Investing articles are chock-full of advice, showering investors with new stock picks to consider every day. All of this can be very overwhelming and confusing.

Claim 50% Off TipRanks Premium and Invest with Confidence

- Unlock hedge-fund level data and powerful investing tools designed to help you make smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis so your portfolio is always positioned for maximum potential

Warren Buffett once said, “It’s far better to buy a wonderful company at a fair price than to buy a fair company at a wonderful price.”

Bearing this in mind, the Wall Street analyst community can provide investors with some much-needed help. The experts possess extensive knowledge about the stocks they cover and can more easily identify which companies are the cream of the crop.

In view of this, we used TipRanks’ database to identify two well-established companies that have earned a Strong Buy consensus rating from the analyst community. These names are either leaders in their respective industries or have created value in a way that is not easy replicated.

Nexstar Media Group Inc. (NXST)

First on our list is Nexstar Media Group, which is the largest local broadcast television group in the US. Nexstar operates or provides services to 196 television stations reaching about 63% of all US television households.

The COVID-19 pandemic and social unrest are just a few examples of how local news and information have become more indispensable than ever. According to Nielsen data, local television evening news viewership among adults aged 18 to 34 increased year-over-year in April, May and June by 151%, 83% and 89%, respectively.

Accordingly, Nexstar posted second quarter earnings per share of $2.13, which blew past the consensus estimate by 66.41% and reflected a 50% jump from the year before. The above-mentioned shift towards local television plus political spending drove the results. Still, the company’s stock is down 18% year-to-date, pressured by a reduction in advertising due to COVID-19.

Deutsche Bank analyst Bryan Kraft sees the positive momentum continuing. “Commentary continues to suggest monthly improvement in core advertising as we head into the thick of the election cycle. Management is cautiously optimistic about the return of sports, and we believe this will be a tailwind for advertising, although not as much as it will be for the broadcast networks,” he explained.

Additionally, Nexstar plans to launch a cable news network called News Nation. The 5-star analyst is enthusiastic about the undertaking, stating, “We are encouraged by the strategic initiative to transform WGN from a subscale general entertainment cable network, mainly consisting of licensed library content, into a politically neutral “unbiased” national news network. Launching into about 75 million homes on September 1st gives the network instant distribution. Leading national advertisers have already shown interest in the network…”

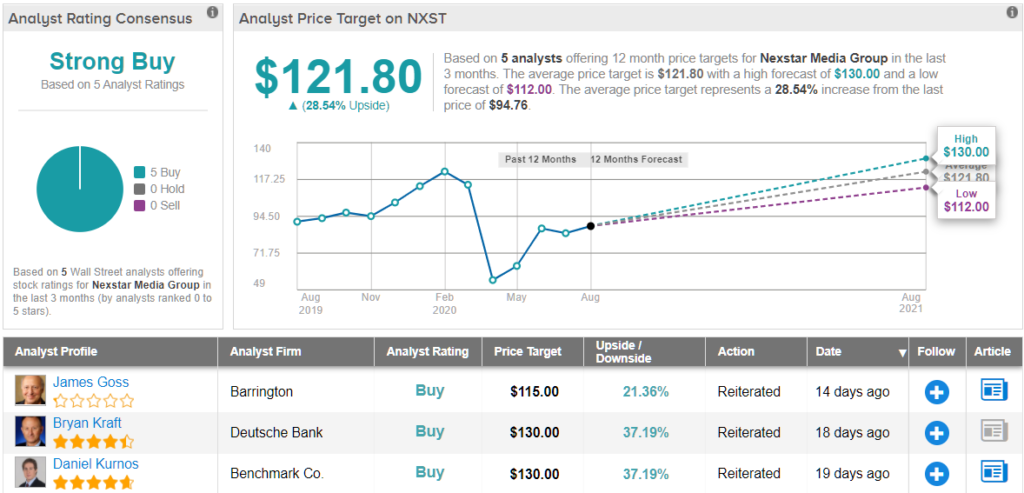

To this end, Kraft rates NXST a Buy along with a $130, which implies upside potential of 37% from current levels. (To watch Kraft’s track record, click here)

Overall, Nexstar has a Strong Buy consensus rating based on 5 Buys and no Holds or Sells. The stock’s average price target of $121.80 indicates potential gains of 28% from the current share price. (See NXST stock analysis on TipRanks)

Madison Square Garden Sports (MSGS)

Completing our list is Madison Square Garden Sports, which owns professional sports teams including the New York Knicks (NBA), New York Rangers (NHL), Westchester Knicks (NBAGL) and the Hartford Wolf Pack (AHL). On April 17, the company spun-off its entertainment businesses.

For the fiscal third quarter ended March 31, 2020, its revenue fell 18% to $288 million from the prior-year quarter. The decrease was due to the halt of the NBA and NHL seasons, with the disruption affecting ticket sales and media rights fees. Not much is anticipated to change when the company reports results for the quarter ended June 2020, with revenue expected to plummet by 93.8% to only $16.47 million from the prior year.

Nevertheless, Oppenheimer analyst Ian Zaffino is of the opinion that the stock is undervalued. “MSGS trades at a meaningful […] discount to its Forbes’ valuation owing to, what we believe is, a misunderstanding of its fundamentals and the stability of its franchises’ values. The company’s cost structure is significantly more variable than widely believed and its revenue stream is supported by media rights and payments from the leagues,” Zaffino explained.

Moreover, the Oppenheimer analyst believes that the effects of COVID-19 will not erode the value of its sports teams. “These teams are scarce, trophies assets and their underlying values have held stable through economic downturns and six consecutive losing seasons by the Knicks. While social-distancing has, and will continue to, impact he business, and may not lead to value appreciation in the near-term, we believe value retention of North American sports teams is high,” he noted.

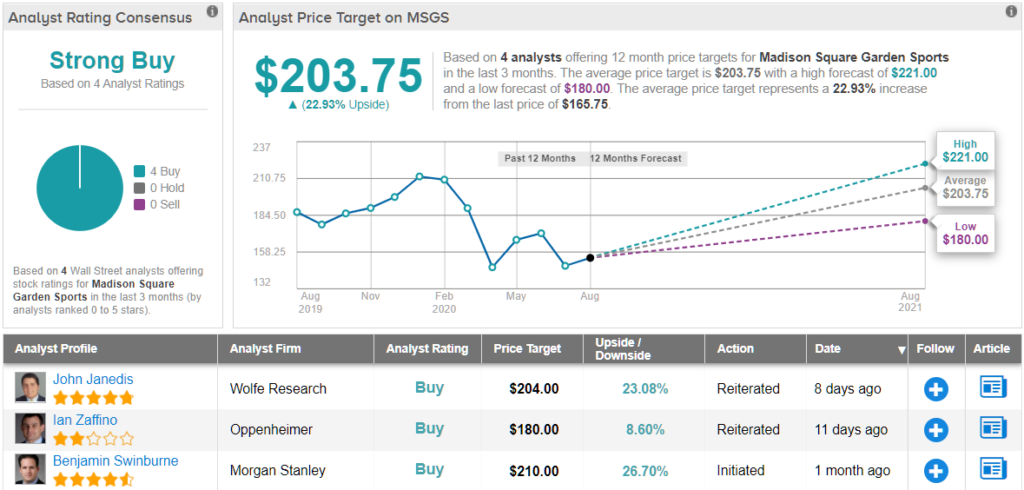

Based on all of the above, Zaffino rates the company a Buy and has a $180 price target on its shares, which indicates a potential gain of 9% over the next year. (To watch Zaffino’s track record, click here)

The rest of the analyst community is on board. MSGS gets a Strong Buy consensus rating, based on 4 Buys and no Holds or Sells. The average price target is more bullish than Zaffino’s at $203.75, and amounts to healthy upside potential of 22%. (See MSGS stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.