Investing during a bear market is never easy, as there’s no clear indication of when the tides might turn. On the flip side, if you completely divest, you run the risk of selling low and buying high.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

However, there’s a hybrid solution that can be implemented, which is called minimum-volatility investing. The minimum-volatility investment factor is a market segmentation approach that doesn’t exhibit a great deal of sensitivity to economic cycles.

Thus, it’s a capital allocation strategy that generally provides low-to-moderate returns throughout every stage of the economic cycle.

The world-renowned hedge fund BlackRock (BLK) manages its iShares MSCI USA Min Vol Factor ETF (USMV), which includes 178 low-volatility holdings, and I picked out three that I’m bullish on.

Newmont Mining (NEM)

Newmont is a low-beta precious metals miner. The stock’s low beta of 0.50 means that it possesses less risk than the broader market. However, being a precious metals stock, Newmont exhibits cyclical attributes.

With commodity prices remaining relatively resilient, Newmont could likely be an outperformer for the foreseeable future, all while providing a stunning dividend yield of 3.6%.

Newmont mines across the globe, with nine of its assets situated in top-tier jurisdictions, amounting to 90% of its gold production. Moreover, Newmont produces sumptuous cash flows, with free cash flow coming in at over $2.4 billion for the last 12 months.

The company is blessed with extraordinary long-life mines that provide it with the leverage to gradually reduce costs. Newmont’s efficiency and pricing power benefits are conveyed through its 39.8% gross profit margin.

Although Newmont’s price multiples are elevated, they still present cyclical value. For instance, the stock’s price-to-earnings ratio is at a 23.18% discount compared to its five-year average.

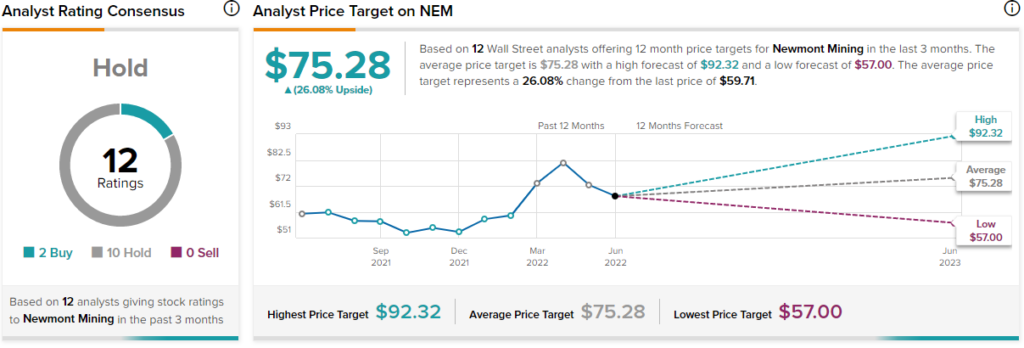

Turning to Wall Street, Newmont earns a Hold consensus rating based on two Buys and 10 Sell ratings assigned in the past three months. The average NEM stock price target of $75.28 implies 26.1% upside potential.

PepsiCo (PEP)

Pepsi retails consumer staples, classifying it as a non-cyclical consumer stock. Defensive stocks tend to outperform the broader market during times of uncertainty, as risk-aversion plays into the investment style.

The company’s latest earnings report conveys its counter-cyclical nature. Pepsi managed to topple rising input costs during its previous financial quarter by beating earnings estimates by 6 cents per share. Pepsi’s organic sales rose 13.7% in the quarter, led by a 22% increase in Latin America, an 18% rise in Africa, and a 13% increase in North America.

Rapid inflation increases across the globe have dented the profit margins of companies. However, PepsiCo has parted from the pack, with its gross profit margin standing strong at 53.42%. In addition, Pepsi’s net income per employee ($32,900 per employee) is robust, deflecting any debate that it’s suffering from wage pressure like many other companies.

Furthermore, Pepsi offers an attractive dividend of $1.15 per share, at a yield of 2.58%, which could prompt many investors to opt for the stock’s safer returns during these uncertain times.

Turning to Wall Street, PepsiCo earns a Moderate Buy consensus rating based on six Buys, six Holds, and one Sell rating assigned in the past three months. The average PEP stock price target of $178.67 implies 5.7% upside potential.

Microsoft (MSFT)

Microsoft is slightly riskier than the other two stocks as its Beta coefficient of 1.04 implies that it exhibits excess risk over the broader market. Nevertheless, Microsoft’s beta is significantly lower than most tech stocks. Thus, it’s considered a low-volatility asset from an intra-sector vantage point.

Secular growth prospects are intact for Microsoft. The company owns a substantial part of critical markets that are growing at double-digit annual rates. For example, Microsoft holds approximately 20% of the infrastructure cloud market and 48% of the productivity & business processes market.

Microsoft’s collective growth is astonishing. The firm’s five-year revenue CAGR (compound annual growth rate) of 16% exceeds the United States’ annual GDP growth rate by a significant amount, implying that it’s a company on an exponential growth trajectory.

Furthermore, after drawing down by more than 20% since the turn of the year, Microsoft has trodded into undervalued territory. The stock’s price-to-earnings ratio is 8.4% under its five-year average. Additionally, Microsoft’s PEG ratio of 0.89x implies that investors are underscoring the company’s earnings-per-share growth.

Turning to Wall Street, Microsoft earns a Strong Buy consensus rating based on 26 Buys and one Hold rating assigned in the past three months. The average MSFT stock price target of $352.57 implies 34.1% upside potential.

Concluding Thoughts: Minimum-Volatility Stocks Can Help Protect Capital

Minimum-volatility investing could be a good way to invest your capital during uncertain times in the market. You likely won’t be exposed to severe drawdowns, and you’ll be sure not to miss out in the event of a market recovery.

The three stocks mentioned in the article provide “best-in-class” attributes and could rise, given their solid fundamentals.