Semiconductor company Advanced Micro Devices (NASDAQ:AMD) is a renowned name in the chip industry. The company’s AI (artificial intelligence)-driven efforts have helped its stock soar 68% year-to-date, clearly outperforming the tech-led Nasdaq Index’s (NDX) 26% gain. While AMD’s Q3 results were solid overall, management’s soft outlook for the Gaming and Embedded segments was disappointing. However, its AI-driven prospects could be a major long-term growth catalyst. Hence, I’m bullish on AMD.

Claim 50% Off TipRanks Premium and Invest with Confidence

- Unlock hedge-fund level data and powerful investing tools designed to help you make smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis so your portfolio is always positioned for maximum potential

What Happened in AMD’s Q3?

The AI rally has proved advantageous for the chipmaker. AMD is powering the AI revolution, as is evident from its better-than-expected third-quarter results. Notably, net revenue in Q3 came in at $5.8 billion, up 4.2% year-over-year, and it surpassed analysts’ estimates of $5.7 billion. Meanwhile, earnings per share (EPS) grew by 4.5% to $0.70 from the prior-year quarter, beating the consensus estimate of $0.68. Additionally, EPS grew by 21% sequentially.

AMD’s Data Center Segment has struggled this year, but it appears to be gradually recovering. In Q3, the segment’s revenue was flat year-over-year at $1.6 billion but grew 21% sequentially, owing to the increased adoption of 4th Gen AMD EPYC CPUs.

Notably, cloud adoption of AMD’s EPYC processors is on the rise. CEO Lisa Su stated in the Q3 earnings call that almost 100 new AMD-powered cloud instances were launched in the quarter from Microsoft’s (NASDAQ:MSFT) Azure, Amazon’s (NASDAQ:AMZN) AWS, Oracle (NYSE:ORCL), Alphabet’s Google (NASDAQ:GOOGL) and many others.

Furthermore, higher Ryzen mobile processor sales in the quarter drove its Client segment’s revenue up 42% year-over-year to $1.5 billion. Combined, the Data Center and the Client segments contributed the highest to total revenue. Meanwhile, revenues from its Gaming and Embedded segments declined by 8% and 5%, respectively, from the prior-year quarter.

However, AMD is working on boosting the Gaming segment’s performance. It has now extended its AI-powered AMD Ryzen processor product line-up with the launch of Ryzen 7045HX3D Series mobile processors, the AMD Ryzen 5 5600X3D processor, and more, which may improve gaming performance. These products have the potential to boost the company’s top and bottom lines in the near future.

AI Could be a Huge Catalyst for the Long Term

AMD is picking up steam with AI products, both hardware and software. The company confirmed that the production of MI300A and MI300X graphic processing units (GPUs) is underway and will be launched in Q4. These products are meant to compete with Nvidia’s (NASDAQ:NVDA) A100 and H100 GPUs. While Nvidia has long held a dominant market share for its GPUs, it is also dealing with supply issues and is working to increase demand.

Moreover, as the AI industry advances, demand for GPUs will rise, benefiting AMD. AMD’s CEO believes MI300 could be the “fastest product to ramp to $1 billion in sales in AMD history.”

She went on to say that with the acquisition of Nod.ai. and Mipsology, AMD is also deepening its AI software capabilities into its hardware.

More importantly, AMD expects strong growth in its Data Center business in the coming quarters, which it believes will offset sluggish demand in the Embedded segment. In the near future, the recovery of the personal computing market should also add to its revenue growth.

Looking ahead, management hopes revenue will ramp up in 2024, with Data Center GPU revenue to be around $400 million in Q4, crossing $2 billion in Fiscal 2024.

AMD hopes to bring in $6.1 billion in revenue, “plus or minus $300 million,” in Q4, and its adjusted gross margin is expected to be around 51.5%. This guidance is nearly in line with analysts’ forecast for revenue of $6.17 billion. Also, according to the analyst consensus, earnings per share could come in at $0.79 for Q4.

The company’s sole focus now is to establish AI capabilities across its entire product portfolio. Its strong balance sheet should support its goal. It ended Q3 with $5.8 billion in cash, cash equivalents, and short-term investments. It also generated $297 million in free cash flow.

Investors should also keep an eye out for AMD’s Advancing AI Event on December 6th. The company plans to discuss its AI-led products, partnerships, and the advancement of its AI offerings.

Is AMD a Buy, According to Analysts?

Turning to Wall Street, on November 1, many analysts rushed to lower the target price for AMD as the company’s outlook was not as rosy as they had hoped. Analysts at Citi, TD Cowen, and Mizuho Securities believe that while Q3 numbers were solid, the sluggish growth in the Embedded and Gaming segments was disappointing. However, the company’s outlook regarding the Data Center segment and AI reassured analysts about its long-term prospects.

Meanwhile, Truist Financial’s analyst William Stein sees AMD’s position in AI as constrained compared to Nvidia’s dominant presence in the chip market. The five-star analyst lowered AMD’s target price to $98 from $128, with a Hold rating.

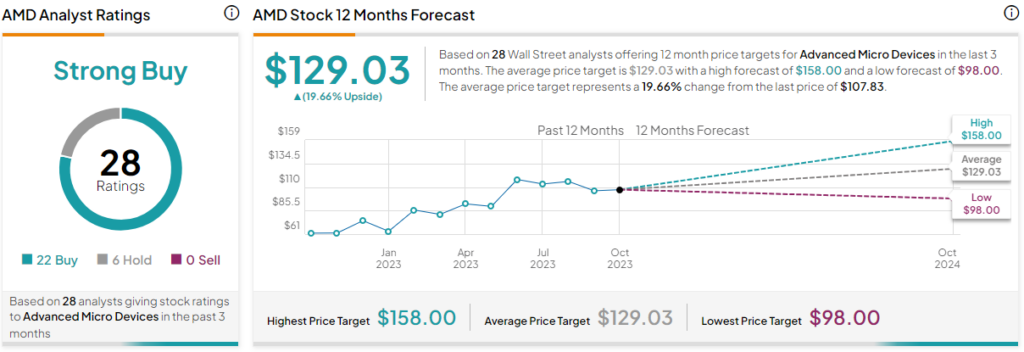

Overall, though, Wall Street’s stance on AMD stock is bullish. On TipRanks, the consensus rating for AMD stock is a Strong Buy, with 22 Buys, six Holds, and no Sell ratings. The average AMD stock price target stands at $129.03, implying upside potential of 19.7% in the next 12 months.

The Bottom Line on AMD

Summing up, AMD remains committed to improving processor and graphics performance through the incorporation of AI into all its products. The company has a diverse product portfolio that will shape the future of AI computing, making a significant impact on its top and bottom lines. AMD remains a key player in the ever-evolving AI niche, leaving me bullish on the stock.