I am neutral on Accenture (ACN) as it has strong growth potential, general bullish sentiment from Wall Street analysts, and meaningful implied upside by its average price target, but its valuation multiples looked stretched relative to historical averages.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Accenture is based in Ireland and boasts a multinational presence with a business model that provides IT and consulting services to other companies.

Strengths

As a Fortune 500 company which reported revenues of $50.53 billion in 2021, Accenture benefits from a global presence, high name recognition, and a strong reputation that enables it to win and retain business.

As a result, the company has won business from the vast majority of the Fortune Global 100 companies and over three-quarters of the Fortune Global 500 companies. Furthermore, its sheer size means that it benefits from substantial economies of scale.

Recent Results

Accenture’s Q1 results for fiscal 2022 were strong, including $14.97 billion in revenue, up 27% year-over-year, and beating the high end of its guidance range by more than $600 million.

Consulting revenues were $8.39 billion, up 33% year-over-year, while outsourcing revenues increased by 21% to $6.57 billion.

The North American business boomed, posting 26% year-over-year growth to $6.91 billion, while the European business did even better, posting revenues of $5.1 billion for growth of 29%. Last, but not least, emerging markets revenue saw growth of 28% to $2.96 billion.

Profitability declined slightly, as gross margins fell by 20 basis points to 32.9%, but operating income still increased to $2.43 billion from $1.89 billion in the year-ago quarter. Operating cash flow was also strong at $531 million.

The balance sheet also remained in strong shape, with a total cash balance of $5.6 billion even after paying out $613 million in dividends to shareholders.

Valuation Metrics

ACN stock looks a bit pricey at the moment. It currently trades at a 16.9 EV/EBITDA ratio, which seems quite high compared to its historical average of 15.5, though the company is expected to grow EBITDA by 17.8% in fiscal 2022 and by 9.3% in fiscal 2023.

The price-to-normalized earnings ratio also appears a bit high as it currently trades at 28.8 compared to its historical average of 26, though normalized earnings per share are expected to grow by 19.8% in fiscal 2022 and by 11.7% in fiscal 2023.

Wall Street’s Take

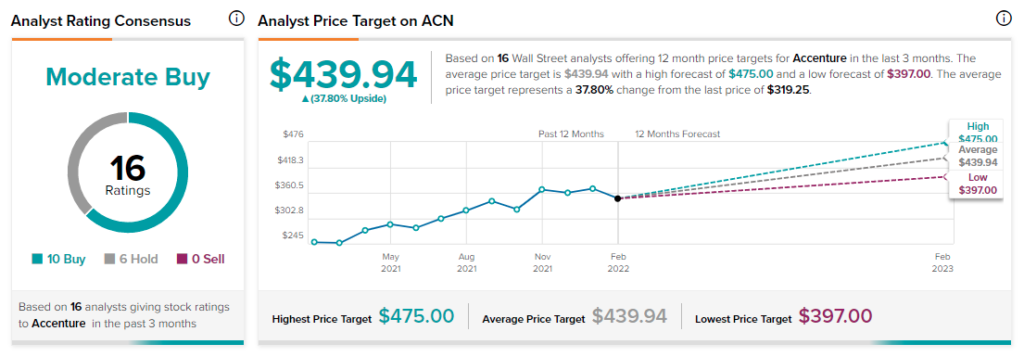

From Wall Street analysts, ACN earns a Moderate Buy analyst consensus based on 10 Buy ratings, six Hold ratings, and zero Sell ratings in the past three months. Additionally, the average Accenture price target of $439.94 puts the upside potential at 37.8%.

Summary and Conclusions

Accenture is a leading player in its industry with competitive advantages stemming from its size, global presence, and powerful network of existing business relationships. Furthermore, it boasts a strong growth outlook as well as general bullishness from Wall Street analysts. Last, but not least, the average price target implies strong upside potential over the next year.

That said, the stock looks a bit pricey here as it is trading well above its historical average valuation multiples.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure