Abercrombie & Fitch’s (ANF) story over the past two years has been one of impressive transformation: a successful rebrand, margin expansion, and renewed relevance among Gen Z shoppers. But in 2025, the narrative has shifted. Slower guidance, macroeconomic headwinds, and questions about pricing power have dampened sentiment and cooled enthusiasm. Still, the fundamentals haven’t collapsed. The company continues to post ROIC figures well above its cost of capital, and its current valuation suggests the market may be overcorrecting.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

For investors with patience and a long-term perspective, this might not just be a temporary dip—it could be an opportunity to invest in a high-quality business trading at a meaningful discount.

ANF’s Hot Streak Cools Off in 2025

After soaring nearly 600% between 2023 and early 2025, Abercrombie & Fitch shares have hit a wall, dropping over 50% year-to-date, as investors grow concerned that the growth story may be running into serious trouble.

Between 2022 and 2024, Abercrombie pulled off a successful brand transformation. Key initiatives included modernizing the brand with a stronger focus on inclusion and better engagement with younger consumers, especially Gen Z. The company also improved operational efficiency and profit margins by closing several flagship stores and shifting toward a more localized retail strategy, particularly in international markets.

Thanks to these changes, Abercrombie was able to grow revenue at a 10% CAGR over the last three years and operating income at a 39% CAGR, with margins climbing from just 2.5% in 2022 to 15% by 2024—far exceeding what the market had initially expected.

But signs of a slowdown in 2025 brought the stock back down to earth. It all started earlier this year with a more cautious outlook: sales growth was projected at just 3% to 5% for fiscal 2025 (recently revised to 3% to 6%), compared to analyst expectations of around 7%. Operating margin guidance also took a hit, revised down from 14–15% to 12.5–13.5%, reflecting a tougher macro backdrop, particularly due to persistent reactivations of the U.S.-China trade war narrative.

Was the ANF Selloff Overdone?

In my view, when a stock experiences a sharp decline, such as what we’ve seen with Abercrombie & Fitch (ANF) this year, it’s important to distinguish between structural challenges and cyclical volatility.

After a strong multi-year rally, part of the recent correction appears to be driven more by elevated volatility than by fundamental deterioration. Over the past 12 months, implied volatility has reached as high as 59%, suggesting the market has been anticipating significant price swings. This may reflect heightened expectations around operational performance as well as the seasonality inherent in the fashion retail sector.

That said, I don’t believe there’s clear evidence of structural headwinds at this stage, though certain risks could evolve in that direction. One of the most notable concerns is Abercrombie’s core customer base—Gen Z—which presents challenges, particularly in terms of pricing power. As Raymond James analyst Rick Patel points out, the company’s recent guidance implies limited confidence in its ability to raise prices, largely due to the price sensitivity of its younger demographic.

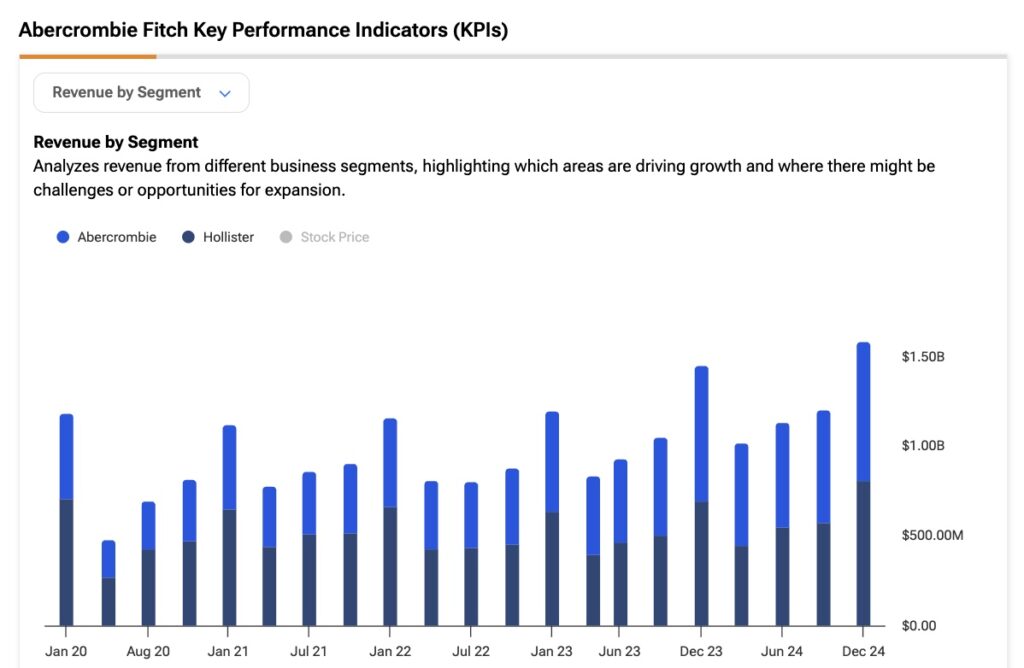

Another area of potential vulnerability is Abercrombie’s reliance on the Hollister brand, which has historically been a key driver of growth. If Hollister’s momentum slows, the company could face difficulty offsetting that weakness, especially as it continues to shift away from large flagship stores, potentially diminishing its physical retail presence and brand visibility.

These concerns seem to be reflected in analyst revisions: over the past three months, EPS estimates for the next two years have been cut by 10%, even though sales projections have remained mostly steady. To me, that signals a fear that Abercrombie will have to sacrifice margins to maintain growth, even if that growth comes in slower than what we’ve seen over the past few years.

Playing It Safe With Value

A big part of the bullish case for Abercrombie & Fitch hinges on its strong return on invested capital (ROIC). Based on the company’s results over the past twelve months—with $721.4 million in operating profit, a 27% effective tax rate, and about $2.3 billion in invested capital—Abercrombie is delivering an ROIC of 23.6%.

That’s a very solid return, especially when you consider that the company’s cost of capital sits around 11%, factoring in a relatively high beta of 1.5, a risk-free rate of 4.5% (10-year U.S. Treasury), and an expected market return of 9%. Even if operating margins take a hit this year, the ROIC would likely still stay above 20%, which is impressive.

Now, looking at valuation: using the same operating profit from the last twelve months and applying it to the current enterprise value of $4.17 billion results in an earnings yield of 17.3%—well above the estimated cost of capital. In other words, Abercrombie is generating strong operational returns relative to its total value, which suggests the stock is attractively priced.

Of course, the catch is that this assumes operating profit stays steady going forward. Even if margins do come under pressure, I still think there’s a decent margin of safety baked into ANF’s current price.

Is Abercrombie & Fitch a Good Stock to Buy?

Over the past three months, 11 analysts have issued ratings on Abercrombie & Fitch. Of those, seven have assigned a Buy rating and four have rated the stock a Hold, leading to a Moderate Buy consensus. The average price target stands at $117.67, suggesting potential upside of ~50% over the next year.

ANF Stock Still in Vogue

Abercrombie & Fitch is currently facing unfavorable short-term momentum, with recent soft guidance raising concerns about whether the challenges are structural in nature or simply part of a cyclical downturn.

That said, there are still encouraging fundamentals. The company continues to deliver strong returns on invested capital, which are expected to remain well above its cost of capital, even under more conservative outlooks. Additionally, the stock’s valuation remains compelling.

Taken together, these factors suggest a potential buy-the-dip opportunity. Abercrombie appears to be a genuine value play rather than a value trap.