Over the last few years, the rewards have kept on coming investors’ way. The S&P 500, considered a representation of the broader stock market, is up 16.5% over the last 52 weeks. In addition, the index has posted an average gain of 10.2% and 15.3% per year over the last five and ten years, respectively. So, everything seems hunky-dory on Wall Street.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Unfortunately, this is not actually the case. According to Dalbar, a financial services market research firm, the average investor typically earns significantly less than the market. For example, over the 30-year period through 2019, the S&P 500 returned an average of 9.96%, while Dalbar estimated the average stock fund investor only earned 5.04% per year. This finding has been witnessed over and over again regardless of the time frame used in the study.

Dalbar believes the main reason for this is psychological. He cites behaviors such as panic selling and not adapting to a changing market that lead to poor investment decisions. For this reason, an investor needs better strategies.

One way to invest without being influenced by psychological factors is to turn to the experts. The analyst community maintains extensive knowledge about the stocks they cover, they constantly update their analysis amid an evolving environment, and they don’t make rash decisions.

With this in mind, we used TipRanks’ database to identify three stocks that have earned a “Strong Buy” consensus rating from the analyst community. Not to mention potential upside gains starting at 20% are on the table.

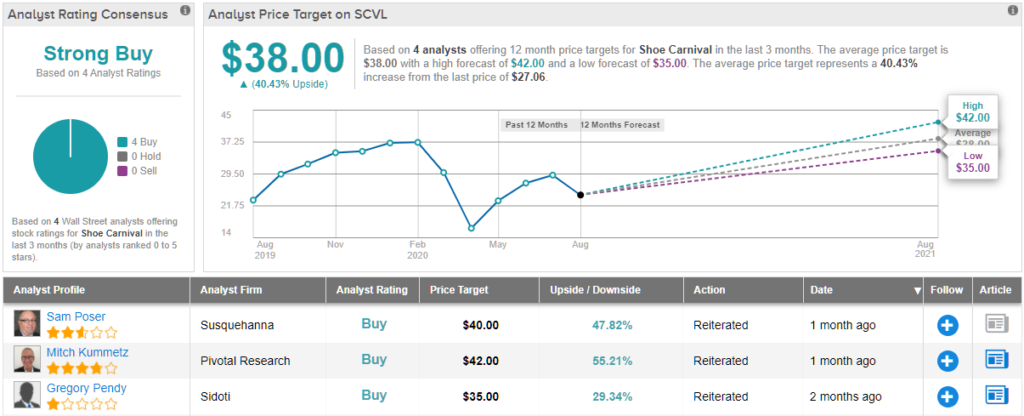

Shoe Carnival (SCVL)

To start us off, we have Shoe Carnival, a value footwear retailer offering name brand and private label products in the US, with 392 stores in 35 states and Puerto Rico. The company also sells its merchandise online.

Management provided a very encouraging mid-quarter business update following the re-opening of its stores. Quarter-to-date, comparable store sales rose 28.1%. Brick-and-mortar comparable sales increased 4%, while online comparable sales skyrocketed almost 470%.

Writing for Pivotal Research, 4-star analyst Mitch Kummetz commented on the update, “In short, for second quarter, we’re raising our comp forecast from 2% to 15%, which reflects SCVL’s strong second quarter-to-date performance…we expect SCVL to continue to drive outpaced digital growth, albeit not at current levels.”

Shoe Carnival’s shares have been battered by the COVID-19 pandemic, along with the rest of the brick-and-mortar retail industry. Although the stock has rebounded off of its March low, it is still down by 27% year-to-date.

Nevertheless, Kummetz is of the opinion that there are better days ahead for the stock. “…we’re now more confident in the company’s ability to perform due to a few particular items…we like how SCVL is positioned as an off-mall retailer, especially as some consumers remain wary of closed environments; we expect SCVL to continue to manage inventory to best maximize its revenue opportunity while minimizing its margin risk,” the analyst explained.

Based on the above, Kummetz has a Buy rating on SCVL along with a $42 price target, which means hefty potential upside of 55%. (To watch Kummetz’s track record, click here)

As for the rest of the Street, three other analysts provided a recommendation on the stock over the last three months, all of which were Buys. This translates to a Strong Buy consensus rating. The average price target is $38, which represents substantial upside potential of 40.5%. (See Shoe Carnival stock analysis on TipRanks)

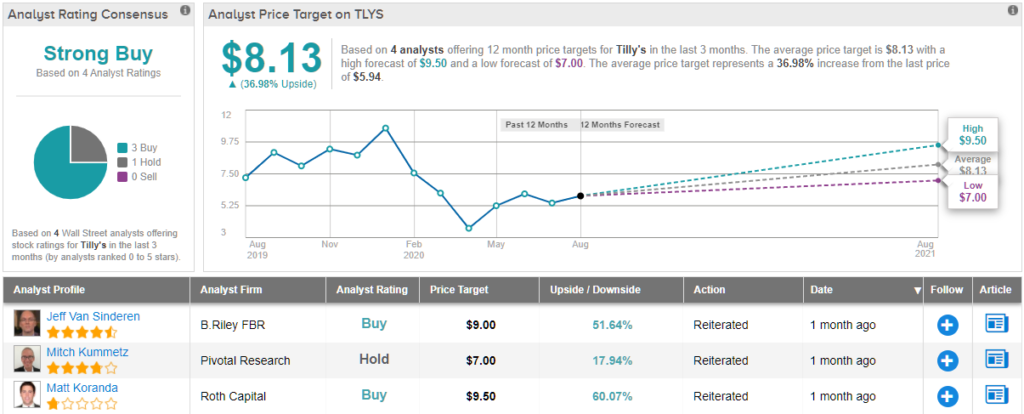

Tilly’s Inc. (TLYS)

Next up is an apparel retailer, Tilly’s, which sells apparel, footwear, and accessories for young men and women, as well as kids in the United States. The company operates about 240 stores in 33 states and also sells its products online.

Tilly’s operating performance has been significantly constrained by the viral outbreak. Making matters worse, a number of the company’s stores are in California (41% of stores and about 50% of sales), a state with a large amount of coronavirus cases. Comparable sales for the second quarter of fiscal 2020 through July 14, 2020 decreased 9.4% to $101.8 million, from the year before. In addition, comparable store sales from physical stores dropped 37.4%, while online sales soared 166%.

B.Riley FBR analyst Jeff Van Sinderen sees online sales as the silver lining in the results. “Digital is growing rapidly with solid margins, as the digital first strategy under the new GMM bears fruit,” he explained.

The spike in online sales is not just a one-time phenomenon due to brick-and-mortar store closures, in Van Sinderen’s opinion. “We believe that TLYS’ progress in digital is more important for the future and recent metrics are worthy of enthusiasm,” the four-star analyst stated.

Looking ahead, Van Sinderen expects “2Q results to be roughly in line with [his] revenue/EBITDA estimates of $115M/($11.6M) with some potential upside to the bottom line.”

Although Tilly’s shares have plummeted 45% year-to-date, Van Sinderen expects the stock to rebound. He rates TLYS a Buy along with a $9 price target. This figure represents sizable upside potential of 52%. (To watch Van Sinderen’s track record, click here)

There are three other analysts who provided ratings for Tilly’s in the last three months. 3 Buys and 1 Hold add up to a Strong Buy consensus rating. The average price target of $8.13 indicates a 37% potential increase from current levels. (See Tilly stock analysis on TipRanks)

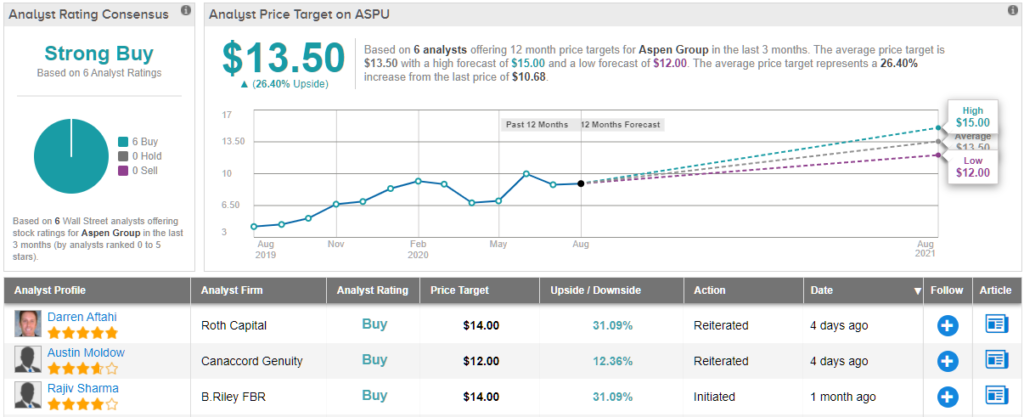

Aspen Group Inc (ASPU)

To wrap our list up, we have Aspen Group, an online postsecondary education company in the US. As of April 30, 2020, the company had 11,444 students enrolled.

What effect has COVID-19 had on ASPU? Operating performance has benefited from the online education trend. Revenue increased 38% to $14.1 million for the fiscal fourth quarter ended April 30, 2020, compared to $10.2 million in 2019. Additionally, net loss for the quarter was $0.7 million, versus a loss of $1.6 million the year before.

5-star analyst Darren Aftahi, of Roth Capital, provided his take on the positive earnings report and its future implications. “Our model sees a slight improvement to revenue/profits and we remain optimistic about higher LTV (lifetime value) segment’s growth potential and operating leverage,” he commented.

What’s more, on August 10, the company announced a quarterly record of 2,351 new student enrollments in the fiscal 2020 first quarter ending July 31, 2020. This represents a sequential increase of 32% and year-over-year gain of 22%.

To this end, Aftahi has a Buy rating on ASPU along with a $13 price target. The target suggests a potential advance of 31% over the next 12 months. (To watch Aftahi’s track record, click here)

Looking at the consensus breakdown, all of the other analysts are on board. The Strong Buy consensus rating breaks down into 6 Buy ratings and no Holds or Sells. At $13.50, the average price target signifies healthy upside potential of 34%. (See Aspen stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.