Long-term investors seeking to diversify their portfolios and enhance income stability could consider investing in real estate stocks, including Real Estate Investment Trusts (REITs). These stocks offer several benefits, including tax advantages, generous dividend distributions, and the potential for capital appreciation.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

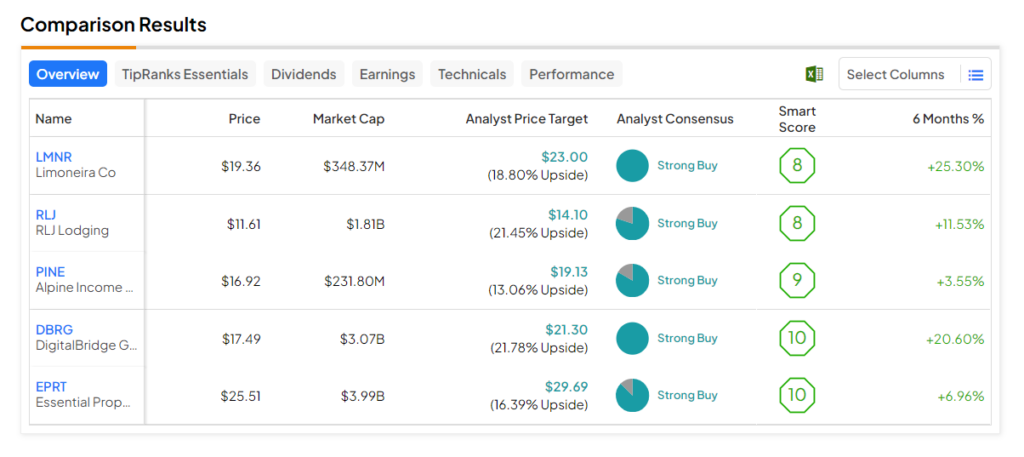

Using TipRanks’ Stock Screener tool, we identified five real estate stocks with the potential to outperform the market. These stocks have received a Strong Buy rating from Wall Street analysts and have an Outperform Smart Score (i.e., 8, 9, or 10) on TipRanks. Moreover, the analysts’ price targets reflect an upside potential of over 10%.

Here are the five key stocks from the real estate sector for investors to consider.

- Limoneira (NASDAQ:LMNR) – Limoneira is an agribusiness and real estate development company that engages in the innovation of the agricultural citrus industry in California. LMNR stock’s average price target implies an upside potential of 18.8%. Further, it has a Smart Score of eight.

- Essential Properties Realty (NYSE:EPRT) –Essential Properties Realty Trust engages in the acquisition, ownership, and management of single-tenant properties that are net leased to middle-market companies. EPRT stock’s price forecast of $29.69 implies 16.4% upside potential. Moreover, it has an outperforming Smart Score of “Perfect 10.”

- DigitalBridge Group (NYSE:DBRG) – DBRG invests and operates businesses across the digital ecosystem, which includes data centers, cell towers, fiber, edge infrastructure, and small cells. The stock’s average price target implies upside potential of 21.8%. Also, its Smart Score of “Perfect 10” is encouraging.

- RLJ Lodging (NYSE:RLJ) – This REIT invests in hotels. RLJ stock has an average price target of $14.10, which implies 21.5% upside potential from current levels. It has a Smart Score of eight.

- Alpine Income Property Trust (NYSE:PINE) – The company owns and operates a portfolio of single-tenant commercial properties. PINE stock has an analyst consensus upside of 13.1% and a Smart Score of nine.