Alphabet (GOOGL) is well-known for its dominance in Google Search and its advancements in AI, but the company is undergoing a significant shift in its operational focus. This shift involves scaling back on some of its experimental ventures, often referred to as “Other Bets,” to concentrate more on AI and its core businesses. This reallocation of resources is essential to strengthening Alphabet’s competitive edge in the AI space over the next decade. Combined with the stock’s appealing valuation relative to other tech giants in the Magnificent Seven (the group of leading tech giants including Apple (AAPL), Microsoft (MSFT), Amazon (AMZN), Nvidia (NVDA), Meta (META), and Tesla (TSLA)), I consider Alphabet stock a top buy.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Alphabet’s Ventures Beyond Core Business

To fully understand Alphabet’s current strategy, it’s important to recognize that the company isn’t just about Google Search and AI. It also has a diverse portfolio of early-stage businesses, known collectively as “Other Bets.” These ventures, which include companies in biotechnology, autonomous vehicles, smart home devices, and internet services, represent Alphabet’s efforts to innovate and enter new industries.

Key players in this segment include Waymo, focusing on autonomous driving; Verily, engaged in healthcare and life sciences; and X, the so-called “moonshot factory” working on breakthrough technologies. These ventures are crucial for Alphabet’s long-term growth, even if they are not the current focus.

The Role and Challenges of Alphabet’s “Other Bets”

Alphabet’s main focus is on its core businesses like Search and AI, but the company also explores new markets through its “Other Bets.” These ventures are like a venture capital approach, aiming to discover and enter new areas where a few major successes can balance out many failures. By using revenue from its Search and advertising businesses, Alphabet funds projects in fields like biotechnology, self-driving cars, and smart home devices.

However, this strategy comes with significant financial challenges. The high costs of research and development, along with the risks of new ventures, have led to ongoing financial losses in this area. Despite these challenges, Alphabet remains committed to these early-stage projects. Still, the company is now scaling back some of its most ambitious projects, especially within its X division. This shift aims to boost profitability and better support its core AI initiatives, ensuring the company can keep innovating while managing its finances effectively.

In my opinion, Alphabet’s strategic focus on AI is likely to generate the highest revenue, profits, and stock growth over the long term.

Alphabet’s Competitive Pressures

Despite the potential upside, Alphabet faces significant competition that could impact its profitability, particularly in the areas covered by its “Other Bets.” For instance, Waymo’s advancements in autonomous driving could be threatened by Tesla’s Full Self-Driving (FSD) technology, which is poised to launch robotaxis soon. Alphabet’s smaller scale in these innovative ventures makes it vulnerable to larger competitors with more resources, like Tesla.

Additionally, even in the AI space, where Alphabet is heavily investing, the company faces stiff competition from newer entrants like OpenAI. This period is critical for Alphabet, as its success in AI will determine its long-term viability and its ability to maintain a leadership position in the tech sector.

GOOGL Stock: The Best-Valued Big Tech Firm

What makes Alphabet especially appealing right now is its valuation. With a forward P/E ratio of 21.5, it stands out as one of the most reasonably priced stocks among the Magnificent Seven. For context, Tesla’s forward P/E ratio is 101, and Microsoft’s is 30.5. Moreover, Alphabet is one of the few major tech companies trading close to its intrinsic value, based on a typical discounted cash flow analysis that assumes significant future free cash flow growth.

I particularly like Alphabet for its low volatility compared to other Big Tech investments. For instance, GOOGL has shown steady EPS growth without non-recurring items, averaging 21.8% over 10 years, 25.9% over 5 years, and 41% over the past year. This combination of low volatility and strong growth supports a bullish outlook.

Beyond its valuation, Alphabet’s stock is particularly attractive due to its lower volatility compared to other Big Tech investments. The company has consistently delivered strong EPS growth, averaging 21.8% over 10 years, 25.9% over five years, and 41% over the past year. This combination of steady growth and reasonable valuation supports a bullish outlook for Alphabet.

In my opinion, if Alphabet continues to scale back on its “Other Bets” and redirects its focus toward AI, it could develop one of the strongest competitive moats in the tech industry. This would likely lead to greater internal efficiencies, higher margins, and a solid base of customers who rely on its AI technologies in conjunction with Google Search.

Is Alphabet Stock Expected to Rise?

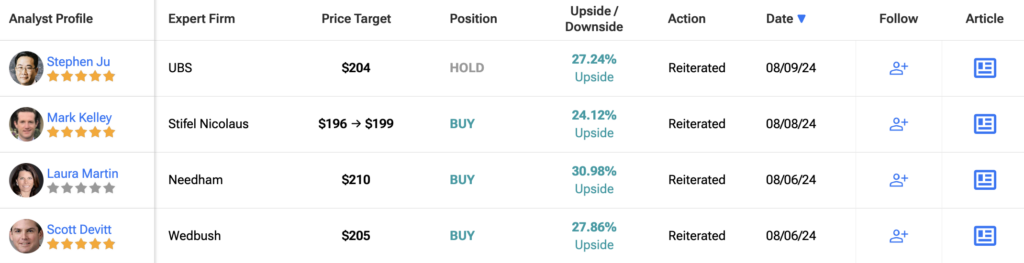

Turning to Wall Street, Alphabet is a Strong Buy according to 37 analysts, 30 of which allocate a Buy rating, seven of which allocate a Hold rating, and zero of which allocate a Sell rating. The average analyst price target of $204.74 indicates a potential 29% upside in the next 12 months.

See more GOOGL analyst ratings

Takeaway: Alphabet Is Undervalued

Alphabet’s shift to prioritize AI while scaling back its “Other Bets” enhances its focus on long-term growth. With a low forward P/E ratio of 21.5 and consistent EPS growth, Alphabet’s stock offers an attractive valuation compared to other tech giants. Despite competitive pressures, this strategic focus on AI and financial stability makes Alphabet a compelling buy with strong potential for future gains.

As a GOOGL shareholder, I see the recent price pullback as a buying opportunity and plan to consider increasing my position later this month.