The Cheesecake Factory (CAKE) had a bad third quarter relative to expectations, according to Quo Vadis Capital’s John Zolidis, who has a Sell rating on the company’s shares. The company produces cheesecakes and other baked products for its restaurants and third-party customers.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

I’m neutral on The Cheesecake Factory. (See Analysts’ Top Stocks on TipRanks)

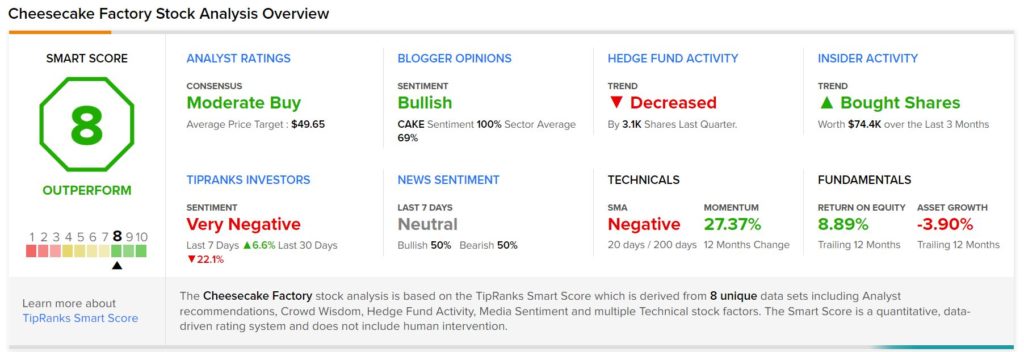

TipRanks’ Smart Score

TipRanks’ Stock Analysis system assigns CAKE a Smart Score of 8 out of 10, citing insider buying in the last three months, strong blogger sentiment, and strong fundamentals.

Missing Expectations

Last week, the company reported $754.5 million in total revenues for the fiscal third quarter of 2021, up from $517.7 million in the same quarter of last year. Net income per common share came in at $0.64 in Q3 2021. Meanwhile, comparable restaurant sales increased 41.1% year-over-year and 8.3% relative to the third quarter of 2019.

Management was pleased with the results, with Chairman and Chief Executive Officer David Overton stating, “We drove strong sales performance at The Cheesecake Factory restaurants and across our concepts during the third quarter despite the surge in COVID-19 cases from the Delta variant,”

He then continued, “Our teams also generated solid profitability in the face of higher than anticipated group medical insurance costs and pandemic environment cost pressures during the quarter.”

However, Zolidis doesn’t see things that way, saying, “Total revs missed, comps missed, RLM came in at 13.7% vs. 15.4% in 3Q19 and guidance for solid margin improvement in 2H vs. ’19’19. EPS was five cents below consensus but included a tax credit. On an 11.5% tax rate (consistent with 1H21) the tax benefit was worth $0.13, suggesting the real bottom-line miss was $0.18. EPS would have been below 3Q19 due to the dilutive share offering during the pandemic. “

Where’s the Pain?

The U.S. restaurant industry is caught at the crossroads of two trends. On the one side, the rising vaccination rates and the pandemic’s easing are bringing people back to restaurants. On the other side, there’s a persistent rise in the direct cost of goods sold by the company (COGS).

That is where Zolidis sees the “pain” for The Cheesecake Factory, “COGS are holding relatively even vs. 2019,” he says. Zolidis continues, “However, both labor and operating costs are higher still. Forecasting 2022 comps is pretty difficult but the business will have to accelerate from here to avoid RLM contraction. Meanwhile, off-premise, CAKE’s big win during the pandemic, peaked in 1Q21 and has now declined sequentially for two consecutive quarters.”

Wall Street’s Take

The 11 Wall Street analysts following Cheesecake do not seem to share Zolidis’s pessimism. The Company has a Moderate Buy consensus rating, based on four Buys, six Holds, and one Sell assigned in the past three months.

The average Cheesecake Factory price target of $49.65 implies 11.4% upside potential, which is not that lousy of a return in a low-interest-rate environment. However, it may be too optimistic given the company’s headwinds.

Analyst price targets range from a low of $40.00 per share to a high of $60.00 per share.

Disclosure: At the time of publication, Panos Mourdoukoutas didn’t own shares of Cheesecake Factory.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates, and should be considered for informational purposes only. TipRanks makes no warranties about the completeness, accuracy or reliability of such information. Nothing in this article should be taken as a recommendation or solicitation to purchase or sell securities. Nothing in the article constitutes legal, professional, investment and/or financial advice and/or takes into account the specific needs and/or requirements of an individual, nor does any information in the article constitute a comprehensive or complete statement of the matters or subject discussed therein. TipRanks and its affiliates disclaim all liability or responsibility with respect to the content of the article, and any action taken upon the information in the article is at your own and sole risk. The link to this article does not constitute an endorsement or recommendation by TipRanks or its affiliates. Past performance is not indicative of future results, prices or performance.