Alibaba Group Holding Limited (BABA) stock jumped 10% on Sep. 26 with investor sentiment improving toward Chinese tech stocks on the back of a series of Fiscal and monetary policy initiatives aimed at reviving economic growth. I believe Alibaba stock is just getting started as the company enjoys a long runway to grow in a few business segments, including e-commerce, AI, and cloud computing. Alibaba stock, despite rising 35% so far this year, is still trading well below the highs of over $300 registered in late 2020. I am bullish on Alibaba given that the company is attractively valued at a forward P/E of just 12 amid the ongoing recovery of the business.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

New Stimulus Packages Will Help Alibaba’s Recovery

My bullish stance on Alibaba is grounded in the long-term growth potential of the company, and the recently announced government stimulus packages in China should pave the way for Alibaba to benefit from an acceleration in revenue growth. Earlier this week, the People’s Bank of China reduced the reserve requirement ratio for banks by 50 basis points, potentially freeing approximately one trillion yuan ($142 billion) for lending. The People’s Bank of China (PBOC) also slashed the 14-day reverse repo rate by 10 basis points, encouraging consumers and businesses to borrow.

In addition to these monetary policy measures aimed at boosting consumer spending, China announced new support measures to revive the falling property sector, including a reduction in mortgage rates and easing restrictions on home purchases. China’s property market crash has been a major factor behind the lackluster economic growth of the nation in the last three years, and these measures aim to boost property market activity.

Alibaba, as the leading e-commerce company in China, will directly benefit from the expected growth in disposable income resulting from the aforementioned policy decisions. After digesting the potential economic impact of China’s latest stimulus packages, billionaire investor David Tepper, the founder of Appaloosa Management, claimed that it’s time to aggressively invest in China as these favorable policy measures will boost economic growth. At the time of writing, Alibaba accounted for more than 12% of Tepper’s portfolio, with a value of $756 million.

Alibaba Is Catching Up In China’s AI Race

One of the main factors behind my bullish stance on Alibaba is the company’s potential to emerge as an AI leader in China, despite a late start compared to Baidu, Inc. (BIDU). Last week, the company unveiled Qwen 2.5, its latest LLM model, which competes directly with the likes of GPT-4 developed by OpenAI. According to data published by the company, Qwen 2.5 meets or exceeds the performance benchmarks of popular LLM models such as GPT-4 and Llama 3.1, suggesting that the company has caught up with the AI market leaders through aggressive investments in the last couple of years.

According to data published by Alibaba last May, Qwen models have attracted more than 2.2 million corporate users within a year of launch. This massive success comes on the back of the open-source nature of these models, which has helped Alibaba catch up with Baidu’s Ernie Bot. For the first quarter of Fiscal 2025, ended last June, Alibaba reported a triple-digit YoY increase in AI product revenue. The number of paying Alibaba Cloud AI users also tripled compared to the previous quarter, demonstrating the strong momentum behind Alibaba’s AI product offerings.

Building on this momentum, continued investments in generative AI models have enabled Alibaba to integrate AI technology into its core products, such as e-commerce and cloud computing. This integration is setting the stage to attract new customers in the coming months when consumer spending stabilizes.

Alibaba’s Core Commerce and Cloud Businesses Will Grow

Looking ahead, I believe Alibaba’s core business segments, such as core commerce and cloud computing, will also grow exponentially in the long-run. The company’s investments in products are beginning to pay off, as evidenced by the increase in return customers and purchasing frequency reported by Alibaba in the most recent quarter. With recently announced stimulus packages expected to boost consumer spending in the coming months, the company is heading toward the holiday season on a strong footing to capture market share from smaller peers who thrived while Alibaba was at the center of a regulatory crackdown for well over two years.

Alibaba’s cloud business is also well-positioned to grow, with the rising use of AI boosting the demand for cloud infrastructure solutions. According to data from Canalys, Alibaba dominates the cloud infrastructure sector in China, with a market share of almost 40%, well ahead of Huawei, which controls just 19% of the market. With cloud spending in China expected to increase 18% this year amid the surge in generative AI usage, Alibaba’s market leadership in the cloud sector will help the company attract new customers.

Moreover, Alibaba’s ambitious global expansion of its cloud business will also open new opportunities to grow. The company is planning to expand into regional markets such as Malaysia, Thailand, and South Korea by establishing new data centers in these regions. In addition, Alibaba is focused on other fast-growing cloud markets, such as Mexico, as well. Successfully expanding Alibaba Cloud’s international presence should result in robust revenue growth in the next few years as cloud infrastructure solutions are in high demand today.

Is Alibaba a Buy, According to Wall Street Analysts?

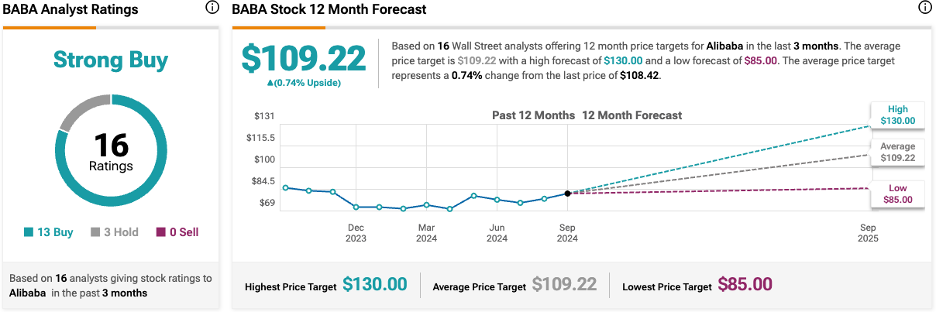

Wall Street analysts have not been oblivious to Alibaba’s attractive growth prospects and cheap valuation; however, they have been cautious in boosting their price targets for the company due to geopolitical tensions between the U.S. and China, which have dampened investor sentiment. Based on the ratings of 16 Wall Street analysts, the average price target for BABA is $109.22, implying an upside of less than 1% from the current market price.

In the coming months, I expect Wall Street analysts to revise their earnings estimates for Alibaba positively after incorporating the positive impact resulting from stimulus packages. In the long-term, strong earnings growth should support a valuation multiple expansion as well, leading to higher stock prices.

Key Takeaway

Alibaba is likely to emerge as a big winner of China’s recently announced monetary and Fiscal stimulus measures. In addition to the strong growth expectations for Alibaba’s core business segments, I am encouraged by the recent success of its AI investments, which point to an acceleration in revenue growth in the second half of Fiscal 2025. At a forward P/E of 12, I find Alibaba cheaply valued at a time when its turnaround is gaining traction.