Our digital age has brought with it a host of new issues, matters that our grandparents could never have dreamed about just a century ago. One of the more serious issues involved in this is online and digital security. Cyber attacks can threaten our bank accounts, our meta data, our social profiles – or even governmental databases and national security. While this may sound like the stuff of nightmares, it has also bread opportunity for investors – as cybersecurity companies are in demand, and their stocks are set to gain as the cyber threats mount.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

In one recent example of the damage malicious hackers can do, the online trading giant Robinhood admitted that it suffered a data breach last week with more than 2 million customer names and 5 million customer emails compromised.

Looking at the situation from Wedbush, analyst Daniel Ives noted, “With the threat landscape growing by the day the backdrop is very bullish for the cyber security sector, as in particular we are seeing strong deal flow around identity threat detection, privileged access management (PAM), endpoint/ vulnerability security, and a discernible shift to zero trust architecture all gaining steam in the field.”

So let’s take a look at cybersecurity. Plenty of Wall Street’s stock watchers are picking out cybersecurity moves for investors to tap into, and we’ve used the TipRanks platform to call up details on three of them. These are all Strong Buy stocks, with considerable upside potential for the coming year – let’s find out what else leads the analysts to recommend them.

Akamai Technologies (AKAM)

We’ll start with Akamai, a leader in content deliver network services and cloud security. Akamai provides both intranet and internet security options through its Intelligent Edge platform. The company counts major names among its business customer base, including the CBC, the Washington Post, Honda, Roblox, Lufthansa, and the AP. In all, more than half of the Fortune 500 companies use Akamai’s services, and the company saw $3.2 billion in revenue during the ‘corona year’ of 2020.

The company’s revenues have been climbing this year. The cumulative top line for 1H21 came in 8.7% above the 1H20 results, and the 3Q21 revenues of $860.3 million were up 8.5% yoy. The gains were driven by the company’s Security Technology Group, which showed a 26% yoy gain in posting revenues of $335 million. Revenue from the Edge Technology Group was flat yoy, at $526 million. The company’s EPS has shown a trend upwards over the past two years, and the Q3 number, at $1.45, was up 11% yoy. Akamai has a sound balance sheet, with $2.8 billion in liquid assets as of the end of 3Q21.

This month, Akamai made two announcements that bode well for future operations. First was the November launch the App & API Protector, a next-gen web application and API (WAAP) security solution. Two days later, Akamai announced an expansion of its existing partnership with Queue-it, the virtual waiting room software and service provider. The expansion will allow customers greater control and coverage of their online traffic.

Cowen’s 5-star analyst Colby Synesael is impressed by Akamai and writes: “Given Akamai’s strong FCF profile, strong balance sheet, strong growth, and current valuation discount, we are encouraged by management commentary as we strongly believe that it would send a meaningful signal to the market that it believes its stock is undervalued… We believe this reflects usual conservatism as demand remains strong and note the company has beat the high-end 12 of the past 13 quarters… We continue to believe AKAM should be valued on a SOP-basis as Security becomes a greater percentage of revenue, resulting in a re-rating higher over time.”

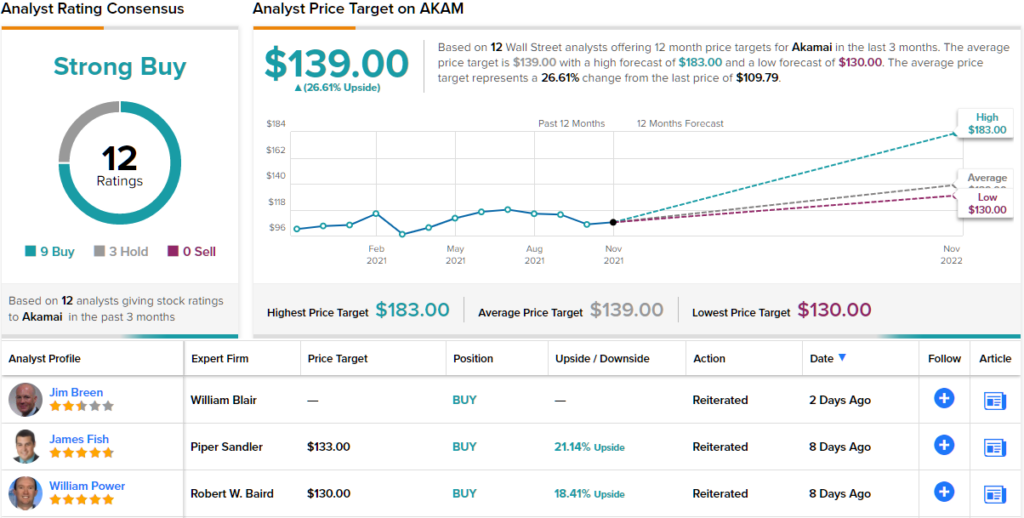

Unsurprisingly, Synesael rates AKAM shares an Outperform (i.e. Buy), and his $183 price target implies a one-year upside potential of 66%. (To watch Synesael’s track record, click here)

It’s clear from the current reviews that Wall Street is in broad agreement with Synesael’s bullish take; the 12 reviews available for this stock break down 9 to 3 in favor of Buys versus Holds, giving the stock its Strong Buy consensus rating. The stock is selling for $109.67 and its average price target of $139 suggests it has an upside of ~27% in the next 12 months. (See AKAM stock analysis on TipRanks)

SailPoint Technologies (SAIL)

The next stock we’ll look at, SailPoint Tech, is a leader in identity security for cloud enterprises. The company’s solutions provide secure access and enable remote work for thousands of business customers worldwide, permitting both management visibility of the workforce and employee’s ability to access their jobs. Features of the company’s security products include password management, access certification, and cloud governance – all essential to managing traffic in and out of cloud-based systems.

The company released its 3Q21 financial results this week – and it started with an eye-catching top line. SailPoint reported $110.1 million – the highest of the past several years, and up 17% yoy. Drilling down, subscription revenues grew 39% yoy, to $70.8 million, a total that included a 71% yoy increase in SaaS revenue, to $29.8 million. Also on a positive note, SailPoint reported a 44% yoy gain in annual recurring revenue (ARR). As of the end of 3Q21, ARR was up to $323.8 million, a total that bodes well for the company going forward. Looking ahead, SailPoint guided toward top line revenue of $112 million to $114 million in Q4, with ARR rising to $358 million to $360 million.

In his coverage of this stock, Morgan Stanley’s Hamza Fodderwala notes, “Improving Visibility with SaaS/Subscription now >50% of total ARR, growing >80% YoY, while the remaining maintenance base is still growing +15% YoY. New disclosures showing ARR breakdown provide much better visibility into forward topline growth, as faster growing SaaS becomes a greater portion of the overall mix. With SAIL trading at >20% valuation discount to core SMID-cap security peers, we see plenty of room for upside in both valuation and estimates.”

To this end, Fodderwala sets an Overweight (i.e. Buy) rating on SAIL shares, along with a $75 price target. Should his thesis play out, a twelve-month gain of ~30% could potentially be in the cards. (To watch Fodderwala’s track record, click here)

Overall, the Strong Buy consensus rating on SAIL is unanimous, based on 10 positive reviews from the Street. The stock’s trading price is $58.38 and the average price target of $70 implies ~20% one-year gain from that level. (See SAIL stock analysis on TipRanks)

Varonis Systems (VRNS)

Last but not least is Varonis, a software company that provides security systems for protecting data on remote network connections. Varonis tracks digital behavior to identify cyberattacks by abnormal user activity and provide real-time defense. The software employs User Behavior Analytics based on enterprise IT data, mapping relationships among employees, registered users, data objects, and site content to develop a baseline for recognizing malicious actors.

Playing up the need for cyber defenses, Varonis released a report in October on cybersecurity in Australia. In the report, which surveyed business across a range of industries including financial services, government, education, healthcare, and IT and telecom, Varonis noted that 63% of Australian companies expect cyberattacks to occur within the next 12 months. A strong customer need exists for cyber defense services.

This is also clear from Varonis’ 3Q21 results, released on November 1. The quarterly revenue moved above $100 million for the first time, topping off at $100.4 million for 31% yoy growth. That include $70 million in Subscription revenues, which were up 59% yoy. The company’s ARR grew 36% yoy, to reach $354.2 million. Varonis finished the quarter with a solid base of liquid assets, totaling $813.4 million.

All of this drew the attention of Berenberg analyst Andrew Smith, who said of the company: “We continue to have a positive outlook for the business based on strong secular drivers such as accelerated digital transformation initiatives and more dispersed data sources, zero trust security initiatives, and heightened awareness around the need for data security. We believe VRNS’s transition to a subscription-based model has made it easier for customers to consume the platform during these compelling market conditions.”

In his view, Varonis’ shares are worth a Buy rating, with an $86 price target. This figure suggests an upside of 40% in next 12 months. (To watch Smith’s track record, click here)

Varonis’ Strong Buy consensus rating is based on 6 recent reviews, that include 5 Buys against just 1 Hold. The stock is selling for $61.41 and carries a $77 average price target, indicative of a 25% one-year upside potential. (See VRNS stock analysis on TipRanks)

To find good ideas for cybersecurity stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.