After a series of ups and downs through most of June and July, making the stock index charts look like a saw, the S&P 500 is rising again. The index is holding above 3,200, giving investors reason to view that level as a new support. Where the upper resistance may lie, is anyone’s guess. At the start of the current rally, analysts placed it at 2,750 to 2,850 – but the index broke above that back in May.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Whether these movements in S&P are lasting or ephemeral, there will always be means to find profit in the markets. Investing is a long-term game, so finding stocks that are going to continue delivering returns six months or a year from now is a key to success. Every investor has his own investing strategy. While some investors like to read stock market news & analysis, others prefer to do their own stock analysis and research. One way or another, there is always room to improve. TipRanks has put together the Smart Score, to gather together data from 8 commonly used predictive factors, and distill them into a single score for every stock.

Opening up the database, we’ve picked out three stocks that have the coveted ‘Perfect 10’ Smart Score – a strong indicator of overperformance in the near future. Here are the details.

Group 1 Automotive (GPI)

First on our list today is Group 1, a major international auto retailer with a strong online presence. The company deals in new and used cars, luxury and bargain models, and also provides financing, maintenance, and repair services. Group 1 boasts a market cap of $1.3 billion, and operations across the US and in Europe and Latin America.

The first quarter, encompassing the coronavirus crisis, the economic crisis, and the various lockdown policies around the world, was understandably hard on Group 1. Sales were down, ancillary services were down, and potential customers were stuck at home while restrictions were placed on travel. It was hardly a profitable environment for an auto dealer. The company saw earnings drop by nearly half, from $3.01 to $1.66.

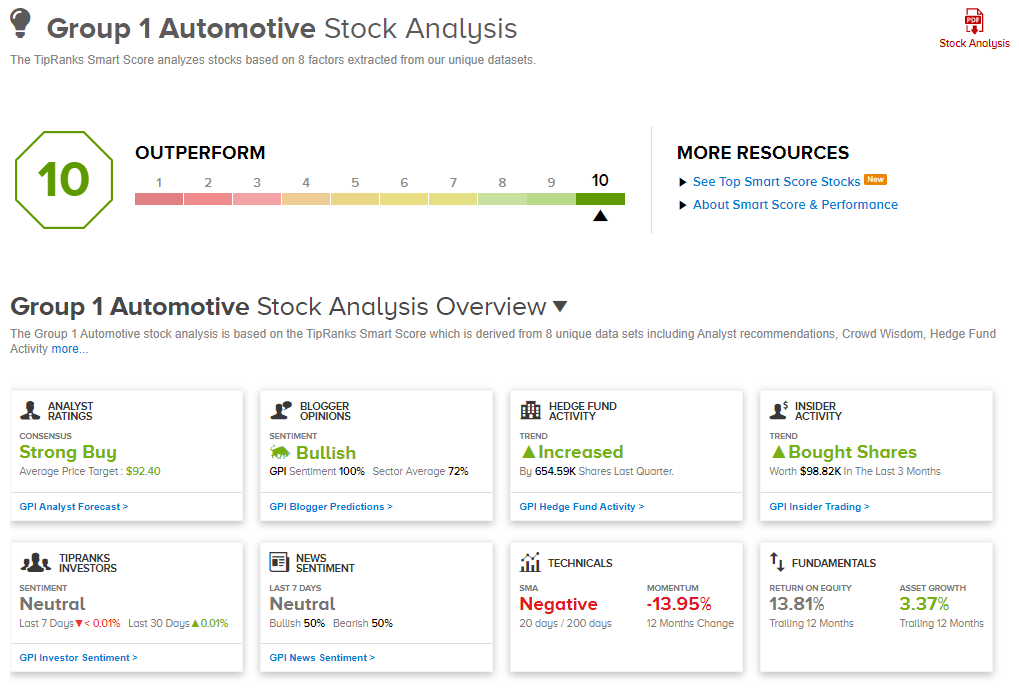

However, GPI has a Smart Score of 10, so clearly something is going right. JPMorgan analyst Rajat Gupta covers this stock, and in his recent note he maintained his Buy rating, laying out the cast for improved sales performance in the near future.

“While it is no surprise that sales are recovering across the board… the surprise to us was the faster than expected recovery in margins… GPI noted significantly improving market conditions and operating trends in May and June MTD vs March/April 2020 in the US. Since early May, revenue for new vehicle sales and service increased at a faster rate than associated costs driving a better than expected improvement in US profitability…”

To this end, Gupta rates GPI an Overweight (i.e. Buy) along with a $94 price target. This figure shows the extent of his confidence; it implies a 27% upside for the coming year. (To watch Gupta’s track record, click here)

Overall, the analyst corps is unanimous on GPI. The stock has 5 Buy ratings, making the consensus view a Strong Buy. Shares are selling for $74.14, and the average price target of $92.40 suggests it has room for nearly 25% growth. (See GPI stock analysis on TipRanks)

MTBC, Inc. (MTBC)

MTBC offers tech solutions for medical billing, transcription, and practice management to hospitals and physician practices. Despite having plenty of potential business upside during a major health crisis, MTBC has still felt the effects of the lockdowns and recessionary pressures – after all, much routine medical treatment was allowed to fall by the wayside during March and April.

The company’s operating loss gaped wider in the first quarter, with the EPS loss hitting 42 cents. That was only partly bad news, however, as that beat the forecast by 39%. Revenue was up 45% year-over-year, to $21.9 million.

Strong revenues will always boost a stock, as will beating the earnings estimates – but holding an in-demand niche lays a sound foundation. MTBC shares are up 52% since the February market crash, drastically outperforming all the major indexes. Clearly, investors see this company as a growth prospect.

Bill Sutherland, writing for Benchmark, is impressed by MTBC’s ability to compete in a crowded marketplace. He points out, “MTBC’s chief competitive advantage is its offshore operations, mainly based in Pakistan where professional labor costs are about 10% U.S. levels.” Turning to the future, Sutherland adds, “We see potential upside to our initial price target based on outperformance of our initial 2021 model, particularly if MTBC begins to see a meaningful acceleration in organic growth.”

Sutherland covers MTBC with a Buy rating and a $15 price target, implying an upside of 37% for the next 12 months. (To watch Sutherland’s track record, click here)

MTBC is another stock with a unanimous Strong Buy consensus. No fewer than 5 analysts have given the stock a thumbs-up recently. The average price target, at $13.46, suggests it has a one-year upside of 23% from the current share price of $10.95. (See MTBC stock analysis on TipRanks)

Franchise Group (FRG)

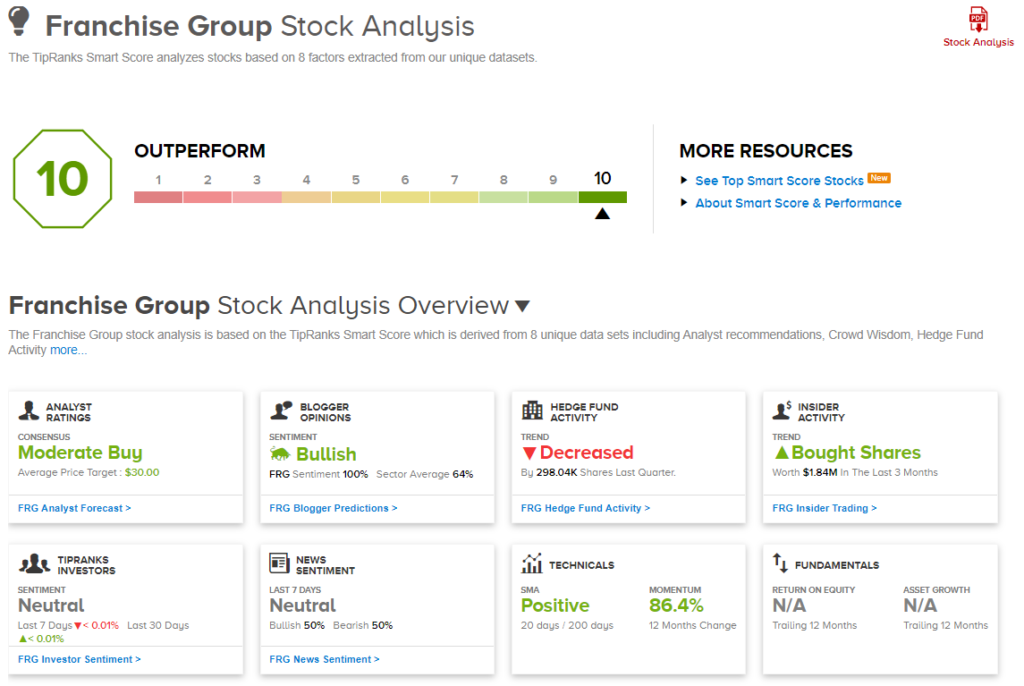

Our last “perfect 10” stock is a holding company, doing business through a group of subsidiaries. Franchise Group’s main subsidiary, and the main source of revenue, is Liberty Tax, the US’ third largest franchised tax preparation company. Other subsidiaries include Buddy’s Home Furnishings, Sears Outlet, and The Vitamin Shoppe.

In June, FRG demonstrated its confidence, despite the pandemic. The company declared a regular quarterly dividend of 25 center per share. At $1 annualized, this gives a yield of 4.7%, more than double the average yield found among S&P companies – and clear attraction for the stock.

Covering the stock for B Riley FBR, analyst Scott Buck wrote: “Near term, we expect the underlying business to benefit from secular changes in consumer behavior following the rise of COVID-19 and from new operating efficiencies moving onto the shared services platform. In addition, we believe that the challenging macro environment for much of retail will likely provide opportunities for FRG to obtain new assets to enhance current concepts or add new businesses at attractive prices.”

To this end, Buck rates FRG a Buy along with a $30 price target, which implies an impressive 40% upside potential for the stock. (To watch Buck’s track record, click here)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.