Last year was marked by strong GDP and corporate earnings growth as the economy reopened and the workforce got back to work post-lockdowns. Stocks rose, too, reaching record highs by year’s end. That all crashed to a halt this past January. This year got started with a steady drop across the main equities indexes, especially on the tech-heavy NASDAQ. The markets troughed, deep in correction territory, in mid-March. Since then they have rebounded, and the stock market losses have moderated. Year-to-date, the S&P is down ~5%, while the NASDAQ is down ~9%.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Make smarter investment decisions with TipRanks' Smart Investor Picks, delivered to your inbox every week.

Against this backdrop, we’ve opened up the TipRanks database to find three stocks that may bear a close look in 2Q22. According to the analyst community, these are all Strong Buy equities with upside potentials starting at 50% and lifting off from there. Let’s check in with the Street’s analysts and see what else should bring these stocks to investors’ attention.

ESS Tech (GWH)

We’ll start with ESS Tech, a company working on modes of long-duration energy storage. This is an emerging field, given an impetus by a number tailwinds that include green tech, grid stabilization, and electric vehicles. ESS Tech focuses on the development, production, and installation of iron flow batteries, a new technology that promises to avoid the drawbacks of traditional chemical batteries, such as short life cycles, charge reduction problems, overheating, fire hazards, and corrosive chemicals.

Among the specific advantages of ESS’s iron flow system, are a 20 to 25 year life cycles, encompassing more than 20,000 charging cycles without degradation of function, flexible energy storage of 4 to 12 hours, and applications in electric grid stabilization.

ESS was founded in 2011, and since then has become a leader in long-duration battery tech. The company was the first such firm to enter the public markets in the US, through a SPAC transaction last autumn. In October of 2021, ESS merged with ACON S2 Acquisition, gaining approximately $308 million in gross capital from the deal. The GWH ticker started trading on October 11 and peaked above $28 the next day. Since then, shares in ESS have fallen steadily and the stock is down 80% from the peak value.

In February, ESS released its financial results for 4Q21 and full year 2021. The release includes the quarter in which ESS went public. While the company does not yet have a revenue stream to report, it did have two important operational updates that bode well for future income. First, ESS reported that it added 54,000 square feet of factory space to its Wilsonville, Oregon production facility during the quarter. For the year as a whole, ESS doubled its factory footprint to 200,000 square feet. In the second operational update, one with more direct bearing on future receivables, ESS reported that its shipment forecast for 2022 is 100% booked.

5-star analyst Joseph Osha, from investment firm Guggenheim, has taken a look ‘under the hood’ at ESS, and sees plenty of potential here for future growth.

“We think that ESS has a credible path to success, and we also believe that the timing is right for the market to potentially embrace a long-duration storage technology… As is the case with other new storage technology equities, the market is assigning a significant discount to ESS’s future prospects. We agree that skepticism is warranted, but in ESS’ case we believe the discount is excessive,” Osha opined.

These comments support Osha’s Buy rating on the stock, and his $10 price target implies an upside of ~78% in the next 12 months. (To watch Osha’s track record, click here)

Overall, ESS has 6 recent reviews, including 5 Buys and 1 Hold, making its analyst consensus view a Strong Buy. The $12.50 average price target suggests the stock has 122% upside potential from its share price of $5.63. (See ESS stock forecast on TipRanks)

Bioventus (BVS)

Next up is Bioventus, an innovative healthcare company. Bioventus is focused on active healing, with a line of products that relieve bone and joint pain, offer restorative therapies, or give surgical solutions. The overall aim of Bioventus is to reduce the need for difficult orthopedic surgeries, and delay or simplify those procedures. The company’s products include an ultrasound bone healing system, Exogen; several osteoarthritis pain relievers; and orthobiologic products designed to make orthopedic surgeries less invasive and easier to recover from.

In the final quarter of 2021, Bioventus announced a major expansion of its manufacturing facilities. The expansion is to a new location in Memphis, Tennessee, and will involve transferring 116 employees to a newer, larger facility. Bioventus plans to remain at the new location for at least 5 years, during which it plans to add up to 40 new positions. The move is scheduled to begin during 2H22.

In March of this year, Bioventus announced that the FDA had given 510(k) clearance to the company’s StimRouter. This product is a neuromodulation system, used to treat chronic pain originating in peripheral nerves exclusive of craniofacial pains. The device uses external electric fields and is considered minimally invasive.

Bioventus went public just over one year ago, and in 2021 saw its revenue increase from $81 million in Q1 to $130 million in Q4. The company’s growth caught the eye of Craig-Hallum analyst Alexander Nowak, who writes: “We see a tremendous opportunity to cross sell against the core products and leverage existing infrastructure to generate stronger growth, higher margins and a path to >$3 in earnings per share.”

“With BVS becoming an orthopedic commercialization powerhouse, a stock valued ~50% below its peers and a clear path to exceptional five-year fundamentals, we see substantial upside to shares,” the analyst summed up.

Nowak’s comments back up his Buy rating, and his $30 price target indicates the stock has potential for 120% upside in the year ahead. (To watch Nowak’s track record, click here)

The Strong Buy consensus rating on BVS is based on 4 analyst reviews that include 3 to Buy and 1 to Hold. The shares are selling for $13.63 and have a one-year upside of ~58% based on an average price target of $21.50. (See BVS stock forecast on TipRanks)

Global Blood Therapeutics (GBT)

The last stock we’re looking at is Global Blood Therapeutics, a biomedical research company working on new treatments for the amelioration of sickle cell disease (SCD). This blood condition is genetically based and is highly dangerous, having been connected to both chronic severe pain and reduced life expectancy. GBT is currently in the advantageous position of having an approved drug on the market, as well as a full pipeline of viable drug candidates in clinical trials.

The company’s approved drug is voxeletor, branded as Oxbryta, which saw sales reach $56.1 million in 4Q21. This was up from $41.3 million in the year-ago quarter, a 35% gain.

In a recent update on Oxbryta, dated February 16, GBT announced that the drug had been approved by the European Commission for treatment of patients ages 12 and up with hemolytic anemia due to sickle cell disease. The approval makes Oxbryta marketable in all EU member nations, plus the non-EU states of Iceland, Liechtenstein and Norway. The company is pursuing separate approval in the UK.

Turning to the pipeline, GBT has several ongoing trials of voxeletor, aimed at expanding the label indications of the drug. The company also has an ongoing Phase 3 trial of another drug candidate, inclacumab, which is intended as a treatment for SCD pain crisis events.

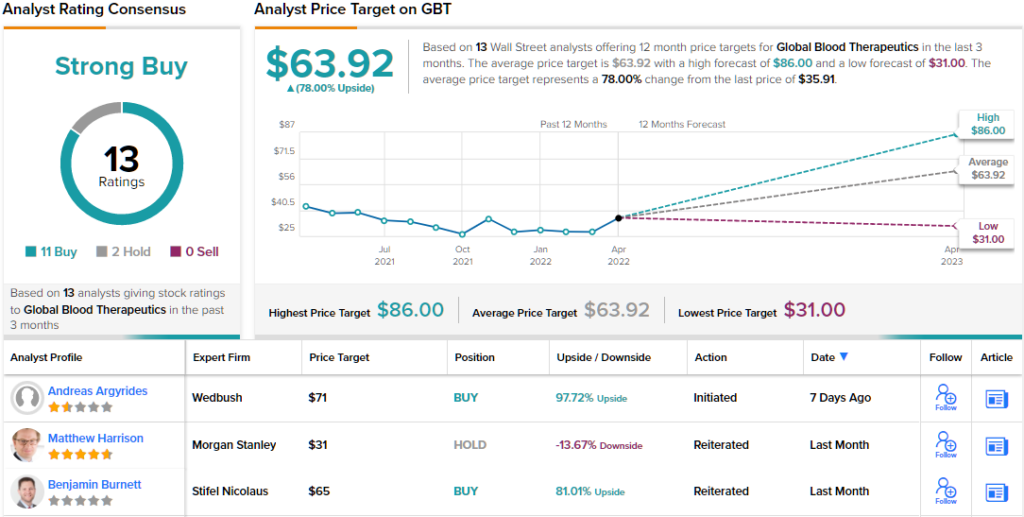

Covering GBT for Wedbush, analyst Andreas Argyrides reminds investors that there are considerable gains in store for GBT in 2022. Argyrides rates the stock an Outperform (i.e. Buy), and his $71 price target implies an upside of ~98% on the one-year time horizon. (To watch Argyrides’ track record, click here)

Baking his stance, the analyst writes: “At the end of 2021, Global Blood reported sequential +8% growth in Oxbryta sales as well as the addition of ~100 new prescribers bringing the total number of unique U.S. prescribers to ~2,000 since launch. Despite likely flat revenue growth in Q1:22, we anticipate more robust growth in H2:22 as the Company anticipates achieving broad payer coverage for SCD patients 4-<12 yo by mid-2022. Since the Company recently obtained EU approval for patients 12 yo+ in February 2022, we expect EU revenue to ramp up in 2023 as Management gains access and reimbursement in different countries.”

Overall, this stock has no fewer than 13 recent analyst reviews, and they break down 11 to 2 in favor of Buy over Hold, to give GBT a Strong Buy rating. The stock’s $63.92 average price target implies an upside of 78% from the $35.91 current trading price. (See GBT stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.