Investing in blue-chip dividend stocks can help you generate a recurring stream of passive income at a low cost. Here, you need to identify quality large-cap companies that thrive across market cycles and generate steady cash flows. Generally, blue-chip companies allocate a portion of these cash flows to shareholders in the form of dividends. Further, these companies increase dividends annually each year, enhancing the effective yield over time.

Claim 50% Off TipRanks Premium and Invest with Confidence

- Unlock hedge-fund level data and powerful investing tools designed to help you make smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis so your portfolio is always positioned for maximum potential

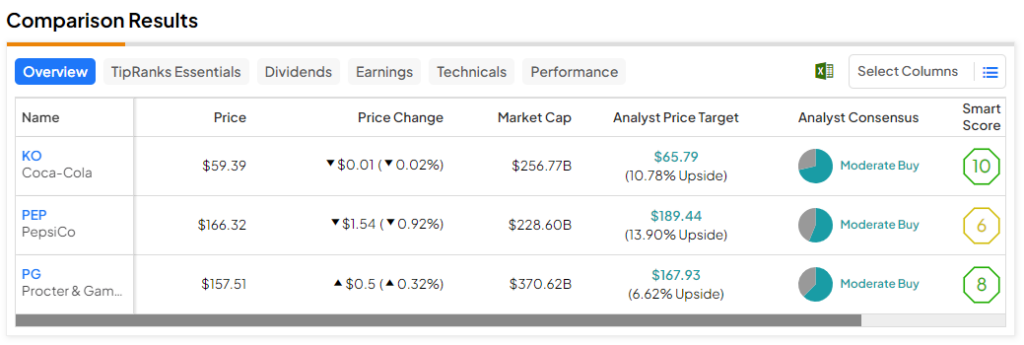

Three such companies that can help you generate passive income include Coca-Cola (NYSE:KO), Pepsi (NASDAQ:PEP), and Procter & Gamble (NYSE:PG). I am bullish on each of these stocks due to their strong brands, predictable earnings, and steady, growing dividends.

Coca-Cola (NYSE:KO)

Valued at $256 billion by market cap, Coca-Cola is among the most recognizable brands in the world. It is engaged in the manufacturing and marketing of non-alcoholic beverages. In the last 20 years, Coca-Cola’s stock has returned 133% to shareholders. But after adjusting for dividends, total returns are closer to 323%. In comparison, the S&P 500 Index (SPX) has returned 538% after adjusting for dividends.

While Coca-Cola has underperformed the broader market, it has still outpaced inflation over the long term. Moreover, the stock is much less volatile than the S&P 500 Index, with a beta of less than 0.6. A beta of less than 1.0 suggests low relative volatility for a particular stock.

Despite its massive size, Coca-Cola increased its sales from $33 billion in 2020 to $43 billion in 2022. In 2023, its sales increased to $45.75 billion. Comparatively, operating income has risen from $9 billion in 2020 to nearly $11 billion in 2022 and $11.3 billion in 2023.

Coca-Cola pays shareholders an annualized dividend of $1.94 per share, indicating a forward yield of 3.3%. In the last 20 years, Coca-Cola has increased its dividends at an annual rate of 7.3%.

Coca-Cola continues to gain market share in the beverage segment and ended 2023 with free cash flow of $9.7 billion. Its payout ratio has ranged around 75%, providing it with enough room to strengthen the balance sheet, reinvest in capital expenditures, and increase its dividends.

What Is the Target Price for Coca-Cola Stock?

Out of the 14 analysts tracking Coca-Cola, 10 recommend Buying, and four recommend Holding. There are no Sell recommendations for KO stock. The average KO stock price target is $65.79, indicating upside potential of 10.8% from current levels.

Pepsi (NASDAQ:PEP)

Valued at $229 billion by market cap, Pepsi is a direct competitor to Coca-Cola. Its portfolio of brands other than Pepsi includes Cheetos, Gatorade, Lay’s, and Mountain Dew, among others. Pepsi currently pays shareholders an annualized dividend of $5.06 per share, indicating a yield of 3%.

Moreover, the company has raised the payouts for 52 consecutive years, which is remarkable. In the last 20 years, Pepsi has grown its dividends by more than 10% annually.

In recent years, Pepsi has increased product prices to offset inflation, showcasing its pricing power. However, due to a sluggish macro environment, Pepsi expects sales to grow by just 4% year-over-year in 2024, lower than consensus estimates of 5.2%.

What Is the Target Price for Pepsi Stock?

Out of the 16 analysts covering PEP stock, nine recommend a Buy, seven recommend a Hold, and none recommend a Sell, giving it a Moderate Buy consensus rating. The average Pepsi stock price target is $189.44, 13.9% above the current price.

Procter & Gamble Stock (NYSE:PG)

The final dividend stock on my list is Procter & Gamble, valued at $370 billion. Operating in the branded consumer packaged goods segment, Procter & Gamble is a household name and operates in multiple verticals, such as beauty, healthcare, and family care, among others.

Similar to other companies, P&G is struggling with tepid consumer spending amid higher interest rates and inflation. Despite these headwinds, P&G saw its earnings grow by 16% in the October-to-December quarter due to cost savings and price hikes.

The company expects organic sales to grow between 4% and 5% in 2024, compared to a 7% increase in 2023. P&G’s focus on cost optimization should drive earnings and dividends higher from here.

P&G pays shareholders an annualized dividend of $3.76 per share, indicating a forward yield of 2.4%. These payouts have increased by 7.6% annually in the last 20 years.

What Is the Target Price for PG Stock?

Out of the 16 analysts covering PG stock, 10 recommend a Buy, six recommend a Hold, and none recommend a Sell, giving it a Moderate Buy consensus rating. The average PG stock price target is $167.93, 6.6% above the current price.

The Takeaway

Passive income investors can consider investing in large-cap dividend stocks. In addition to the dividend yield, investors are also positioned to benefit from long-term capital gains.

Given the average yield of 2.8% for these three stocks, an investment of $5,000 in each of these dividend giants will help you earn $420 in annual dividends. In case the payouts increase by 7% each year, your dividends will double in the next 10 years.