A lot has changed in the world over the past few months, but you wouldn’t know it from the stock market. The NASDAQ, for example, is up 11% year-to-date and recently set a new all time high.

Claim 50% Off TipRanks Premium and Invest with Confidence

- Unlock hedge-fund level data and powerful investing tools designed to help you make smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis so your portfolio is always positioned for maximum potential

However, when it comes to dividend stocks things have definitely changed. This is due to the impact of COVID-19, which caused several companies to slash their dividends to conserve cash leaving investors in shock. Now more than ever, before jumping into a dividend stock it is prudent to carefully examine how safe it is.

With this in mind, we looked for dividend stocks with strong balance sheets and cash flow generation that comfortably cover their dividend payments. We used TipRanks’ database to identify dividend stocks that have earned a “Strong or Moderate Buy” consensus rating from the analyst community. The platform steered us toward three dividend stocks that offer investors yields ranging from 6% to just over 9%. Not to mention upside potential between 10% and 25%.

AT&T (T)

The first dividend stock is AT&T, the telecom giant with staggering annual revenues approaching$180 billion. The company operates four business divisions that comprise: Communications, WarnerMedia, Latin America, and Xandr.

First quarter operating performance was soft, partially due to COVID-19. Revenue was $42.8 billion and adjusted earnings were 84 cents per share, compared with $44.8 billion and 86 cents in the first quarter of 2019.

On the bright side, the stock is currently yielding a healthy 6.72%. Moreover, the company has a long track record of 36 years of increasing its dividend payment.

5-star Oppenheimer analyst Timothy Horan sees improvement ahead for the AT&T’s stock. In a recent research note, Horan commented on why he likes the company’s prospects.

“AT&T has a solid balance sheet and an attractive dividend yield. It has the ability to integrate its services in unique ways, and we see substantial room to use virtualized technologies to greatly reduce operating and capital expenditures,” Horan noted.

To this end, Horan rates T a buy along with a $47 price target. This figure represents upside potential of 55% from current levels. (To watch Horan’s track record, click here)

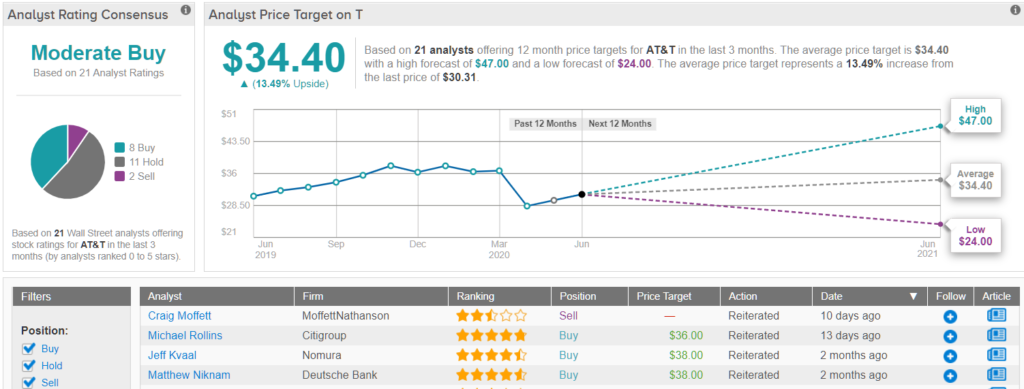

What does the rest of the Street think? Looking at the consensus breakdown, opinions from other analysts are more spread out. 8 Buy ratings, 11 Holds and 2 Sells add up to a Moderate Buy consensus. In addition, the $34.40 average price target indicates 13.5% upside potential. (See AT&T stock analysis on TipRanks)

Enterprise Products Partners (EPD)

ֵֵThe next dividend stock is Enterprise Products Partners, a master limited partnership that provides midstream energy services to producers and consumers of petroleum products. The company owns a large amount of pipelines, storage and processing facilities, and transportation services, which transport products to end users.

EPD wasn’t affected by the severe downturn in the oil sector as it earns income for the use of its services regardless of the costs of petroleum. In fact, first quarter results actually improved, with net income rising to $1.4 billion, compared to $1.3 billion, in the first quarter of 2019.

Turning to the company’s dividend — it currently yields a very generous 9.15%. Distributable cash flow was $1.6 billion in the first quarter and provided 1.6x coverage of the dividend payment. Sufficient coverage significantly lowers the risk of a reduction to the dividend payment.

Among EPD’s bulls is BMO analyst Danilo Juvane. He explains investors why he is excited about the company: “EPD reported in-line 1Q20 earnings, the sum of which spoke to a resilient model in the face of an adverse macro backdrop. Announced capex reductions are a positive insasmuch at it provides additional cushion to an already strong balance sheet coupled with ample payout coverage and liquidity. Bottom line is that we reaffirm EPD as one of our top picks, as we see its platform positioned to weather the storm in the coming quarters.”

As a result, Juvane rates Enterprise an Outperform (i.e. Buy) and has a $27 price target on the stock, which translates into a huge upside potential of 78%. (To watch Juvane’s track record, click here)

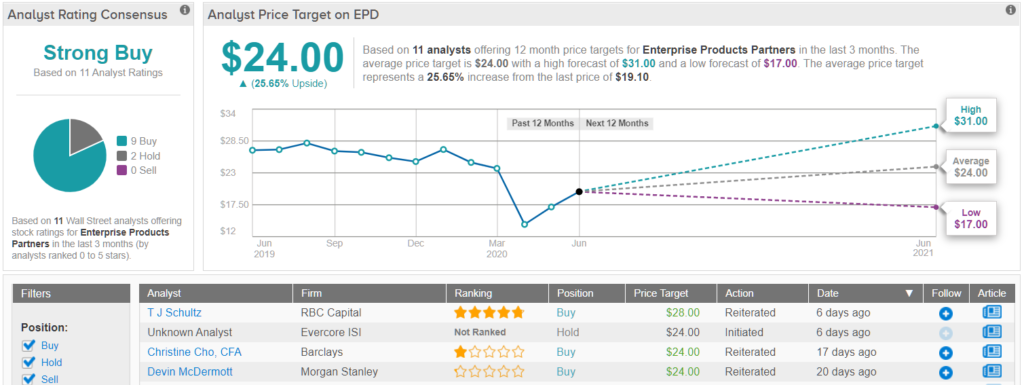

Other analysts are also enthusiastic about the stock. Enterprise sports a Strong Buy consensus rating that breaks down into 9 Buys and 2 Holds. The average price target is $24.00 with significant upside potential of 25%. (See EPD stock analysis on TipRanks)

Bank Of Nova Scotia (BNS)

Our last dividend stock is Bank Of Nova Scotia, a Canadian bank with over $1.2 trillion in assets. The bank provides retail, commercial, wealth management and investment banking services in Canada and internationally.

BNS’s recent quarterly earnings plunged as it set aside a record C$1.85 billion for loan losses due to COVID-19. Net income for the three months ended April 30 dropped to C$1.32 billion, from C$2.26 billion, a year earlier.

BMO analyst Sohrab Movahedi tells investors that despite the large drop in earnings the bank is still in good shape as “the balance sheet and liquidity position remain strong.”

Movahedi’s comments provide investors with comfort regarding the safety of the company’s dividend payment. The bank recently paid out a quarterly dividend of $0.65 per share, which represents an attractive 6.14% yield.

While BNS saw its shares drop almost 20% over the last year, Movahedi believes there are better days ahead for the stock once the economy reopens. He based his opinion on “higher-than-peer earnings growth driven by its international banking segment and recent acquisitions, and continued efficiency improvements.” The analyst concluded, “We see “growth on sale” based on the stock’s current valuation.”

All in all, Movahedi rates BNS a Buy alongside a C$65.00 (US$47.76) price target, which implies an upside potential of 14% from current levels. (To watch Movahedi’s track record, click here)

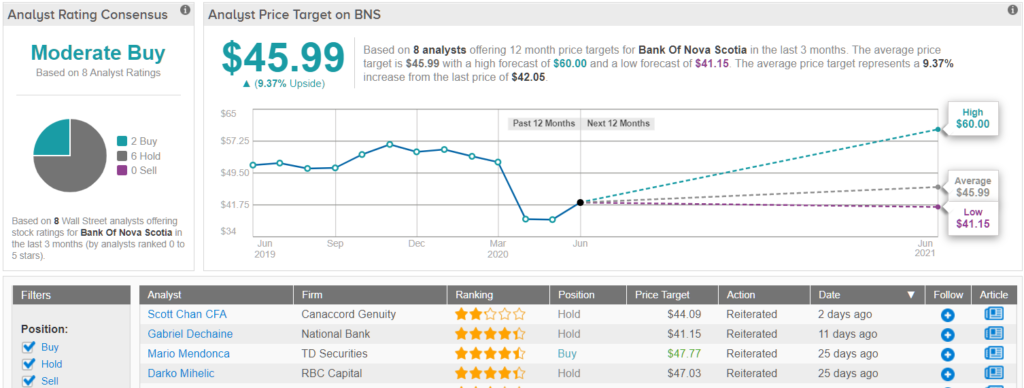

Overall, BNS holds a Moderate Buy rating from the analyst consensus, based on 2 “buy” ratings and 6 “holds.” Shares are selling for $42.05 on the NYSE, and the average price target of US$45.99 implies nearly 9% upside from current levels. (See BNS stock-price forecast on TipRanks)

To find good ideas for dividend stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.