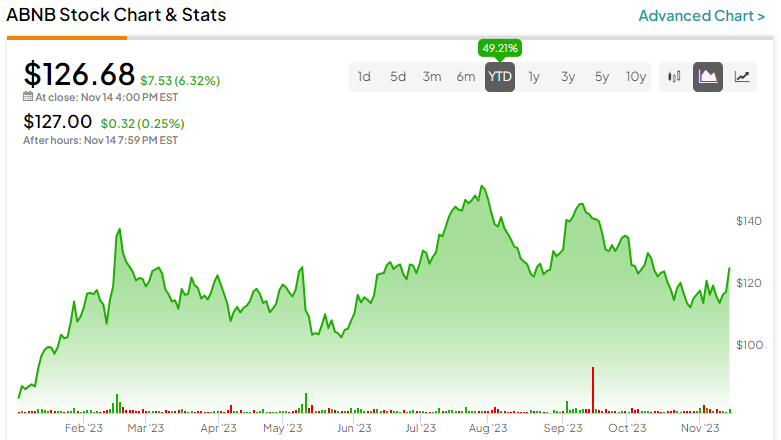

Vacation rental leader Airbnb’s (NASDAQ:ABNB) shares have struggled in the last three years, but the company’s financials remain solid. In a time when rising inflation is weighing on consumer discretionary companies, Airbnb reported another stellar quarter. Despite the challenges, Airbnb continues to thrive, which is likely why its stock is up 49.2% year-to-date, outpacing the S&P 500’s (SPX) gain of 17%. Its unique asset-light business model is keeping its pockets deep, which is why I am bullish on Airbnb.

Claim 50% Off TipRanks Premium and Invest with Confidence

- Unlock hedge-fund level data and powerful investing tools designed to help you make smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis so your portfolio is always positioned for maximum potential

Airbnb’s Green Flags

Airbnb has evolved from a simple home-sharing concept to a company redefining how people explore new places. Following the pandemic, the “workation” trend, which allows employees to work and travel from anywhere in the world, caused a surge in travel demand.

And Airbnb’s unique concept of matching tourists with hosts looking to use their houses as vacation rentals gained a lot of traction. Rental homes, as opposed to traditional hotels, provide a one-of-a-kind personalized experience that attracts travelers.

Airbnb also has an advantage in that it allows travelers to rent out homes in offbeat locations where most traditional hotels would not be able to operate.

This is probably why the company’s revenue jumped from $3.6 billion in 2018 to $9.6 billion for the trailing 12 months. In its third quarter, revenue jumped 18% year-over-year to $3.4 billion, driven by robust growth of 14% in Nights and Experiences booked. Adjusted net income also increased to $1.6 billion, up from $1.2 billion in Q3 2022.

Cash is King

Airbnb ended the quarter with a hefty $11.0 billion in cash, cash equivalents, and short-term investments. It’s not quite often that a growing company maintains a robust balance sheet while generating substantial profits.

Having an asset-light business model allows Airbnb to generate positive free cash flow (FCF) and use it to fund growth strategies. It generated FCF of $1.3 billion, representing 37% year-over-year growth. The positive FCF enabled the company to repurchase $500 million of its shares in the quarter.

Airbnb’s Challenges

Over the years, what set Airbnb apart was its distinct business model, which provided travelers with a differentiated experience in comparison to traditional hotels. However, other companies may eventually challenge ABNB with a similar concept, resulting in stiff competition.

Furthermore, travelers are also complaining about rising costs on the Airbnb platform, which was supposed to be a low-cost, effective alternative to hotels. Airbnb might have to raise the stakes by offering something new to continue thriving in this cutthroat industry.

Airbnb is also facing regulatory concerns. One of the most recent challenges it has faced is New York City’s ban on short-term rentals in an effort to alleviate the housing shortage crisis. Some other cities are doing the same. The ban, however, has created a black market for short-term rentals.

Though this remains a short-term concern to watch out for, it’s unlikely to dent Airbnb’s growth. According to the company, it currently has over four million Hosts across almost every country around the world.

Looking ahead, despite the market volatility brought on by macroeconomic pressures and rising geopolitical conflicts, Airbnb anticipates that its growth trend will continue. For Q4, it expects revenue in the range of $2.13 billion to $2.17 billion, representing 12% to 14% growth from the year-ago period. Meanwhile, analysts project revenue of $2.16 billion and EPS of $0.66 in Q4. For context, last year’s EPS was $0.48.

Despite the skepticism surrounding travel in Europe and the Middle East as a result of escalating geopolitical tensions, analysts remain optimistic about Airbnb’s full year 2023. For 2023, analysts predict Airbnb’s revenue to increase by 17.3% to $9.8 billion, while earnings are forecast to grow to $8.33 from $2.79 in 2022.

Is Airbnb Stock a Buy, According to Analysts?

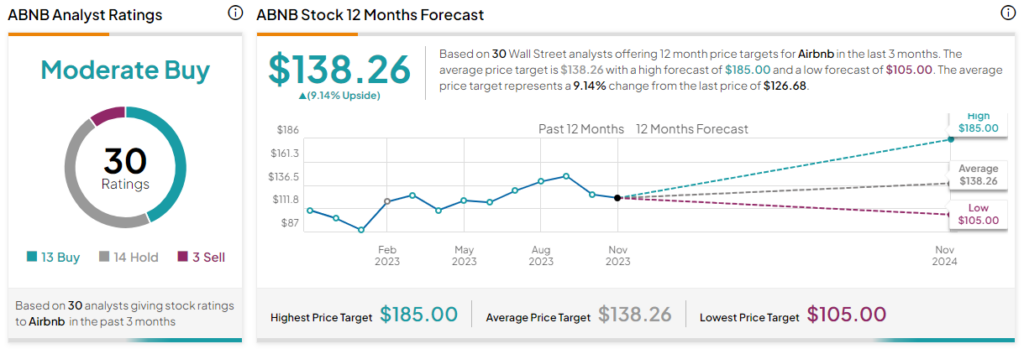

Overall, ABNB stock has a Moderate Buy consensus rating. Out of the 30 analysts covering the stock over the past three months, 13 rate it a Buy, 14 rate it a Hold, and three recommend a Sell. The average ABNB stock price target stands at $138.26, indicating upside potential of 9.1% over the next 12 months.

The Bottom Line

Overall, Airbnb’s innovative approach to travel accommodation has changed the way people travel around the world, fostering a more personalized and immersive travel experience. According to Statista, the global travel and tourism market is projected to be worth around $1.02 trillion by 2027.

As long as Airbnb continues to evolve and adapt, it should be able to grow its revenue and profits. Therefore, I’m optimistic about Airbnb’s ability to maintain its position as the vacation rental leader.