Investing in the Energy sector could prove beneficial to your portfolio. The energy sector is one of the major contributors to the growth of an economy. Now, more than ever, when American companies are transitioning to cleaner power alternatives, investors should scan for the best energy companies and take exposure to them. Most of these companies also pay lucrative dividends, making them an apt investment option.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

To help simplify your investment decision, we used the TipRanks ETF Screener to scan for energy sector-focused ETFs with more than 20% upside potential. What’s better, the three ETFs have a Smart Score of eight, meaning they are poised to outperform market expectations.

iShares U.S. Oil & Gas Exploration & Production ETF (IEO)

The iShares U.S. Oil & Gas Exploration & Production ETF invests 99.8% of its funds in the oil and gas exploration and production sector. IEO has $880.65 million in assets under management (AUM), with the top 10 holdings contributing 71.34% of the portfolio. Further, the ETF boasts a current dividend yield of 3.2%. Meanwhile, the expense ratio of 0.40% is one of the lowest in the industry.

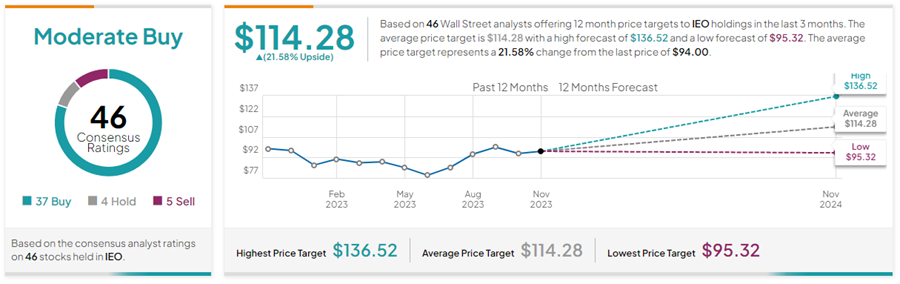

On TipRanks, IEO has a Moderate Buy consensus rating. This is based on the consensus rating of each stock held in the portfolio. Of the 46 stocks held, 37 have Buys, four have a Hold, and five stocks have a Sell rating. The average iShares U.S. Oil & Gas Exploration & Production ETF price forecast of $114.28 implies 21.6% upside potential from the current levels.

Invesco Dorsey Wright Energy Momentum ETF (PXI)

The Invesco Dorsey Wright Energy Momentum ETF (Fund) is based on the Dorsey Wright Energy Technical Leaders Index (Index). The PXI currently invests 89.3% of its funds in the energy sector. PXI has $102.28 million in AUM with its top 10 holdings contributing 46.50% of the portfolio. Notably, PXI has a current dividend yield of 2.91%. Its expense ratio stands at 0.60%.

On TipRanks, PXI has a Moderate Buy consensus rating. Of the 38 stocks held, 34 have Buys, three have a Hold rating, and one stock has a Sell rating. The average Invesco Dorsey Wright Energy Momentum ETF price target of $54.45 implies 26.3% upside potential from the current levels.

Invesco Dynamic Energy Exploration & Production ETF (PXE)

The ETF invests 100% of its funds in companies that engage principally in the exploration, extraction, and production of crude oil and natural gas from land-based or offshore wells. PXE has $158.91 million in AUM, and its top 10 holdings contribute 47.26% of the portfolio. Further, PXE has a current dividend yield of 2.91%. PXE has a relatively higher expense ratio of 0.63%.

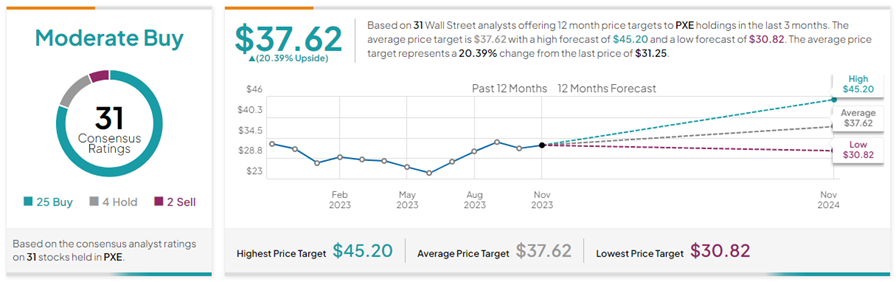

On TipRanks, PXE has a Moderate Buy consensus rating. Of the 31 stocks held, 25 have Buys, four have a Hold rating, and two stocks have a Sell rating. The average Invesco Dynamic Energy Exploration & Production ETF price target of $37.62 implies 20.4% upside potential from the current levels.

Ending Thoughts

Sector-focused ETFs can help investors get exposure to their preferred sector with maximum diversification and low risk. The aforementioned three energy sector-focused ETFs, selected with the help of our TipRanks ETF Screener tool, could enhance investors’ total returns with high upside potential and lucrative dividend yields.