Since early last year, for some 18 months now, the Federal Reserve has increased interest rates from near-zero to more than 5.5%. The move has tightened access to both capital and credit, effectively reducing the money supply – the classic response to persistent high inflation. Their efforts have borne some fruit, as the pace of inflation has slowed, in just over a year, from over 9% annually to 3.2% in the most recent data.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

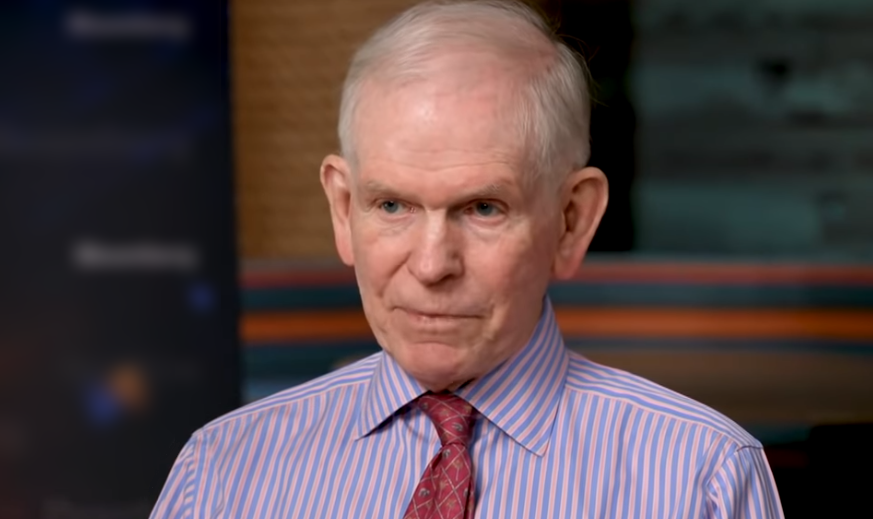

The dramatic shift from more than a decade of loose money and low rates to a high-interest-rate regime cannot come without consequences, however, and legendary investor Jeremy Grantham has been laying out those consequences.

“The power of interest rates rising and depressing the real estate market, a very negative, slow-moving influence, leads me to suspect that they will once again dominate. We may have a recession running deep into next year, accompanied by a decline in stock prices,” Grantham said.

Grantham, who has an acknowledged skill at predicting and avoiding asset bubbles, discounts the good news that has been floated about the economy. Yes, tech is booming on AI, but all of that, in Grantham’s view, cannot alter what is coming.

“Personally, I think AI is very important, but I think it’s perhaps too little, too late to save us from a recession,” Grantham added.

Taking Grantham’s warning at face value, we can start taking action to protect our portfolios. The simplest step would be a move into high-yield dividend stocks, the classic defensive play. Dividend stocks offer the advantage of a steady passive income stream to maintain returns in a down market. We’ve used the TipRanks database to pull up the latest info on two of these stocks, both with ‘Strong Buy’ ratings and at least 9% dividend yield.

Sixth Street Specialty Lending (TSLX)

First up, Sixth Street Specialty Lending is a finance company that provides both credit and financial services to small businesses, specifically targeting small- and mid-sized enterprises that may not have easy access to capital through the traditional commercial banking system. These small businesses are significant drivers of overall US economic activity, and their ability to adapt to changing conditions largely depends on their relationships with companies like Sixth Street.

This BDC lender was founded in 2011 and, in the 12 years since its inception, has originated approximately $27.6 billion in loan activity. As of 1H23, the company’s full lending portfolio was assessed at a fair value of $3.09 billion, distributed across 86 portfolio companies and 44 structured credit investments. Sixth Street typically engages in transactions ranging from $15 million to $350 million, with a majority of its investments taking the form of first or second lien senior secured loans.

Sixth Street’s lending activities, characterized by a decidedly conservative strategic approach, have consistently been profitable, and the company’s revenues have shown steady growth for over a year. In the latest financial release, for 2Q23, the firm reported a top line of $107.6 million, marking an impressive 68% year-over-year increase and surpassing the forecast by nearly $7 million. The company’s bottom line, a non-GAAP net investment income per share, stood at 58 cents, surpassing estimates by 3 cents.

In addition to exceeding earnings estimates, Sixth Street has maintained strong liquidity. While the company holds over $1 billion in debt, it still has more than $650 million available on its revolving credit facility, along with approximately $11 million in unrestricted cash assets and just over $15 million in restricted cash. This strong liquidity position has enabled the company to uphold a generous dividend policy.

The dividend was declared in conjunction with the August 3 financial release. The declaration includes a base dividend of 46 cents per common share, scheduled for a September 29 payout, and a supplemental dividend of 6 cents to be paid on September 20. The regular dividend annualizes to $1.84, offering a robust 9.2% yield.

Liquidity and dividends were prime factors attracting Sixth Street to RBC Capital’s 5-star analyst Kenneth Lee.

“Credit performance remains strong; tail risks around ICR seem very manageable. Mgmt still sees specialized opportunities, which is a contributor to TSLX’s above-peer-avg ROE generation pot’l, including ABL due to banks’ changing capital framework. We continue to favor TSLX’s conservative profile with substantial liquidity, a dividend policy that maximizes returns, and above-peer-avg ROE generation,” Lee noted.

These comments back up Lee’s Outperform (i.e. Buy) rating, and his $22 price target suggests the stock will appreciate by 10.5% in the next 12 months. Based on the current dividend yield and the expected price appreciation, the stock has ~20% potential total return profile. (To watch Lee’s track record, click here)

Overall, the Strong Buy consensus rating on TSLX shares is unanimous, based on 6 recent positive analyst reviews. (See TSLX stock forecast)

Crescent Capital BDC (CCAP)

Next up is another business development company, Crescent Capital BDC. This firm, based in Los Angeles, works with private debt investments for small- and mid-market companies. Crescent invests in existing loans and also originates new loans and debt instruments for its client base. The company primarily operates within the US market.

As of June 30 of this year, Crescent’s portfolio totaled $1.6 billion at fair value. Of this amount, 99% is composed of floating-rate debt instruments, with 89% of the total representing first lien investments. Crescent’s debt investments are spread across 187 companies, demonstrating a well-diversified portfolio. Specifically, 28.5% is invested in healthcare equipment & services companies, 19% in software & services, and 13.5% in commercial & professional services, among other sectors such as insurance and consumer services.

Similar to Sixth Street mentioned earlier, Crescent has experienced improved business results over the past year. Both revenues and earnings have shown modest growth since mid-2022, and the share price has increased by 29% year-to-date.

Looking at Crescent’s 2Q23 report, we find that the firm reported $46.7 million in net investment income, representing a 74.5% increase from the prior year – surpassing estimates by ~$999,000. Crescent’s adjusted net income per share was 56 cents, slightly exceeding expectations by 1 cent. The company’s cash assets amounted to $21.5 million, with liquidity exceeding $314 million in undrawn credit capacity.

Crescent’s strong performance has given the Board confidence to declare a regular common share dividend of 41 cents. This payment, which annualizes to $1.64 per common share, is scheduled to be paid in the upcoming month of October, yielding 10.2% at current share prices. Additionally, the Board has declared an 8-cent per share supplemental cash dividend, scheduled for a September 15, 2023 payout. The company has also indicated its commitment to continuing supplemental dividends when appropriate, using a predefined formula to determine each quarterly supplemental payment.

For 5-star analyst Robert Dodd, covering CCAP shares for Raymond James, the implementation of the supplemental dividend policy was one of several positive factors in his review. Dodd stated in his recent note, “We see an attractive risk/reward, with positive rate sensitivity and strong credit quality, and an implemented variable dividend policy — for a BDC trading at a material discount to current NAV/share, and at a discount multiple to its peer group.”

Looking ahead, Dodd goes on to give Crescent an Outperform (i.e. Buy) rating, backed up by an $18 price target that indicates room for an 11.5% upside on the one-year horizon. (To watch Dodd’s track record, click here)

All in all, Crescent Capital has 4 recent analyst reviews, and they are all positive – for a unanimous Strong Buy consensus rating. (See CCAP stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.