With the summer travel season fast approaching and consumer demand for leisure and business travel continuing to rebound, investors are once again turning their attention to the travel and hospitality sector. Travel-related stocks have shown resilience in recent years, supported by strong booking trends, improved global mobility, and the growing preference for experiential getaways.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

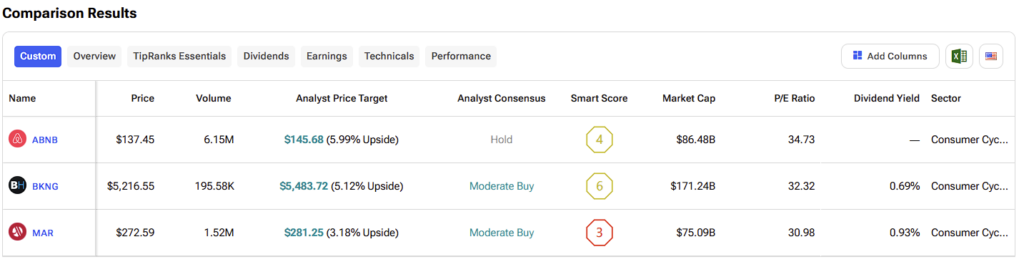

In this article, we’ll take a closer look at three key players in the industry — Airbnb (ABNB), Booking Holdings (BKNG), and Marriott International (MAR) — to assess their market positioning, financial health, and growth prospects. Which of these travel and accommodation giants presents the most compelling opportunity for investors this summer?

Airbnb (NASDAQ:ABNB)

Airbnb, a platform that connects property hosts with travelers seeking short-term accommodations, has emerged as a significant force in the global travel and hospitality industry over the past several years.

Notably, the company demonstrated resilience during a period marked by economic uncertainty, including concerns around tariffs, global trade tensions, and recessionary risks — all of which could have impacted travel demand. In its most recent quarter, Airbnb reported a 6% year-over-year increase in revenue (8% on a constant currency basis), alongside an 8% growth in nights and experiences booked, reflecting sustained consumer interest.

Valuation-wise, Airbnb currently trades at approximately 32.8x projected 2025 earnings, compared to the S&P 500’s multiple of roughly 20.5x next 12 months’ earnings. While its valuation is relatively elevated, it may be justifiable given the company’s growth trajectory. However, assessing its attractiveness requires a comparison with peers, which we’ll explore in the following sections.

Although Airbnb does not pay a dividend, the company has actively returned capital to shareholders through share repurchases. In Q1 2025 alone, Airbnb repurchased $807 million worth of shares, bringing its 12-month total to $3.5 billion — a clear indication of management’s confidence in the company’s long-term prospects.

Is Airbnb a Good Stock to Buy?

On Wall Street, ABNB earns a Hold consensus rating based on 13 Buys, 17 Holds, and five Sell ratings assigned in the past three months. ABNB’s average stock price target of $145.68 implies almost 6% upside potential from current levels.

Booking Holdings (NASDAQ:BKNG)

Booking Holdings, a more established and larger player in the travel sector, is often categorized as a value stock compared to the newer and more growth-oriented Airbnb. However, recent performance suggests otherwise. In fact, Booking Holdings is currently outpacing Airbnb in revenue growth. In the most recent quarter, Booking reported an 8% year-over-year increase in revenue, along with 7% growth in both room nights and gross bookings.

What makes this performance particularly notable is the scale at which Booking is operating. The company generated $4.8 billion in revenue during the quarter — more than double Airbnb’s $2.3 billion — making its growth on a larger base all the more impressive. While Airbnb is often seen as the poster child for growth in the travel space, these results highlight that perceptions don’t always align with performance.

From a valuation perspective, Booking Holdings also stands out. The stock trades at approximately 24.3x forward earnings estimates, making it slightly more affordable than the broader market and considerably less expensive than Airbnb. Both companies appear reasonably valued given their fundamentals, but Booking Holdings offers a more compelling case on valuation alone.

In addition, Booking Holdings has recently bolstered its shareholder return profile by initiating a dividend in 2024. The current yield stands at 0.8% — modest, but meaningful — and the company has already increased its quarterly payout from $8.75 in 2024 to $9.60 in 2025. With a conservative payout ratio under 20%, Booking is positioning itself as a potential dividend growth stock.

Like Airbnb, Booking Holdings is also actively repurchasing shares. During the latest quarter, the company repurchased $1.8 billion worth of its stock and still has $25.9 billion remaining under its current authorization — signaling robust commitment to shareholder returns.

What is the Price Target for BKNG?

BKNG currently carries a Moderate Buy consensus rating based on 23 Buys, 11 Holds, and zero Sell ratings assigned in the past three months. The average BKNG stock price target of $5,483.72 implies ~5% upside potential from current levels.

Marriott International (NASDAQ:MAR)

Finally, while not a direct peer to Booking Holdings or Airbnb, it’s worth considering Marriott International— a more traditional player in the travel space. As a global operator and franchisor of well-known hotel brands such as Marriott, Courtyard, Residence Inn, Sheraton, Westin, and W Hotels, Marriott’s business model differs significantly. Unlike Airbnb and Booking Holdings, which function primarily as online booking platforms, Marriott generates revenue through property management and franchise agreements.

In the most recent quarter, Marriott reported a 4.1% year-over-year increase in RevPAR (revenue per available room), driven by more than 6% growth internationally and approximately 3% growth in the U.S. and Canada. The company also posted solid 7% growth in base management and franchise fees, underscoring the strength of its core operations. While these are healthy results, particularly given ongoing macroeconomic headwinds, Marriott’s top-line growth still trails that of Airbnb and Booking Holdings. Looking ahead, the company has guided for a moderation in RevPAR growth to a range of 1.5% to 2.5% in the second quarter, down from a prior forecast of 2% to 4%.

From a valuation standpoint, Marriott trades at approximately 27.2x projected 2025 earnings, placing it between Airbnb and Booking Holdings and above the broader market average.

Marriott does pay a dividend, offering a current yield of 0.93%. While this is slightly higher than Booking Holdings’ yield, it remains below the average yield for the S&P 500, and the difference between the two companies’ payouts is relatively minor.

In addition to its dividend, Marriott continues to return capital to shareholders through share repurchases. During Q1 2025, the company bought back 2.8 million shares for a total of approximately $800 million.

Is Marriott International Stock a Buy or Sell?

Marriott International carries a Moderate Buy consensus rating based on six Buys, 11 Holds, and zero Sell ratings assigned in the past three months. The average MAR stock price target of $281.25 implies 3% upside potential from current levels.

Booking Holdings Leads as the Most Compelling Travel Stock

All three of these leading travel companies — Airbnb, Booking Holdings, and Marriott International — are performing well despite facing a range of macroeconomic challenges, including lingering global uncertainty and a mixed travel demand environment. Each brings unique strengths to the table: Airbnb continues to innovate and capitalize on the growing preference for alternative accommodations; Marriott leverages its established global footprint and brand recognition; and Booking Holdings demonstrates strong execution and scale in the online travel space.

That said, among the three, Booking Holdings stands out as the most compelling investment opportunity right now. Despite being perceived by some as a more mature, value-oriented company, Booking Holdings is currently outpacing both Airbnb and Marriott in terms of revenue growth — a notable achievement given the company’s already sizable revenue base.

Taken together, these factors — leading revenue growth, a reasonable valuation, growing shareholder returns, and a strong capital return strategy — make Booking Holdings the most well-rounded and attractive choice among the three major travel stocks. While Airbnb and Marriott each have their own merits, Booking Holdings’ blend of growth, value, and capital discipline gives it the edge in today’s market environment.