COVID is receding, and markets are rising; those are the two trends that investors have most on their minds right now. It’s entirely sensible that they’ll go together. As the economy reopens, money will begin to circulate faster – and find its way in the equity market.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

With economic conditions improving, investors are on the lookout for the best returns in an expansionary environment. One natural place for them to look: the small-caps market. While big names get the headlines, the small-cap stocks offer the highest returns.

With this in mind, we’ve used the TipRanks database to seek out three stocks that meet a profile for growth under current conditions. We’ve found three Strong Buy small-cap stocks – valued under $700 million – that are trading below $10. Not to mention substantial upside potential is on the table.

Shift Technologies (SFT)

Not least among the changes we saw during the pandemic year was the strong shift toward online business and e-commerce. Shift Technologies brought e-commerce to the used car market, with an end-to-end, hassle-free sales model designed to streamline the customer’s experience. Shift provides digital solutions connecting car owners and buyers, making it easy to find a car, test drive it, and purchase it. Currently, Shift is operating in California, Oregon, Washington state, and Texas, primarily in urban centers.

Like many smaller tech-oriented companies, Shift went public last year through a SPAC merger. In this case, the special acquisition company (SPAC) was Insurance Acquisition Corporation. The merger was completed in October, in a transaction valued between $340 million and $380 million. The SFT ticker started trading on the NASDAQ on October 15. Since then, the stock has slipped 35%, leaving the company with a market cap of $602 million.

Despite the slip in share value after completion of the merger, Shift still had some $300 million in newly available capital to conduct operations. The company has plenty of room to maneuver, as the used car market is worth more than $840 billion annually.

In the company’s Q4 report, Shift’s first as a publicly traded entity, it reported strong year-over-year growth in revenues and units sold. For the quarter, revenues reached $73.4 million, company record and 168% higher than the previous year. Shift sold 4,666 units during the quarter, a 147% yoy increase. For the full year, the revenue of $195.7 million represented an 18% yoy gain, while the total units sold reached 13,135, also up 18%. The sale numbers skewed heavily toward e-commerce, which made up 9,497 units of the year’s total sales.

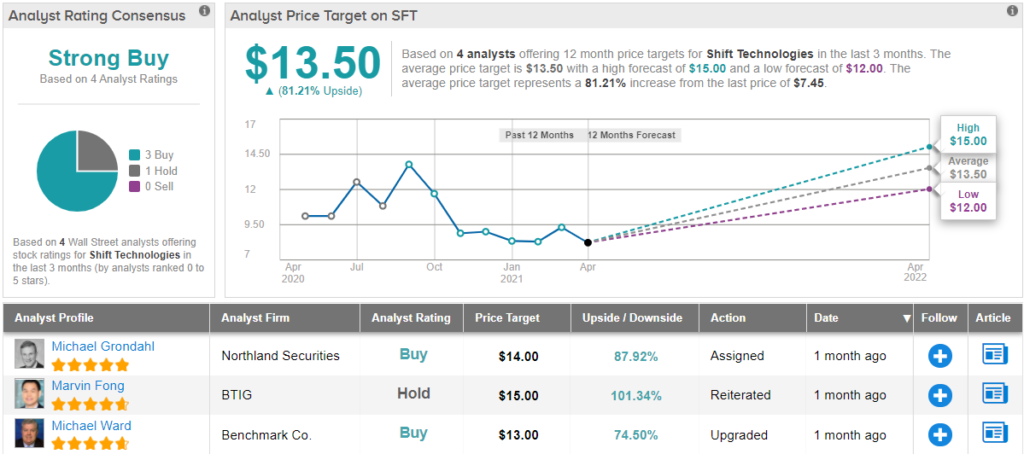

Shift has attracted attention from Benchmark’s 5-star analyst Michael Ward, who sees a higher level of conviction for growth in 2021 and 2022.

“[In] our view, positive trends with revenue per unit and cost performance in early-2021 have set the company on a positive path… and given the recent pullback in the stock, view it as a favorable time to Buy. The used vehicle market in the US is a $1 trillion revenue opportunity, pricing has increased on double-digit rates since mid-2020 and given the pricing/inventory trends in the new vehicle market, we expect the positive pricing environment to continue into the second half of 2021,” Ward opined.

In line with his upbeat outlook, Ward rates Shift shares a Buy, and his $13 price target suggests a one-year upside of ~74%. (To view Ward’s track record, click here)

Wall Street tends to agree with Ward’s confidence on the automotive e-commerce firm, considering TipRanks analytics reveal SFT as a Strong Buy. Shares in SFT are selling for $7.45 each, and the average target of $13.50 indicates a possible upside of ~81% by year’s end. (See SFT stock analysis on TipRanks)

Casper Sleep (CSPR)

The next stock we’re looking at, Casper Sleep, is a $290 million company in the bedding business. Specifically, the company sells mattresses, pillows, bedframes, and bedding – household items that everyone needs. Casper operates mainly online, but has showrooms as well.

The NYC-based company has seen earnings rise in 2H20, with Q4’s top line reaching the highest level the company has seen since it went public in February of 2020. That top line was $150.3 million, up more than 18% year-over-year. Full year revenue reached $497 million, for a 13% yoy gain. It’s important to note that these gains came after the company’s announcement, in the third quarter, of agreements with four large retailers to carry Casper products. Ashley HomeStore, Denver Mattress, Mathis Brothers, and Sam’s Club all began to carry Casper Sleep bedding, giving the company a high profile among the country’s largest mattress retailers.

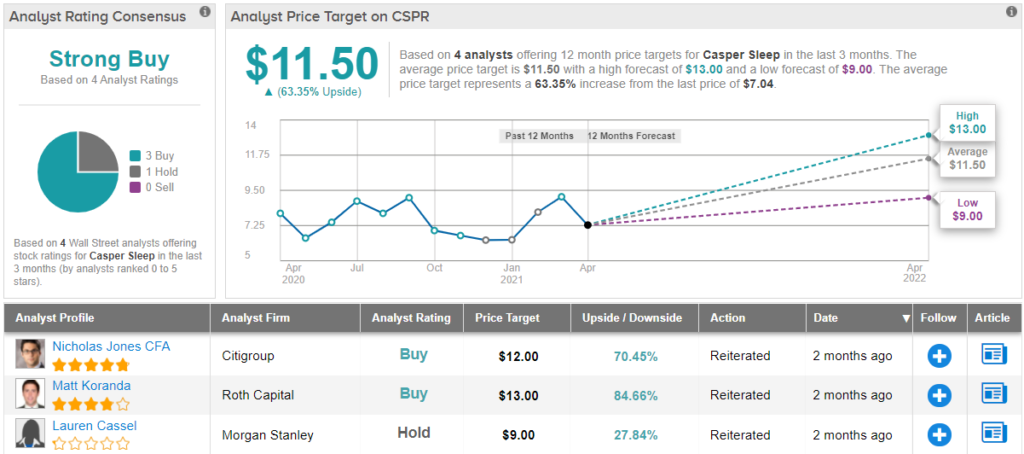

Covering Casper for Piper Sandler, analyst Robert Friedner set an Overweight (i.e. Buy) rating and a $12 price target that indicates room for 70% share appreciation from the current $7.04 share price. (To view Friedner’s track record, click here)

“CSPR has bounced back from the challenged Q3 that saw supply chain delays negatively impact sales. The company appears to be operating at a higher level going into 2021, as it has diversified its supplier base and is showing steady progress on posting positive EBITDA in 2H 2021. With sales growth rebounding, new products rolling out in 2021, and easy compares ahead, we believe the sales multiple for CSPR… will continue to expand,” Friedner noted.

In general, the rest of the Street has an optimistic view of CSPR. The stock’s Strong Buy status comes from the 3 Buys and 1 Hold issued over the previous three months. The upside potential lands at 63%, slightly below Friedner’s forecast. (See CSPR stock analysis on TipRanks)

Intellicheck Mobilisia (IDN)

The proliferation of online commerce – and the general increase in virtual interactions via the web – has boosted demand for tech security. Intellicheck operates in that sphere, offering a suite of SaaS products based on a propriety ID validation platform. Intellicheck boasts a high-profile customer base, including 5 top financial institutions and over 50 law enforcement agencies.

Intellicheck also has a strong presence in the retail industry, where its ID validation is used to authenticate customer photo identification documents. The pandemic – which slammed brick-and-mortar retail – was hard on the company, but the economic reopening has seen business expand.

The company saw its record revenue – $3.12 million – in the first quarter of 2020, right before taking a heavy hit at the beginning of the coronavirus crisis. Sales and revenues bounced back, however, and Intellicheck’s Q4 top line of $3.08 million, was only 1.2% off that peak – and up 6% from 4Q19. The company’s SaaS revenue grew 18% yoy, and 23% sequentially. More importantly, the company recorded positive EPS in Q4, with earnings coming in at 7 cents per share. This compared favorably to the break-even result in Q3, and the 5-cent per share loss in Q2.

These facts lie behind 5-star analyst Scott Buck’s optimistic view of the company. In his coverage for H.C. Wainwright, Buck sees Intellicheck holding a strong position for long-term growth.

“[As] several large states have begun to ease COVID-19 related restrictions and younger people have been, or can be, vaccinated at this time, we expect same-store scans to show improvement through the remainder of 2021…. New implementations are expected to include additional retailers as well as more traditional financial service providers and potential new markets such as healthcare, real estate, and standardized testing. While new customers are unlikely to have a meaningful impact on the quarter’s results, they will provide incremental revenue over the next 12 months,” Buck wrote.

The analyst summed up, “With additional sales hires, we believe the company will again be positioned to complete between 30 and 40 software implementations during 2021 driving meaningful revenue growth into 2022.”

To this end, Buck puts a Buy rating on IDN, and his $18 price target implies an upside potential of 113% for the year ahead. (To watch Buck’s track record, click here)

All in all, Intellicheck’s Strong Buy consensus rating is unanimous, based on 3 recent positive reviews. The stock has an average price target of $14.83, suggesting a 75% one-year upside for the current price of $8.45. (See IDN stock analysis on TipRanks)

To find good ideas for small-cap stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.