Small-cap stocks, which have a market valuation between $300 million and $2 billion, are referred to as hidden gems in the stock market. They offer investors substantial growth potential. However, they are accompanied by higher volatility and risk compared to the larger and more established companies.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

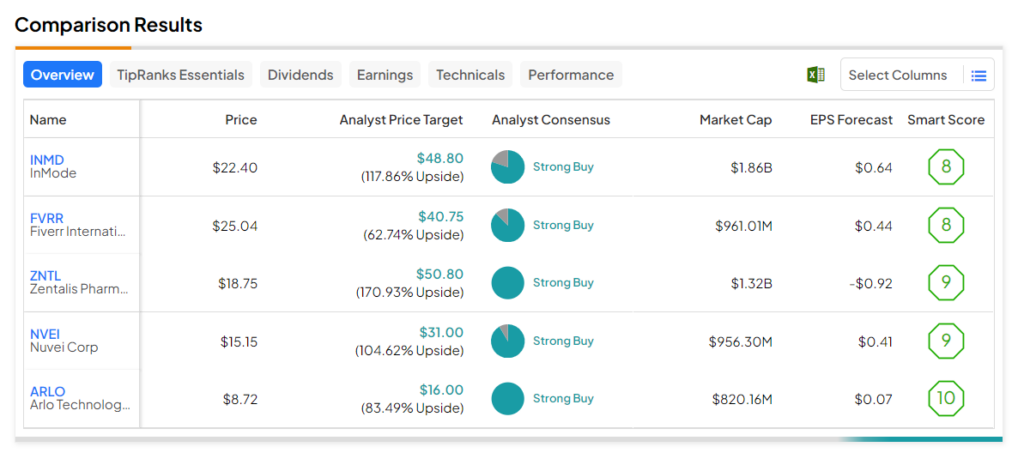

Thus, to support investors’ search for the best small-cap stock, we have leveraged the TipRanks Stock Screener tool. These stocks have received a Strong buy rating from analysts and boast an Outperform Smart Score (i.e., 8, 9, or 10) on TipRanks, which points to their potential to beat the broader market. Further, analysts’ price targets reflect an upside potential of more than 60%.

Here are the five best small-cap stocks for investors to consider.

- InMode (NASDAQ:INMD) – This medical technology company specializes in aesthetic treatments and surgical technologies. Its price forecast of $48.80 implies a 117.9% upside. Also, the stock has a Smart Score of eight.

- Fiverr International (NYSE:FVRR) – Fiverr is an online marketplace that connects businesses with freelancers offering various digital services and creative tasks. The stock’s average price target of $40.75 implies a consensus upside of 62.7% and carries a Smart Score of eight.

- Arlo Technologies (NYSE:ARLO) – ARLO specializes in home security and video monitoring products, including wireless cameras and doorbells. The stock has an analyst consensus upside of 83.5% based on the average price target of $16. On TipRanks, ARLO earns a “Perfect 10” Smart Score.

- Zentalis Pharmaceuticals (NASDAQ:ZNTL) – The biopharmaceutical company focuses on developing targeted therapies for cancer treatments. ZNTL stock’s price forecast of $50.80 implies a 170.9% upside. It has a Smart Score of nine.

- Nuvei Corp. (NASDAQ:NVEI) – Nuvei provides payment processing solutions for businesses of all sizes. The stock’s average price target of $31 implies a 104.6% upside potential. Also, its Smart Score of nine is encouraging.