Acadia Pharmaceuticals’ (ACAD) share price was cut almost in half as doubt crept into investors’ minds as to whether or not its lead product, Nuplazid, will be approved for Dementia-Related Psychosis (DRP).

Don’t Miss TipRanks’ Half-Year Sale

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Make smarter investment decisions with TipRanks' Smart Investor Picks, delivered to your inbox every week.

The setback came as a shock to the investor community as the product seemed poised for approval before its April 3, 2021 PDUFA date. The FDA requested additional information on the statistical methods used to determine the efficacy of the product in DRP. Naturally, this raises the question of whether additional clinical trials need to be conducted, further delaying the much-needed treatment.

Further complicating matters is the virtual silence on the part of the management team at ACAD. Most likely, the team is not intentionally avoiding the analyst community. Instead, they are trying to determine what the FDA wants and how to proceed before commenting.

To illustrate how out of the blue the delay is, ACAD offered a glimpse of the market opportunity for Nuplazid in DRP. The team estimates that the addressable market is 10x larger than the current market for Nuplazid in Parkinson’s Disease Psychosis (PDP). Nuplazid generated sales of $442 million in 2020, underscoring the potential for a new blockbuster indication for the therapy.

Stock Market Reaction

The market offered a swift and brutal response to the disappointment by lopping off over $4 billion from ACAD’s market cap. However, the market has severely overreacted to the news for a few reasons.

First and foremost, the FDA has “identified some deficiencies precluding labeling discussions,” according to CEO Steve Davis. The natural question is, what are the deficiencies, and how can they be addressed?

The FDA has not identified or provided details of the deficiencies cited, and a final decision has yet to be rendered. So, is this a golden opportunity to accumulate or a sign of more problems to come?

Taking a deeper look at this unique situation, Nuplazid is an approved product with a growing sales base. The FDA did issue a Black Box warning that Elderly patients with PDP treated with antipsychotic drugs are at an increased risk of death. With a lack of safer, more effective alternatives, clinicians thus far, have been comfortable with the risk associated with the product. Therefore, the aging demographic of the industrialized world should serve as a tailwind for broader adoption.

At a current market cap of over $4 billion with an approved product that has a decent shot of approval for a patient population 10x its current market, the risk-reward profile seems promising. The sudden drop in the share price may coax Big Pharma to step up and look to acquire the asset at a discounted price. The more prominent players have the clout with the FDA to spearhead a troubled product through the regulatory process more effectively than a smaller player such as ACAD.

ACAD does have a few assets in earlier stages for different neurological conditions. However, as an early-stage asset, it is difficult to assign a value before clinical readouts, and thus, the value of ACAD revolves around the growth trajectory of Nuplazid. If it can gain approval for the DRP indication, ACAD is poised to reach new heights.

The Street’s Take

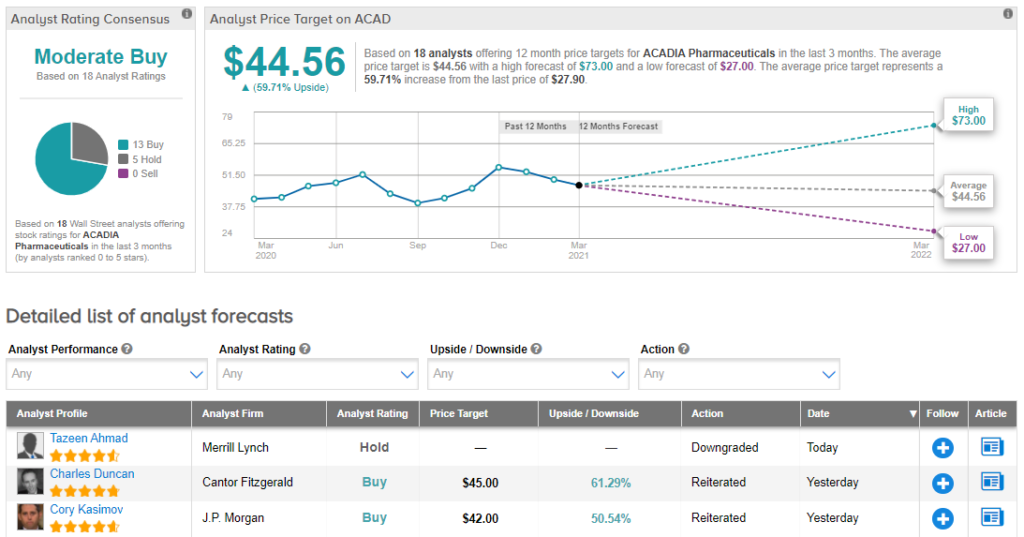

Looking at the consensus breakdown, 13 Buys and 5 Holds have been assigned in the last three months. So, ACAD is a Moderate Buy. Based on the $44.56 average analyst price target, the upside potential lands at 60%. (See Acadia Pharmaceuticals stock analysis on TipRanks)

Disclosure: Alexander Poulos held no position in any of the stocks mentioned in this article at the time of publication.

Disclaimer: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities.