Electric vehicles (EVs) have been on the roads for the better part of two decades now, in slowly increasing numbers. The technology isn’t new – EVs were part of the initial wave of automotive technology over a century ago – but modern metallurgy, batteries, and drive trains have made them more practical. While the internal combustion engine still offers an overall better package of performance, power, and price, EVs are catching up.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

They are getting a boost from the government, in the form of supportive policies. The Biden Administration is seeking a pledge from US automakers to make a full-court press in promoting electric cars, with a goal of reaching 40% EV sales by 2030. New companies are springing up to fill the demand, building new and innovative models of all-electric or hybrid-electric cars, and expanding the necessary charging networks to keep them powered up. This brings up new opportunities for investors, as well as new challenges.

On the challenge side, 2021 was a tough year for EV makers. Between semiconductor chip shortages, supply chain disruptions, and rising cost inflation, the auto companies are facing a storm of headwinds. Plenty of new companies entered the markets – through IPOs and SPAC transactions – but most of them ended the year with share prices significantly below their starting points.

But according to D.A. Davidson analyst Michael Shlisky, with the year-end past us, the low EV share prices may present investors with an attractive entry point.

“We believe now might be the right time for investors to take a closer look at the EV stocks individually and assess which are furthest along, offering the best risk/reward. We look for companies actively booking binding orders and delivering vehicles as our best bets, with additional points for good management, a wide moat or a head start,” Shlisky wrote.

So let’s take a closer look at some of Shlisky’s picks among the new EV companies. According to the TipRanks data, these are stocks with Strong Buy consensus ratings, share prices below $10, and triple-digit upside potential. Let’s take a closer look.

Hyzon Motors (HYZN)

We’ll start with Hyzon Motors, a green automaker focused mainly on the development of heavy duty commercial trucks. The ‘gimmick’ here is in the power source – Hyzon is working on hydrogen fuel cells to power its EVs, as an alternative to batteries. Fuel cells use oxygen in the air to complete an electrochemical reaction with stored hydrogen to generate electricity; the process produces less toxic waste than traditional batteries, although it is more expensive to build. The only by-product of the reaction is pure water.

Hyzon currently has a fuel cell manufacturing facility in Rochester, New York producing 150kW fuel cells, and preparing for production of higher-capacity 370kW cells. The 370kW systems will produce the equivalent of 500 horsepower, enough for a variety of heavy-duty commercial truck applications. Hyzon aims to produce vehicles in the marine, mining, and locomotive niches.

Hyzon currently has several commercial trucks with prototypes in operation. These include a municipal sewage cleaner, of which two have been delivered to the municipality of Rotterdam in the Netherlands, a 55-ton mild delivery truck in use with the FrieslandCampina dairy coop, and the Rochester Development Vehicle, the first Hyzon truck to hit the road in North America. These vehicles feature ranges between 400 and 600 miles, and zero pollutant emissions.

Hyzon’s vehicles are not yet in regular production, and the company is delivering small orders for purposes of testing and demonstration. In effect, the company is in the ‘proof of concept’ stage. Last month, Hyzon delivered 29 fuel cell electric heavy duty trucks for use in the commercial steel industry in China, and signed an agreement with the Dutch waste management company Geesinknorba. These are typical of the company’s current small-scale deliveries.

Because Hyzon is still delivering demo batches, it hasn’t started bringing in a regular revenue stream. In the most recent reported quarter, 3Q21, the company showed just $968,000 at the top line. On a positive note, Hyzon expects that its Rochester, New York and Bolingbrook, Illinois manufacturing facilities will be in full production by the end of 1H22.

Despite the positive outlook, Hyzon’s stock has been falling, and is down 62% from its February peak. Like many highly speculative companies, Hyzon is vulnerable to ‘short reports,’ that is, reports of delayed or cancelled deliveries that negatively impact share price. These reports were not correct, according to Shlisky, but left Hyzon as a ‘show me’ stock.

Shlisky also points out that Hyzon is doing the showing. He writes, “HYZN appears to be on-track with its strategy of selling fuel-cell trucks to natural early adopters, while making early investments in hydrogen infrastructure. It’s a strategy we believe will work–or at the very least, may result in interest from a larger truck company. The recent deal with Geesinknorba places the company in an exclusive position with the largest waste-truck manufacturer in Europe. The Shanghai HongYun contract, which was dismissed in a recent short report as imaginary, appears instead to be very much real and with none other than Baosteel, the world’s largest steel company; 29units have been delivered thus far. Most other initiatives appear to be on-track, with the supply chain the key near term risk (like the rest of the Industrial economy).”

In line with these comments, Shlisky rates Hyzon a Buy, and his $21 price target indicates room for ~231% upside potential in the year ahead. (To watch Shlisky’s track record, click here)

Overall, there 6 recent analyst reviews for Hyzon shares, and they break down 5 to 1 in favor of Buy over Hold, giving the stock its Strong Buy consensus rating. The shares are priced at $6.30 and the $14.17 average price target implies an upside of ~125% this year. (See HYZN stock analysis on TipRanks)

Electric Last Mile Solutions (ELMS)

Next up is Electric Last Mile, a Michigan-based company aiming at a highly specific, and highly useful, niche – and one that emphasizes the strengths of EVs while minimizing some of their weaknesses.

ELMS is working on a low-cost, all-electric delivery van. The projected vehicle is a Class 1 commercial van capable of carrying a 2,100 pound payload with a range of 110 miles. The vehicle is optimized for urban spaces, featuring a 10-foot wheelbase and a 20-foot turning radius, and 35% more cargo room than similarly sized combustion engine vehicles. The Urban Delivery van is available now, with a starting price at $28,000.

The company also has a Class 3 commercial truck chassis under development. This tractor will feature a 125 mile range and a 5,700 pound carrying capacity. This vehicle, to be available later this year, is designed to fill the tractor-trailer role.

A sharp-eyed reader will note that both vehicles feature relatively short ranges. This is a natural drawback of EVs, and is related to current battery technology. However, by optimizing them for urban use, ELMS has turned a drawback into an attractive feature. The vehicles are designed and marketed for the ‘last mile’ of the delivery chain, and by remaining in urban areas they can stay close to their home base charging points. City delivery driving, with the ability to circle back to the depot for charging, will minimize the short-range issue of EV batteries, while providing a vehicle capable of filling an important niche with lower total estimated costs of maintenance.

ELMS launched the Delivery Van in 3Q21, and has already made initial deliveries of the vehicle to customers. The company has secured orders for up to 6,000 units. That said, revenues have yet to take off; there is a lag between commitment to purchase, delivery, and payment, and ELMS only generated $136,000 in revenue in Q3. Look for that number to expand going forward, as more vehicles are ordered and delivered. In the meantime, the company’s stock is down 53% in the last 12 months, as the company had to reduce its full year 2021 guidance.

All of that said, the story here looks to improve soon, according to Shlisky.

“We view ELMS as an under-the-radar EV option with minimal competition and a better product–with the rare combination of an equivalent sticker price and lower operating cost. ELMS’s primary offering is a Class 1 commercial EV; it is the only one available and the only likely player for several years if not more. Production is up and running at this point, and customers are placing orders; they either like the equivalent upfront costs or the higher cargo volume vs. ICE options,” Shlisky opined.

“There are already takers announced for parts of the 1,000-unit Randy Marion Auto order, and we expect an additional 5,000 units in 1Q:22 (plus other incremental orders). Management stands out from the crowd vs. other EV start-ups, with the former CEOs of Cadillac and Key Safety as co-founders,” the analyst added.

Shlisky’s upbeat outlook leads him to put a Buy rating on the stock, and his price target, of $14, suggests a robust upside of ~125% for the coming 12 months.

Overall, the unanimous Strong Buy consensus rating here, based on 3 recent positive reviews, shows that Wall Street agrees with Shlisky on this stock. The shares are trading for $6.21, and the average price target of $14 is completely in-line with Shlisky’s objective. (See ELMS stock forecast on TipRanks)

Lightning eMotors (ZEV)

Last on our is Lightning eMotors, and EV company that is approaching the sector from two different directions at the same time, producing both vehicle drive systems and electric charging stations. This gives Lightning a more diverse portfolio than its peers, an advantage that is accentuated by the company’s approach to the EV side of the equation. Lightning eMotors produces high-end all-electric powertrain systems designed to fit existing – and popular – vehicle models, such as Ford’s F-450 and F-550 series busses and trucks, and multi-purpose Transit van. Lightning’s systems allow for an easy conversion of existing models to an all-electric format without losing their existing customer base.

Lightning’s electric powertrain systems are targeted at the commercial fleet market. The company systems are designed for a variety of trucks, delivery vans, and busses – all of which have existing use, as gasoline vehicles, in municipal fleet services. To facilitate the move to electric, Lightning also offers the charging infrastructure needed to maintain an electrified fleet. The company’s services on this end include charge points, installation, support, and maintenance. Charging is offered on the ‘as-a-Service’ model, with customer subscriptions. Call it CaaS, charging as a service.

Like the other stocks on this list, ZEV shares went public recently, just in May of last year. The company entered the public markets through a SPAC transaction. Like many SPACs, ZEV has seen its shares fall after completion of the business combination (it is down 54% in 12 months); but in this case, ZEV can point to supply chain bottlenecks forcing delays from suppliers and OEMs, impacting the company’s own production.

However – Shlisky sees Lightning eMotors in solid position, and poised for takeoff. He writes, “We consider ZEV a fully-formed company at this point (founded in 2008) that happens to be experiencing a very high, multi-year growth tailwind. ZEV is one of the few EV SPAC deals with early evidence that its long-term ‘hockey stick’ is close to reality. This is thanks to two significant contracts for EV shuttle buses and EV Class A school buses, among other products. We have seen multiple ZEV vehicles making deliveries at this point, and the drivers we have spoken with have been satisfied with their experience. Customers that ordered less than 100 units in 2021 are on track for several hundred in 2022, while some new customers could be in for quantities approaching 1,000 units for the year.”

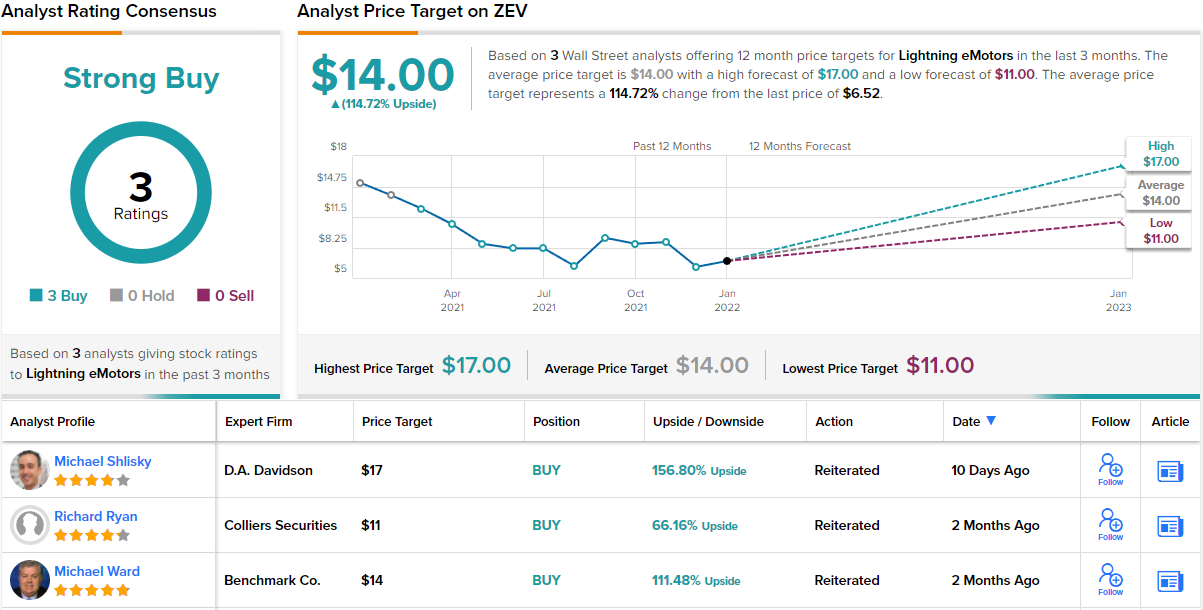

To this end, Shlisky puts a Buy rating on ZEV shares, with a price target of $17 to suggests ~157% upside in the next 12 months. (To watch Shlisky’s track record, click here)

While ZEV only has 3 recent ratings on record, they are all positive – making the Strong Buy unanimous. Shares are trading for $6.82 and the $14 average target implies a one-year upside of ~115% from that level. (See ZEV stock forecast on TipRanks)

To find good ideas for EV stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.