For those that thought the extreme market volatility was behind us, think again. This month, another burst of volatility was brought on by concerns about the U.S. economic recovery, hefty valuations, and a second wave of COVID-19.

While challenging at times, Wall Street pros believe the healthcare space is becoming more exciting, with several long-term tailwinds on the horizon.

As healthcare stocks tend to be riskier in nature, we narrowed our search to include only the best of the best, according to the analyst community.

TipRanks’ database revealed three such stocks that won’t break the bank; each one trades for less than $5 per share and has earned a “Strong Buy” consensus rating from the Street’s pros. Not to mention triple-digit upside potential is on the table here.

VYNE Therapeutics (VYNE)

Using its Molecule Stabilizing Technology (MST) platform, VYNE Therapeutics hopes to solve some of the most difficult therapeutic challenges. Given the strong performance of one of its products and its $1.52 share price, some members of the Street think that now is the time to snap up shares.

Singing the healthcare name’s praises is Cantor analyst Louise Chen. “We continue to believe the market opportunity for VYNE’s products and pipeline are underappreciated. Therefore, upwards earnings revisions and multiple expansion should drive VYNE shares higher, in our view,” the analyst opined.

Chen is particularly excited about Amzeeq, which is the first topical minocycline product in the U.S. designed for the treatment of inflammatory lesions of non-modular moderate-to-severe acne vulgaris in adults and pediatric patients aged nine years and older. The therapy was launched back in January. “We believe that Amzeeq is a highly competitive product with supporting data that demonstrate a topical minocycline treatment does not pose a risk of resistance,” the analyst noted.

Monitoring the launch closely, Chen points out that against the backdrop of COVID-19, Rx trends indicate a strong recovery. Throughout the industry, the pandemic has weighed on the launches of new therapies. Additionally, the number of unique prescribers exceeded 4,200 during Q2 2020. To this end, the analyst argues “the peak sales potential of Amzeeq is underappreciated and the launch could exceed expectations, despite the COVID-19 pandemic.”

To support this claim, Chen cites a competing product’s launch. Seysara is an oral product developed by Almirall for the same indication. Like VYNE’s therapy, COVID-19 impacted the launch, but Rx trends are also rebounding, with the company expecting peak sales to reach $150-$200 million. That being said, given that Seysara is an oral product, Chen believes Amzeeq offers a better value proposition, with the launch trajectories likely to differ.

It should be noted that the President and CEO of VYNE, David Domzalski, and CFO Andrew Saik both bought up shares of the company this month. “We believe they are excited about the rebrand of the company and they purchased stock to show their commitment to the company and enthusiasm for VYNE’s potential as they get ready to potentially launch Zilxi (its topical foam product) in moderate-to-severe rosacea in Q4 2020,” Chen said.

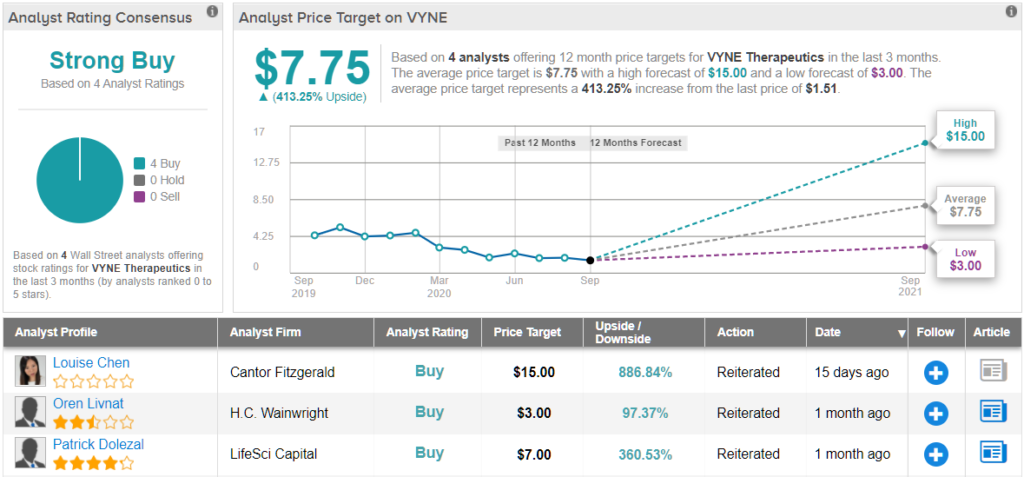

To this end, Chen rates VYNE an Overweight (i.e. Buy) along with a $15 price target. This target conveys her confidence in VYNE’s ability to skyrocket 893% in the next year. (To watch Chen’s track record, click here)

Turning now to the rest of the Street, other analysts echo Chen’s sentiment. 4 Buys and no Holds or Sells add up to a Strong Buy consensus rating. With an average price target of $7.75, the upside potential comes in at 413%. (See VYNE stock analysis on TipRanks)

BioDelivery Sciences (BDSI)

Working to deliver innovative therapies, BioDelivery wants to improve the lives of patients with serious and debilitating chronic conditions. While shares have fallen 41% year-to-date, several analysts believe that at $3.69, its share price reflects an attractive entry point.

Northland Capital’s Tim Chiang is among those recommending that investors purchase shares on the weakness. With Belbuca (its Schedule III opioid) and Symproic (its naldemedine for the treatment of opioid induced constipation) volume trends holding up strong, he thinks his 2H20 estimates are attainable and that there’s potential for upside. During Q2 2020, there were record high sales volumes of 104,687 prescriptions, up 31% year-over-year.

Turning to Belbuca, which was designed for use in patients with pain severe enough to require daily, around the clock, long-term opioid treatments, it was approved by the FDA back in 2015. Buprenorphine, the active ingredient, is a partial opioid agonist and is classified as a Schedule III controlled substance, with other opioids like fentanyl, morphine and oxycodone being deemed Schedule II. Schedule II drugs have more dosing restrictions as they are more likely to be abused, and can’t be refilled like Schedule III therapies.

Due to the ongoing opioid crisis, which has led to overdose deaths and a high rate of addiction, physicians are shifting away from prescribing traditional opioids like oxycodone, which bodes well for BDSI, in Chiang’s opinion.

Based on Chiang’s estimates, Belbuca could generate more than 500,000 prescriptions in 2020, resulting in sales of approximately $138 million. He also believes that Belbuca’s market share could increase from the low-single digits into the mid-to-high single digits over the next 4-5 years, with annual sales hitting $230 million by CY22 and $320 million by CY25.

“While COVID-19 has significantly impacted the U.S. healthcare system, we believe the incidence of chronic pain (defined as pain lasting longer than 12 weeks) has not been impacted; in fact we believe the incidence may be rising due to the pandemic. Based on an estimated 13.5 million opioid prescriptions dispensed in 2020 for chronic pain (Schedule II / III), we believe our 4% market share estimate for Belbuca this year could be conservative,” the analyst explained.

Everything that BDSI has going for it convinced Chiang to keep an Outperform (i.e. Buy) rating on the stock. Along with the call, he attached a $9 price target, suggesting 143% upside potential. (To watch Chiang’s track record, click here)

Are other analysts in agreement? They are. Only Buy ratings, 4, in fact, have been issued in the last three months. Therefore, the message is clear: BDSI is a Strong Buy. Given the $7.75 average price target, shares could climb 109% higher in the next year. (See BDSI stock analysis ratings on TipRanks)

Chiasma (CHMA)

By leveraging Transient Permeability Enhancer (TPE) technology, Chiasma is able to convert select peptide-based injectables into oral formulations. Currently going for $4.37 apiece, Wall Street is pounding the table on this healthcare name.

On August 31, the company announced that Mycapssa, the first and only oral somatostatin analog (SSA) approved as a long-term maintenance treatment for acromegaly patients who have responded to and tolerated octreotide or lanreotide (other approved therapies), had been launched one month ahead of guidance. Acromegaly is an orphan disease typically caused by a benign tumor on the pituitary that results in the excessive secretion of growth hormones, causing bone overgrowth and enlargement of internal organs with co-morbidities.

In terms of pricing, a 28-day supply goes for $5,152, with CHMA intending to build on physician and patient experience with octreotide, incorporate telemedicine and build a sales team of 45 representatives.

Weighing in on this development for Piper Sandler, 5-star analyst Edward Tenthoff tells clients he is optimistic about the therapy’s prospects.

“We see strong demand for an effective oral therapy from acromegaly patients who currently receive painful monthly injections and experience break-through symptoms,” he commented. To this end, Tenthoff still expects total Mycapssa sales to clock in at $3 million in Q4 2020.

Tenthoff also points out that with the first commercial sale of Mycapssa, CHMA is set to receive $15 million from Healthcare Royalty Partners (HCR) and $10 million in early 2022. As part of the deal, HCR is eligible for 12.25% up to $125 million, 4% from $125-250 million and 1% on sales over $250 million.

When it comes to the next potential catalyst, Tenthoff cites the top-line Phase 3 MPOWERED data readout, which is slated for Q4 2020, as it could “ultimately support European approval.”

It should come as no surprise, then, that Tenthoff stayed with the bulls. He continues to put an Overweight rating and $19 price target on the stock, implying 319% upside potential. (To watch Tenthoff’s track record, click here)

All in all, other analysts are on the same page. CHMA’s Strong Buy consensus rating breaks down into only Buy ratings, 4 to be exact. The $12.33 average price target brings the upside potential to 182%. (See Chiasma stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.