Out on the Street, focus has landed squarely on a new stimulus package that may be announced as soon as next week. Congress is working on another COVID-19 aid package on top of the $3 trillion already pumped into the economy to mitigate the pandemic’s negative impact, but investors are wondering how the government is going to pay for all of this.

Claim 50% Off TipRanks Premium and Invest with Confidence

- Unlock hedge-fund level data and powerful investing tools designed to help you make smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis so your portfolio is always positioned for maximum potential

Making matters worse, according to the government, there is only enough money to pay social security benefits until 2035. After that, benefits are expected to be reduced. So, the writing is on the wall, lots of government spending and underfunded social security add up to you supplementing your retirement income.

One way to generate income is to assemble a portfolio of dividend stocks. Using TipRanks’ database, we identified three yielding over 5% that are backed by enough Wall Street analysts to earn a “Strong Buy” consensus rating. Moreover, these stocks have an upside potential starting at 22%.

Phillips 66 (PSX)

The first company on our list is Phillips 66, an oil refiner with a $28.6 billion market cap. Besides refining, the company also generates significant revenue from its Midstream, Chemicals, and Marketing and Specialties segments.

The oil industry has been battered by the COVID-19 pandemic. Demand for refined products like gasoline and jet fuel plummeted because people are working from home and air travel is limited. Despite all of this, Phillips 66 was profitable in the first quarter, generating adjusted earnings of $450 million. The gain was attributed to the company’s non-refining segments.

In a recent research report, J.P. Morgan analyst Phil Gresh commented on the company’s diversification: “While PSX has not been immune to this challenging energy macro environment, we believe that this first major recessionary test of PSX’s business model should end up demonstrating the resilience of its diversified and well-integrated portfolio.”

Turning to Phillips 66’s dividend, it pays $3.50 per year and currently yields a healthy 5.8%. Despite the challenging industry conditions, the five-star analyst believes the dividend is safe. “We also like management’s capital discipline, with an increasing free cash flow wedge in 2021 plus that should limit any potential damage to the balance sheet from the recession,” he stated.

Accordingly, Gersh rates PSX an Overweight (i.e. Buy), along with a $98 price target, which implies a generous one-year upside potential of 42%. (To watch Gresh’s track record, click here)

In general, the analyst community agrees with Gresh. Phillips 66 has a Strong Buy consensus rating based on 13 Buy ratings, 3 Holds and no Sells. The average price target is $88.93, which adds up to upside potential of 36% from current levels. (See PSX stock analysis on TipRanks)

Marathon Petroleum (MPC)

Next up we have another giant oil refiner, Marathon Petroleum Corporation, with a $24.4 billion market cap. Like Phillips 66, Marathon Petroleum operates other businesses as well, namely Retail and Midstream. These businesses provide the company with diversification to balance out its volatile refining business.

Consistent with the industry, Marathon Petroleum’s refining business has been hurt by the COVID-19 pandemic. In response, management announced it will reduce capital expenditures by $1.4 billion, along with other liquidity enhancing measures. In addition, the company is planning to spin-off its Retail Speedway gas station business, after its deal to sell the business for $22 billion was cancelled due to COVID-19.

Analyst Roger Read, of Wells Fargo, weighed in on the likely proceeds from a spin-off: “We estimate MPC would acquire approximately $5.5 billion of cash via a dividend paid by the Retail unit upon the spin-off date. We assume the cash would be used to de-lever MPC.”

These actions give investors confidence that Marathon will be able to maintain its dividend, which yields 6%. Read explained why he feels the dividend payment is on solid ground. “Based on attractive shareholder returns, merger-related synergies, capital discipline, and cash flow yield, we maintain a positive outlook on MPC. We expect predicted free cash flow will be directed to share repurchases and growing the dividend,” he noted.

In line with his bullish stance, Read reiterated his Overweight (i.e. Buy) rating on Marathon, and keeps a $51 price target, which suggests considerable upside potential of 36%. (To watch Read’s track record, click here)

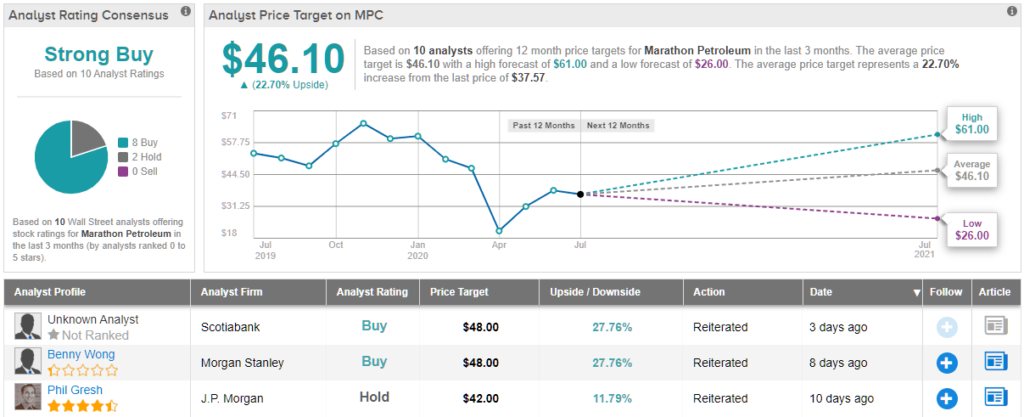

Overall, other Wall Street analysts are on the same page as Read. Marathon gets a Strong Buy consensus rating, with 8 Buy ratings, 2 Holds and no Sells. The average price target is $46.10, which represents upside potential of 23%. (See MPC’s stock analysis on TipRanks)

VICI Properties Inc (VICI)

Rounding out our list is VICI Properties, a gaming and hospitality real estate investment trust, with a $11.3 billion market cap. The company leases properties to established gaming and hospitality operators such as Caesars Entertainment Corporation and Century Casinos Inc.

Due to COVID-19, major casinos and hotels shut their doors, including all 28 of VICI’s leased properties. As casinos start to reopen, it remains unclear whether, and at what pace, gamblers will return. Nevertheless, despite being closed, VICI’s tenants payed their rent in full for the months of April and May, and management expects rent for June will also be paid in full.

Writing for Wolfe Research, analyst Jared Shojaian spelled out why he feels VICI’s cash flow will remain stable. “VICI leases properties to five gaming tenants through a triple-net lease structure, which means the tenants pay all the expenses, including taxes, insurance, and capital expenditures. Those tenants pay rent to VICI, and currently nearly all of that rent is fixed. Total lease payments should be highly predictable, we think even in this environment, because we believe VICI’s tenants have adequate liquidity, and gaming revenues are typically more resilient than perceived,” he explained.

Stable and reliable cash flow provide comfort that VICI can maintain its current dividend of $1.16 per year. This amounts to a dividend yield of 5.9%. Additionally, Shojaian thinks that the share price represents a good entry point. “VICI is down 23% from its February high, which seems like an opportunity to us,” he said.

In addition to initiating coverage with an Outperform (i.e. Buy) rating, Shojaian set a $29 price target, which translates to sizable upside potential of 37%. (To watch Shojaian’s track record, click here)

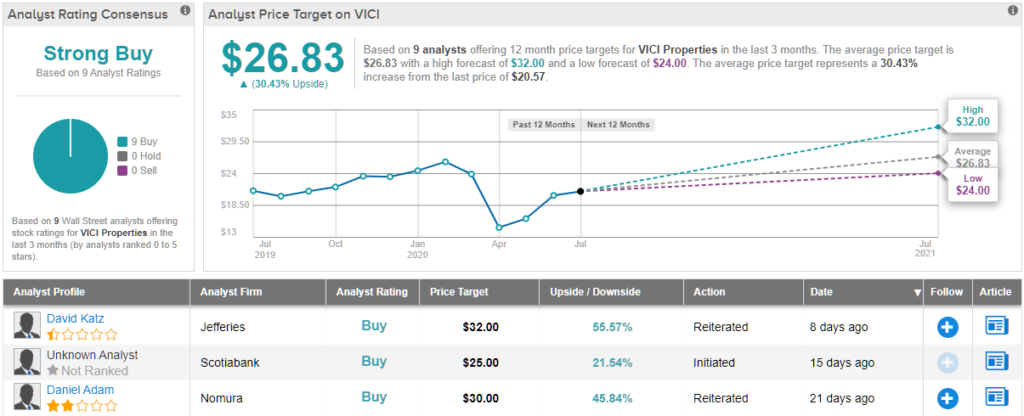

Looking at the consensus breakdown, other analysts like what they’re seeing. VICI’s Strong Buy consensus rating breaks down into 9 Buy ratings and no Holds or Sells. The average price target is $26.83, which signifies upside potential of 30%. (See VICI stock-price forecast on TipRanks)

To find good ideas for dividend stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.