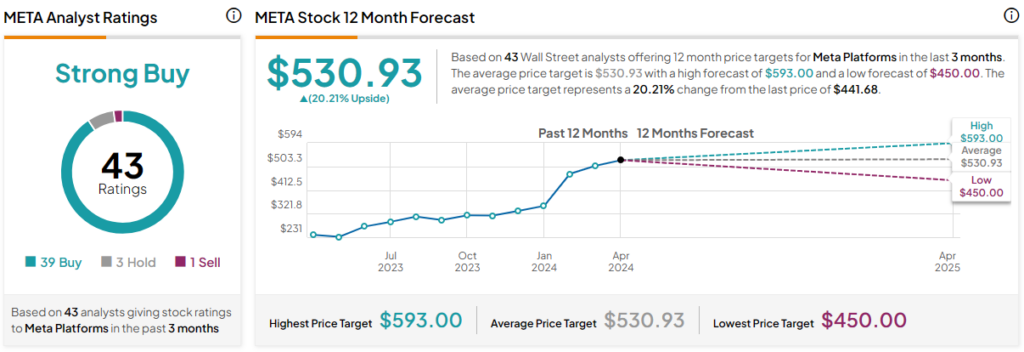

Meta Platforms has a Strong Buy consensus rating based on 39 Buys, three Holds, and one Sell rating assigned over the last three months. At $530.93, the average Meta Platforms stock price target implies upside potential of 20.2%.

Conclusion: Bullish on AMZN, Neutral on META

While it’s hard to go wrong with Amazon or Meta Platforms, Amazon is the clear winner of this pairing due to its valuation, successful implementation of AI to boost demand, and results from its cloud computing division, AWS.

On the other hand, Meta’s AI ambitions are incomplete as it significantly boosts spending on AI. As a result, those AI efforts look like a bit of a show-me story, at least until the capital is spent and we see the results of those ambitions. It’s understandable that investors would be concerned about Meta’s ability to turn its new technologies into earnings based on the Reality Labs losses that are piling up.