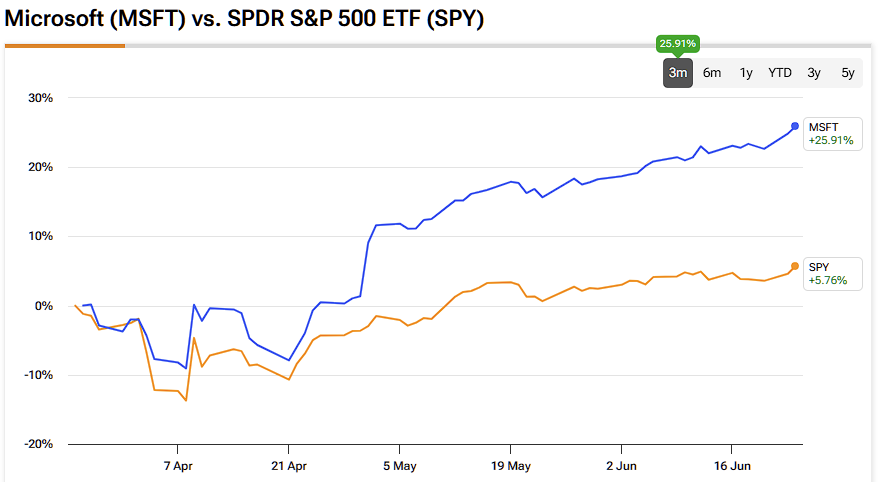

U.S. tech giant Microsoft (MSFT) briefly lost its crown as the world’s most valuable company but has since surged back, gaining 38.5% from its April 2025 low of $344, outperforming the S&P 500 (SPX) by ~20%.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Back in March, I viewed the dip as a rare buying opportunity for a fundamentally sound business. Now, with the stock back at record highs, investors who acted are seeing strong returns. The key question now: Is there still room to run? I believe the answer is a confident yes.

While the stock may remain range-bound in the near term due to macroeconomic concerns and uncertainties surrounding partnerships with OpenAI, the long-term investment case remains robust. Microsoft’s diversified portfolio and continued focus on scaling Azure amid the ongoing AI boom make it a solid long-term holding.

Relentless Innovation Allows MSFT to Surf the AI Wave

Microsoft continues to deliver consistent year-over-year growth in revenues and earnings, underpinned by a resilient, diversified business model. All three of its business segments have posted impressive revenue growth rates over the past few years, with Azure’s Intelligent Cloud division leading the charge, posting a compounded annual growth rate, or CAGR, of over 20%. The business consistently improves its quarterly revenue figures year after year, as shown by TipRanks data.

Leading enterprises across various sectors are already leveraging Microsoft’s AI, with notable names like Walmart (WMT) in retail and Siemens (SIE) in industrial settings integrating its models into their daily operations. Still, the broader market—particularly mid-sized and smaller companies—remains largely untapped, suggesting significant room for future growth.

To meet this rising demand, Microsoft plans to invest $80 billion in AI infrastructure and data centers in FY2025, significantly scaling its capacity to support compute-intensive workloads.

At the same time, Microsoft is laying the groundwork in quantum computing. The global market is projected to surge from $1.3 billion in 2024 to $93 billion by 2040, and Microsoft’s development of its Majorana-1 quantum system signals a clear ambition to lead in this next wave of computing innovation.

MSFT Debuts ‘Open Agentic Web‘

At the Build 2025 conference held in May 2025, Microsoft outlined its vision for the “open agentic web”—an internet ecosystem powered by AI agents that can navigate and interact across web platforms on behalf of users, teams, and organizations.

Key product announcements included Copilot Tuning, which enables low-code agent creation and multi-agent orchestration in Copilot Studio, and the NLWeb Initiative—a foundational open framework aimed at serving AI-powered web interaction, much like HTML did for the early internet.

Together, these innovations are designed to help developers build intelligent applications that can understand, interact with, and take action across the web.

Azure: Microsoft’s Core Growth Engine

Since its launch in 2010, Azure has evolved from a cloud platform into a key force in AI infrastructure. Its deep integration with OpenAI’s models has strengthened its value proposition, enabling customers to embed AI directly into their operations.

As TipRanks data shows, Azure now accounts for 43% of Microsoft’s total revenue—up from 25% ten years ago—and generated $4 billion in annual recurring revenue (ARR) in FY2024. With AI adoption accelerating, Azure’s growth continues to outpace that of its rivals.

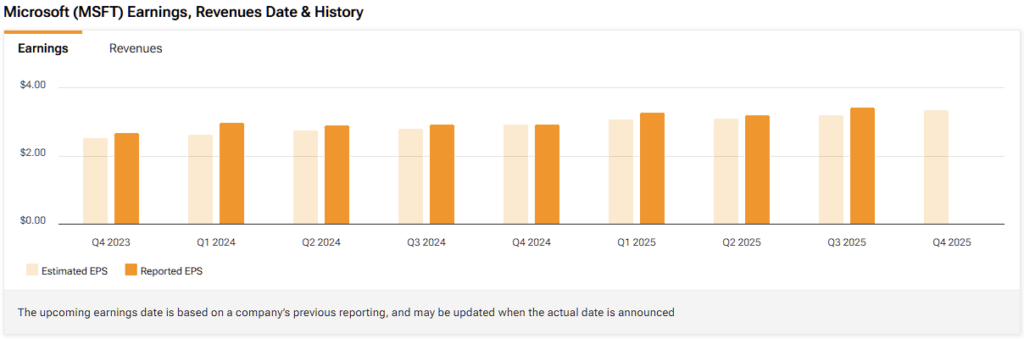

Strong Q3 Results Reinforce Bullish Outlook

On April 30, Microsoft delivered its 11th consecutive quarter of better-than-expected earnings, surpassing analyst estimates once again. Adjusted earnings of $3.46 per share came in 24 cents above the consensus forecast of $3.22, marking a 17.7% year-over-year increase from $2.94. Currently, MSFT’s P/E ratio is ~36 compared to a sector median of 22, indicating that the market believes the company will grow faster than its peers, so it’s willing to pay more for each dollar of current earnings.

Regarding revenues, MSFT’s revenue grew 13% year-over-year to $70.1 billion, exceeding expectations. Meanwhile, its Intelligent Cloud segment—which includes Azure—delivered $26.8 billion in revenue, a 21% year-over-year increase. Specifically, Azure and other cloud services experienced a 33% growth rate, surpassing the 31% growth rate of the previous quarter.

Despite ongoing uncertainties surrounding its partnership with OpenAI, Microsoft issued a robust outlook for the upcoming fourth quarter. The company expects to deliver double-digit revenue growth of approximately 14%, with projected revenues ranging between $73.15 billion and $74.25 billion, reinforcing confidence in its sustained growth momentum. Azure, in particular, is forecast to grow by 34% to 35% in constant currency during Q4 FY2025.

When compared to the broader sector, MSFT is leading the pack according to a TipRanks peers comparison.

The Double-Edged Sword of OpenAI

Tensions are beginning to emerge in the Microsoft–OpenAI partnership, despite its largely successful track record. Reports indicate that OpenAI may be exploring alternative alliances, including one with Alphabet (GOOGL), even after Microsoft’s $14 billion investment since 2019.

Adding to the complexity, OpenAI has accused Microsoft of anti-competitive practices. The company’s planned transition to a public structure, which it views as essential for attracting future funding, also requires Microsoft’s approval as a major stakeholder.

These developments suggest that a renegotiation of partnership terms or equity structure could be on the table. Any weakening of the collaboration may impact Microsoft’s AI monetization efforts in the near term.

Separately, Microsoft recently announced a round of job cuts—part of a broader trend across the tech industry—as firms look to offset the margin impact of heavy AI-related spending. While difficult, these actions reflect an industry-wide recalibration of operating costs amid structural transformation.

Elevated Valuations Remain Justified

Being the most valuable stock in the world, Microsoft’s valuation looks pricey, trading at a forward P/E of 35x. For comparison, Azure competitor Amazon (AMZN), an online retail and cloud computing giant, trades at a 34x forward P/E, while Apple (AAPL) trades at 28x.

Nonetheless, the premium is justified, given MSFT’s favourable industry-leading market position, strong margins, diversified revenue stream, and huge upside potential to high-growth AI, Quantum computing, and cloud businesses.

Is Microsoft a Buy, Hold, or Sell?

Wall Street analysts remain bullish on Microsoft stock. The stock commands a Strong Buy consensus rating based on 30 Buys and five Holds assigned in the past three months. Microsoft’s average stock price target of $516.14 per share implies a 5% upside potential from current levels over the coming year.

Long-Term Outlook Favors MSFT Bulls

Microsoft remains firmly positioned at the forefront of the AI and cloud computing landscape. While near-term pressures—including OpenAI-related friction or broader macro challenges—could create volatility, the company’s long-term trajectory appears strong.

Its track record of innovation and operational excellence supports continued confidence, and I see any short-term pullbacks as potential buying opportunities for long-term investors.