Amid the market volatility, high-yielding ASX shares delivering dividends, have become favourites amongst many investors. Insignia Financial Ltd (ASX:IFL), Perenti Global (ASX:PRN), Nine Entertainment Co. Holdings Limited (ASX:NEC) are among the highest-paying dividend shares, all with yields of more than 6%.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Investing in dividend shares in uncertain times

Share prices can drop steeply in rough market conditions, erasing capital gains for investors. However, many dividend-paying companies can deliver bankable returns even in a market downturn. Therefore, dividend shares can both provide you with an income and a hedge for your portfolio during uncertain times.

Let’s take a closer look at the three ASX shares with lucrative dividend yields and sustainable payout ratios. The dividend payout ratio shows us the percentage of a company’s profit that goes to funding dividend payments. A low payout ratio means that a company is retaining more money from its profit, which can be a sign of dividend stability.

Insignia Financial shares offer 7.5% dividend yield at 32% payout ratio

Melbourne-headquartered Insignia Financial provides an array of financial products and services. Those services include financial planning, stockbrokering, and investment management. For a company that has been in business since 1846, Insignia has weathered many economic recessions.

Insignia shares currently offer a dividend yield of 7.51%, well above the sector average, just over 2%. The company has a modest payout ratio of 32.7%. Insignia’s next dividend payment date is set for 29 September. The company plans to host its 2022 AGM on 10 November.

According to TipRanks’ analyst rating consensus, Insignia stock is a Strong Buy. The average Insignia share price target of AU$3.99 implies over 26% upside potential. The shares have risen about 13% in the past three months.

Perenti offers 6.49% dividend yield, at just over 17% payout ratio

The company provides mining services, such as exploration drilling and production drilling. Perenti shares currently offer a dividend yield of 6.49%, which exceeds the sector average of 1.64%. The company has a disciplined dividend program, offering a payout ratio of only 17.8%.

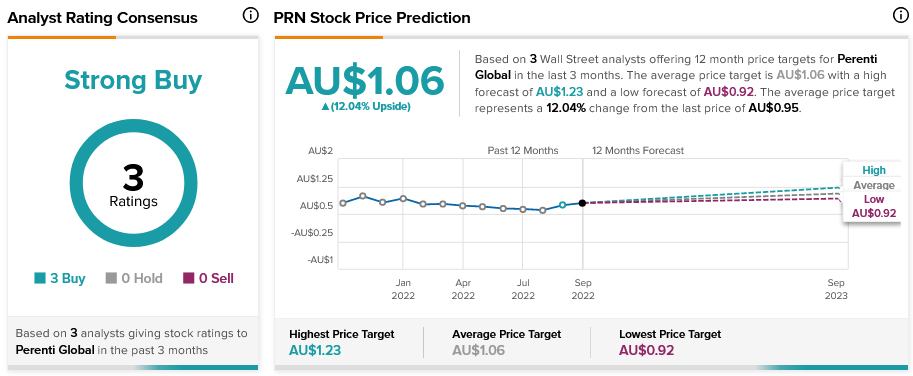

According to TipRanks’ analyst rating consensus, Perenti stock is a Strong Buy. The average Perenti share price forecast of AU$1.06 implies modest 12% upside potential. The shares have gained more than 59% over the past three months.

Nine Entertainment shares offer over 6% in dividend yield at nearly 35% payout ratio

The media company operates television and radio stations. It also runs a digital platform that offers subscription media and other services. Nine Entertainment is the parent company of the Australian Financial Review newspaper. The company delivered strong revenue and profit growth in the latest fiscal year.

Nine Entertainment shares currently offer a dividend yield of 6.07%, far above the sector average of 0.54%. Its payout ratio is a conservative 34.7%. The company has been paying increasing annual dividends over the last two years. Nine Entertainment’s next dividend payment date is set for 20 October.

According to TipRanks’ analyst rating consensus, Nine Entertainment stock is a Strong Buy. The average Nine Entertainment share price prediction of AU$3.18 implies over 55% upside potential. The shares have gained more than 15% over the past three months.

Final thoughts

When shopping for dividend shares in uncertain times such as these, dividend stability is an important factor to consider. Insignia, Perenti, and Nine Entertainment are not only high-yielding dividend shares, but their modest payout ratios suggest they can also sustain the distributions.