The “Magnificent Seven” is a term coined to describe big tech giants such as Microsoft (NASDAQ:MSFT), Apple (NASDAQ:AAPL), Nvidia (NASDAQ:NVDA), Amazon (NASDAQ:AMZN), Alphabet (NASDAQ:GOOGL) (NASDAQ:GOOG), Meta (NASDAQ:META), and Tesla (NASDAQ:TSLA). Each of these stocks gained at least 49% in 2023 and have strong competitive advantages. Here, I have shortlisted one Magnificent Seven stock, Alphabet, to see if it is a good buy right now.

Claim 50% Off TipRanks Premium and Invest with Confidence

- Unlock hedge-fund level data and powerful investing tools designed to help you make smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis so your portfolio is always positioned for maximum potential

Overall, I am bullish on Alphabet due to its attractive valuation, the AI megatrend, and its expanding profit margins.

An Overview of Alphabet

Alphabet is the parent company of Google, the largest search engine platform globally. Valued at $1.93 trillion, Alphabet generates a majority of its sales from online ads on its search engine and YouTube, which Google acquired more than a decade ago.

Moreover, Alphabet sells applications, digital content, and in-app purchases via the Google Play store. In recent years, Alphabet has entered high-growth segments such as public cloud and artificial intelligence, diversifying its revenue streams in the process.

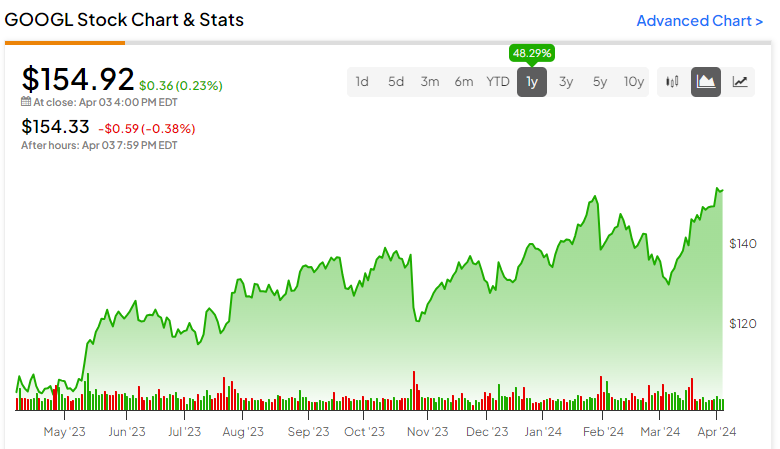

Shares of Alphabet went public in August 2004 and have since returned a monstrous 5,637%. It means a $1,000 investment in GOOGL stock soon after its IPO would be worth close to $60,000 today. In this period, the S&P 500 Index (SPX) returned “just” 600%.

How Did Alphabet Perform in Q4 2023?

Despite an uncertain macro environment in 2023, Alphabet increased its sales by 9% year-over-year to $307 billion. Its top-line growth accelerated to 13% in the December quarter, surpassing $86 billion.

A focus on cost optimization meant the company’s cost of sales rose by only 5% to $23.6 billion, while operating expenses stood at $25 billion, up 11%, allowing the tech giant to report an operating income of $23.7 billion, up 30% compared to the year-ago period, indicating a healthy margin of 27%.

A high operating margin translates into free cash flow, which can be deployed to reinvest in organic growth, enhance shareholder wealth, and target accretive acquisitions. In Q4, Alphabet reported free cash flow of $7.9 billion, while the number was much higher at $69 billion in 2023.

Similar to other tech heavyweights, Alphabet allocated $62 billion to share buybacks for its Class A and Class C shares last year and ended 2023 with $111 billion in total cash.

Alphabet Bets Big on AI

Alphabet is among the leading players in the artificial intelligence space. In fact, the company is deploying AI capabilities to improve its portfolio of products from Search to ads. In the last year, Alphabet launched AI-powered products such as Bard and Gemini, which should fuel the next generation of advances.

While Gemini has encountered some issues, the platform is engineered to understand and combine text, images, audio, video, and code while running on devices ranging from smartphones to data centers.

Alphabet emphasized that it is experimenting with Gemini in Search, making SGE (Search Generative Experience) faster for users. By integrating AI with Search, Alphabet serves a wide range of information requirements.

Bard is Alphabet’s conversational AI tool that is powered by Gemini Pro. Available in 40 languages and 230 countries, Bard will remain a key platform for Alphabet, going forward.

Subscriptions Sales Touch $15 Billion

Alphabet ended 2023 with more than $15 billion in annual subscription revenue, primarily driven by YouTube. Today, YouTube Music and YouTube Premium are available in more than 100 countries, and these platforms enjoy a highly engaged user base.

Generally, recurring sales allow a company to generate steady cash flows across market cycles. Alphabet’s increase in subscription sales over the years showcases its ability to deliver high-value offerings to a wide range of users.

Another subscription service offered by Alphabet is Google One, where you pay to store your photos, videos, files, and other data. Google One is experiencing strong user growth and has attracted almost 100 million subscribers to date.

Google Cloud Sales Up 26%

Turning to Google Cloud, the business increased sales by 26% year-over-year in Q4 to $9.2 billion. The segment is now reporting consistent profits, ending Q4 with an operating income of $864 million, indicating a margin of 9%. For FY 2023, Google Cloud sales rose 26% to $33 billion, accounting for more than 10% of total revenue.

Google Cloud aims to integrate Gemini to widen its base of enterprise customers which should also drive engagement rates higher. Alphabet claimed strong demand for its vertically integrated AI portfolio will create new opportunities for Google Cloud across its product portfolio.

What Is the Target Price for GOOGL Stock?

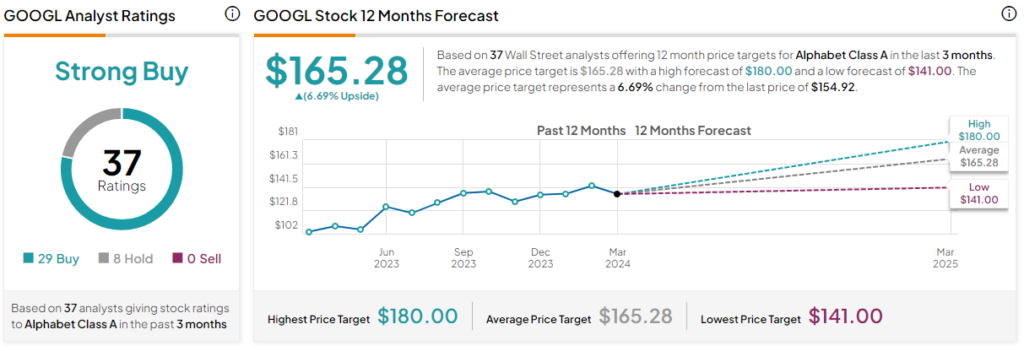

Out of the 37 analyst ratings given to GOOGL stock, 29 are Buys, eight are Holds, and none are Sells, indicating a Strong Buy consensus rating. The average GOOGL stock price target is $165.28, indicating upside potential of 6.7% from current levels.

GOOGL Stock Is Not Too Expensive

Analysts tracking GOOGL stock expect adjusted earnings to expand from $5.80 per share in 2023 to $6.81 per share in 2024 and $7.85 per share in 2025. So, priced at 22.8x forward earnings, Google stock is not too expensive, even though it trades at a higher multiple than peers, as its bottom line is forecast to grow by more than 15% annually in the next two years.

The Takeaway

Alphabet is a company firing on all cylinders. Despite its massive size, the tech behemoth continues to grow revenue and earnings at an enviable pace while improving profit margins. Additionally, its investments in AI should equip Alphabet with the resources to gain traction in the highly disruptive market over time.