To say the last week in the capital markets was volatile would nearly be an understatement. After a post-thanksgiving COVID-19 variant scare and subsequent bounce, investors were still rattled going into the following week. It appears the Fed may be considering tapering its bond purchases at a rate faster than expected, and a much-anticipated correction is finally hitting both small and large cap growth stocks.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Navigating these highly choppy waters is a daunting task, especially for those who wish to end their year on a strong note. However, there is a group of individuals who tend to outperform the market, due to their close relationships with certain companies.

Financial data aggregator TipRanks provides a list of over 80,000 insiders, or individuals who either have more than a 10% stake in a public company, are on a board of directors, or hold a senior official role. While insider trading has a bad reputation, it is not explicitly illicit. In most cases, upon completing a transaction, the corporate insiders have up to two days to file a Form 4 to the Securities and Exchange Commission (SEC). This form declares the type and amount of trade, and after approval is later published by the SEC for public examination.

Although most trades are executed due to any number of reasons, there is one kind of transaction which holds more indicative power than others. As deemed by TipRanks on its Insiders’ Hot Stocks and Daily Insider Transactions tools, the Informative Buy shows when an insider used their own capital to purchase shares.

An Informative Sell transaction may not wield the same information as an Informative Buy, though there have been some high-profile sales as of late. Both CEOs, Elon Musk of Tesla (TSLA) and Satya Nadella of Microsoft (MSFT) sold off billions of dollars in stock over the last few weeks.

Additionally, the Top 25 Corporate Insiders list can be leveraged by everyday investors to follow the best-performing individuals.

Let’s take a look at two stocks which have seen considerably positive insider activity during the last few volatile trading days.

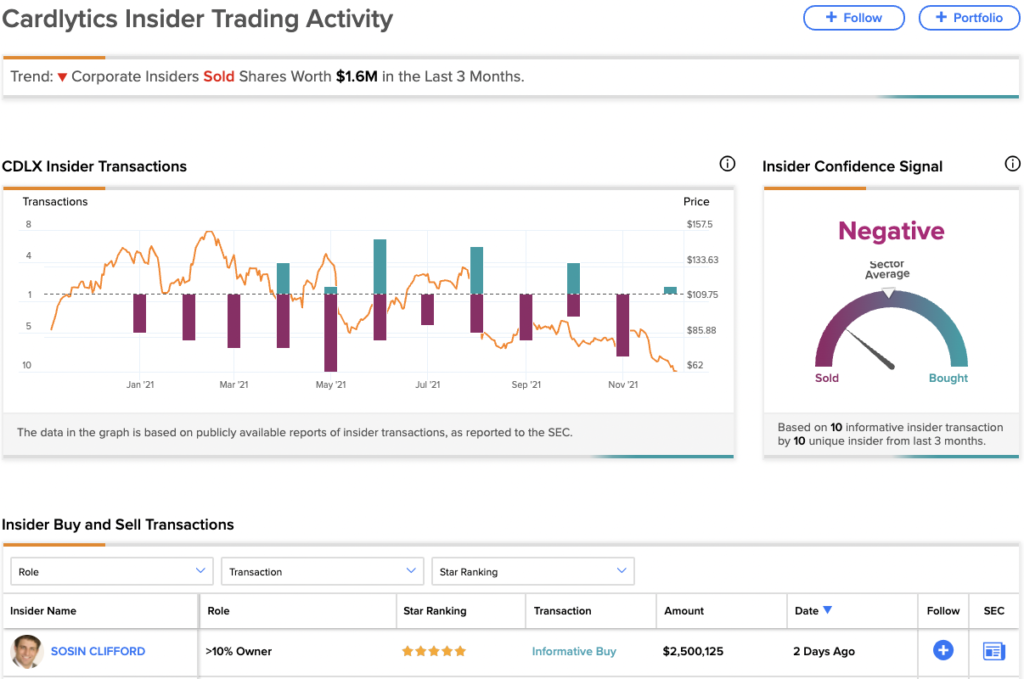

Cardlytics

The societal shift toward digital, electronic, and sometimes contactless or application-based payments was accelerated by the COVID-19 pandemic. Coupled with a boom in ecommerce activity, financial marketing solutions companies like Cardlytics Inc. (CDLX) saw their valuations soar. However, after several early 2021 peaks, CLDX has seen its share price fall about 53% since July.

The company operates a digital marketing platform that partners with financial institutions to provide targetable data on their customers to advertisers. Over the last few years, ads have become a highly lucrative field to engage in, if the company can properly execute. Last month, Cardlytics printed solid Q3 earnings, beating out Wall Street consensus estimates on both revenue and EBITDA. However, since then, the stock has continued to decline along with the shaky broader market.

It appears that now, one insider in particular sees this as an attractive buying opportunity.

Clifford Sosin of CAS Investment Partners saw the recent weakness in CDLX as a moment to raise his holding value. The insider picked up $2,500,125 in company stock, increasing his position to $323,428,020. Considering that Sosin now holds about a 15% stake in Cardlytics, it can be inferred that he is highly confident in the company’s possibility for upside.

Moreover, the insider himself has a quality record of picking stocks. On TipRanks, Sosin has been successful on 90% of his transactions, netting an average return of 188.8% on each over the last year.

Despite the five-month slump in the stock’s valuation, Wall Street analysts are equally as bullish. Last month, Kyle Peterson of Needham & Co. updated his hypothesis on the company, noting that CDLX had bested the Street’s estimates even throughout the difficult macro environment. Supply side constraints and labor shortages plagued the retail sector, which in turn affects advertisers and their spending.

Peterson wrote that he remains “bullish on CDLX’s core advertising platform and broad base of bank partnerships, which we view as a valuable and differentiated asset.”

The analyst reiterated his Buy rating on the stock, and assigned a price target of $120 per share. This target represents a possible 12-month upside of 92.43% from Friday’s closing price of $62.36.

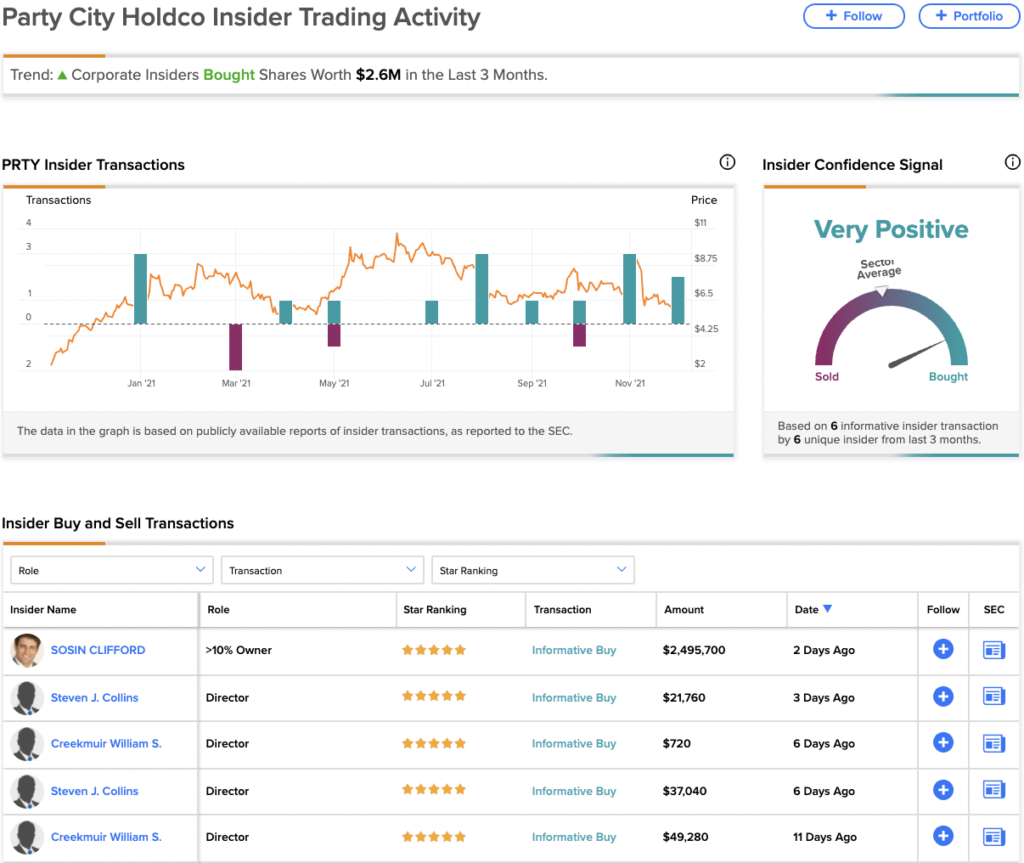

Party City

After slumping through the start of the pandemic, Party City Holdco Inc. (PRTY) saw its valuation rise along with the rest of the reopening stock plays, once the vaccine rollout was confirmed in early November 2020. The party goods and Halloween accessories retailer finally got its stock off of the ground, although as 2021 has worn on, the company is in steady decline yet again. Over the last six months, about 40% of PRTY’s share price has been shaved off.

The company is highly sensitive to the supply and shipping obstacles persisting against most all retailers, and after Halloween, PRTY’s product offerings are left with less to capitalize on. To add insult to injury, New Year’s parties this year may yet again face restrictions as the Omicron variant spreads across national borders.

However, a group of bullish investors have capitalized on the recent downturn. Over the last 11 days, three individuals have increased their stakes in Party City, over the course of five transactions worth a total of $2,604,500. Although the overwhelming money put down was yet again by Clifford Sosin, who owns more than 10% of the company, two board members also threw their confidence behind the company. Steven Collins and William Creekmuir both bought in, increasing their holding values to $479,237 and $920,053, respectively.

Additionally, the two directors both have impressive track records across their investment histories. Collins and Creekmuir have been correct on their trades 69% and 63% of the time, respectively, and have returned an average of 46.2% and 48.4%, respectively. On TipRanks, both of the two directors hold five-star ratings.

Using TipRanks unique data and analyses, it can be identified that PRTY’s Smart Score is a 7 out of 10. The stock currently has positive metrics in its blogger and news sentiment, hedge fund activity, and insider activity. However, its analyst commentary has been less than stellar. Two of three of the analysts to rate the stock most recently have rated it a Hold, with only 1 confident enough for a Buy.

Last month, Joseph Feldman of Telsey Advisory Group assigned a Hold rating to Party City, and lowered his price target from $10 to $9 per share. While he was encouraged by the previous quarter’s performance, his outlook on the stock is not as bullish. Meanwhile, PRTY closed trading Friday at a price of $5.29 per share.

Disclosure: At the time of publication, Brock Ladenheim did not have a position in any of the securities mentioned in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates Read full disclaimer >