Since reaching its lowest point in early 2024, Sea Limited’s (SE) stock has experienced a consistent upward trajectory. This positive performance aligns with the company’s strategic efforts over the past few years to reverse negative cash flows, accelerate revenue growth, and enhance operational efficiency, contributing to steadily improving operating margins.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Sea Limited’s Q1 results reaffirmed its positive momentum, setting a strong tone for the start of 2025. Management reinforced this trajectory with confident forward guidance, which was well-received by the market and helped sustain bullish sentiment. However, given the stock’s significant gains and the progress already reflected in its valuation, much of the current optimism appears to be priced in.

That said, Sea’s underlying fundamentals and long-term growth prospects continue to support a constructive investment case. While the upside potential may now be more moderate, I maintain a cautiously bullish outlook on SE.

Shopee’s Comeback and Sea’s Rising Tide

For those less familiar, Sea Limited is widely seen as the leading tech conglomerate in Southeast Asia. It dominates the e-commerce space through its Shopee platform, expands rapidly in fintech via its Monee division, and maintains a strong presence in gaming with hits like Free Fire under its Garena segment. Sea’s stock has performed incredibly well, climbing from around $71 per share over the past year to recent highs near $160. The company’s strong revenue growth has been a key driver behind this surge.

After slowing down in 2023 and early 2024, Sea has reaccelerated its growth over several consecutive quarters, from just 4.8% year-over-year to rates between 23% and 36% last year. This rebound has been led by Shopee, which had been losing momentum but has regained market share in various Southeast Asian countries, especially in Latin America, where it’s now the second-largest player. Strategic investments in logistics and a more profitable product mix have also played a significant role in driving this turnaround.

Beyond top-line performance, the company has also turned profitable over the past two years, maintaining positive operating margins for multiple quarters. Back in 2022, Sea’s operating margin was around -15%. That figure has improved to about 5% over the last twelve months, thanks to tighter cost control, lower customer acquisition costs, and a focus on expanding in higher-margin markets.

Cash flow from operations has been even more impressive, reaching 19% of revenue over the trailing twelve months—a strong indicator of financial health, especially for a company operating in capital-heavy industries like e-commerce and digital finance.

Mighty Quarter Fuels Sea’s Momentum

Two weeks ago, Sea Limited reported its Q1 earnings, and they definitely helped confirm the bullish momentum behind the stock’s massive rally over the past year. The headline was a 30% year-over-year jump in revenue to $4.84 billion, but even more impressive was the GAAP net income of $410.8 million—a major turnaround from a $23 million loss in the same quarter last year.

Shopee was the standout performer, generating $3.5 billion in revenue—a 28% year-over-year increase—fueled by 21% growth in gross merchandise volume (GMV), improved take rates, and enhanced advertising monetization. Core marketplace revenue rose by 39%, indicating higher transaction volumes and increased profitability per transaction. Notably, Shopee’s significant investment in logistics is showing strong returns, with EBITDA improving from a $22 million loss in the same quarter last year to a $264 million profit this quarter.

But Sea Limited isn’t just about Shopee. The fintech arm, Monee, also showed strong momentum with revenues up 58% year-over-year to $787.1 million, and its user base growing by 50% to reach 28 million. If that wasn’t enough, after struggling for several quarters, Garena delivered a solid comeback, with bookings of $775.4 million (up 51% YoY) and adjusted EBITDA rising 57% to $458.2 million.

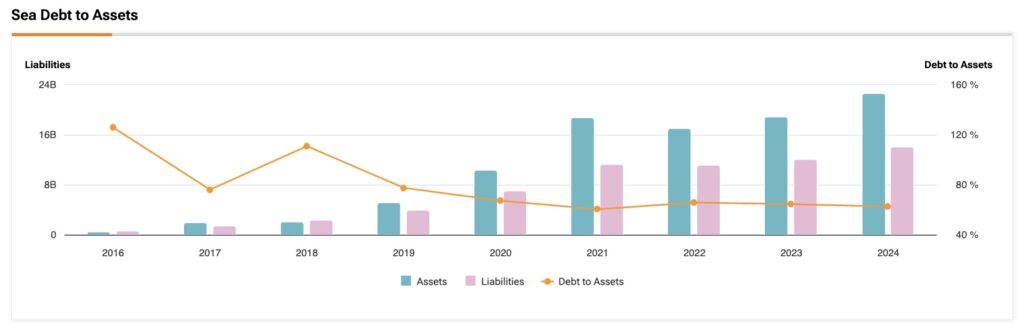

Overall, it was a stellar quarter across the board. In addition to the strong revenue and margin improvements, Sea also showed healthy cash generation and a rock-solid balance sheet. Unlike in 2022, when it was burning cash, the company now holds $8.6 billion in cash and short-term investments, with no near-term liquidity concerns in sight.

High Hopes and High Multiples

The solid guidance from management is more important than just the reassuring quarterly numbers, especially on the bottom line. With a strong start to the year, CEO Forrest Li expressed confidence in hitting their full-year targets. Management expects robust double-digit growth across key segments in 2025, and analysts have taken notice, raising EPS growth expectations by 6% for FY2025 and 5% for FY2026 after Q1 results.

That said, when we look at the stock’s valuation after its huge run-up, some caution is warranted. Sea Limited’s forward price-to-sales ratio is now sitting at 4.6x—the highest it’s been in the past three years. That’s almost double the average of 2.6x during that time and well above the 1.2x multiple seen at the start of 2024.

Of course, high valuations can still be justified if margins are improving and long-term profitability is clearly on the horizon, which does seem to be the case here. That’s the key reason investors are willing to pay a premium today.

So, I wouldn’t say the stock is overvalued because it’s trading near its historical highs. But with less of a margin of safety, the upside could be more limited from here, unless the company continues to deliver stronger growth to match these higher expectations.

Is SE Stock a Buy or Sell?

Wall Street sentiment toward Sea Limited remains largely positive. Of the 16 analysts who have issued ratings over the past three months, 12 recommend the stock as a Buy, while four have assigned a Hold rating. However, the potential upside appears relatively limited at current levels. SE’s average price target of $171.63 implies a modest 4.8% increase from the current share price.

Plenty of Wind in the Sails, Just Mind the Price Tag

Sea Limited offers compelling support for a strong, long-term bullish outlook. Robust revenue growth—driven primarily by Shopee’s expansion—along with solid performance from Monee and a Garena recovery, reflects a well-diversified and strengthening business.

These gains, improving margins, and a healthy cash position contribute to a promising overall picture. While valuation multiples appear elevated and may limit short—to medium-term upside following the stock’s strong rally over the past year, the momentum remains positive.

I maintain a cautiously optimistic long-term view on SE, as its premium valuation is arguably justified by its consistent progress toward sustainable profitability.