Hedge funds are repurchasing Chinese stocks. JPMorgan (JPM) recently released a note stating that various multi-strategy hedge funds are buying back into the Chinese market after a period of vicious selling.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

It remains doubtful whether the recent buying spree will persist. According to JPMorgan’s hedge fund team: “Whether this trend continues is likely dependent on a number of macro risks that might need to be overcome, such as higher inflation, supply chain issues from the Russia/Ukraine conflict and COVID-19 lockdowns, and the risk of a growth slowdown.”

I could see the buying trend continue as Chinese stocks are largely oversold. I’ve identified three Chinese stocks that hedge funds are buying. I’m bullish on all of them.

Baidu (BIDU)

Baidu operates as an internet data company and holds a lucrative market position. Baidu’s user base has surged lately, with its mobile ecosystem’s monthly active users now standing at 632 million. Additionally, its AI cloud developer community has reached 4.77 million, and its IQIYI (IQ) daily subscribers currently amount to 101 million.

Furthermore, Baidu’s been able to monetize its large following. The company’s first-quarter report stated that its quarterly revenue expanded 18% amid 35% year-over-year growth of its core non-ad revenue. In addition, Baidu aims to cut its content costs considerably as it establishes bargaining power over its suppliers.

Baidu stock is significantly relatively undervalued on a normalized basis. For instance, the stock’s price-to-sales ratio is at a 48.1% normalized discount to its five-year average, and its price-to-book ratio is at a 52.9% normalized discount for the same time frame.

Hedge funds have snapped at Baidu’s prospects by adding 893,200 in net shares during the previous financial quarter. According to TipRanks’ hedge fund tracker, big names such as Ray Dalio and Richard Driehaus recently added Baidu stock to their portfolios.

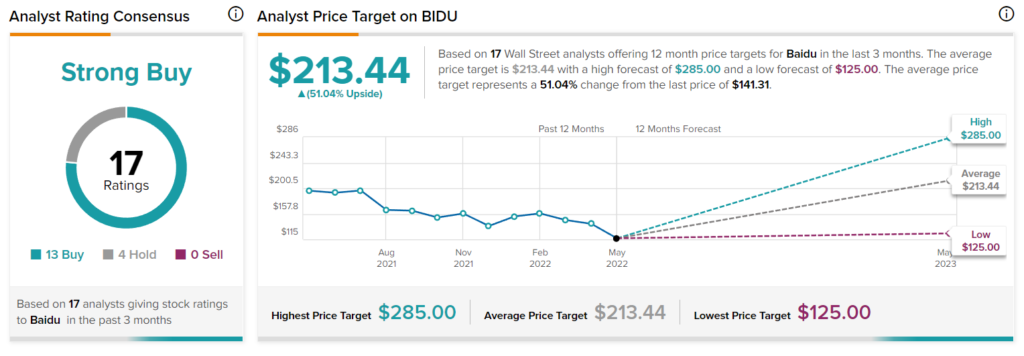

Turning to Wall Street, Baidu earns a Moderate Buy consensus rating based on 11 Buys and four Hold ratings assigned in the past three months. The average Baidu stock price target of $213.44 implies 51.04% upside potential.

Alibaba (BABA)

BABA investors have all experienced a topsy-turvy time lately. Due to its prominent presence that spans a large part of the Chinese ADR space, Alibaba stock is inextricably linked to China’s economic prospects. China’s economic climate has been volatile during the past two years, causing Alibaba to shed much of its market value. However, investors seem to have overreacted, as the stock is in oversold territory.

Alibaba recently reported its fourth-quarter earnings, revealing an earnings target beat of 10 cents per share. Alibaba’s quarterly results convey that the company’s active customers have increased by 2% (year-over-year) in China and 13% (year-over-year) internationally.

Looking ahead, Alibaba could benefit from a recovery in its “China commerce” segment. China’s stringent COVID-19 policies have slowed manufacturing output. However, as the virus wanes, we’re likely to see the firm generate improved results in the business unit that spans 69% of its revenue mix. Moreover, China is one of the few nations that isn’t struggling with high inflation, meaning that Alibaba possesses the capacity to avoid input cost-related headwinds.

Furthermore, hedge funds are clearly upbeat about Alibaba’s prospects. TipRanks’ 13-F tracker indicates that hedge funds added a net 676,700 shares of Alibaba stock to their portfolios during the previous financial quarter. Most notably, John Paulson increased his stake in the company by 1.81x, conveying a sense of belief among Wall Street’s heavyweights.

Turning to Wall Street, Alibaba earns a Strong Buy consensus rating based on 17 Buys and two Hold ratings assigned in the past three months. The average BABA stock price target of $159.84 implies 71.17% upside potential.

NIO (NIO)

NIO stock is a secular play. The electronic vehicle manufacturer recently released its May deliveries report, which revealed a 38% increase in deliveries.

During the month, manufacturing in China has gradually improved, allowing enhanced upstream functionality for NIO. Additionally, NIO made a conscious effort to partner with various entities to curb its supply-chain problems. In turn, the company expects more immediate manufacturing processes during the latter part of the year to accommodate the rising global EV uptake.

NIO’s secular growth prospects are conveyed by its quantitative metrics. During the past year, the company’s revenue has increased by 22.3%, its EPS increased 41.7%, and its book value increased 28%.

Hedge funds have piled into NIO stock due to the firm’s robust growth. According to TipRanks’ hedge fund screening tool, hedge funds have added 3.5 million net shares during the past financial quarter, with Catherine Wood leading the pack after she entered a new position in NIO stock.

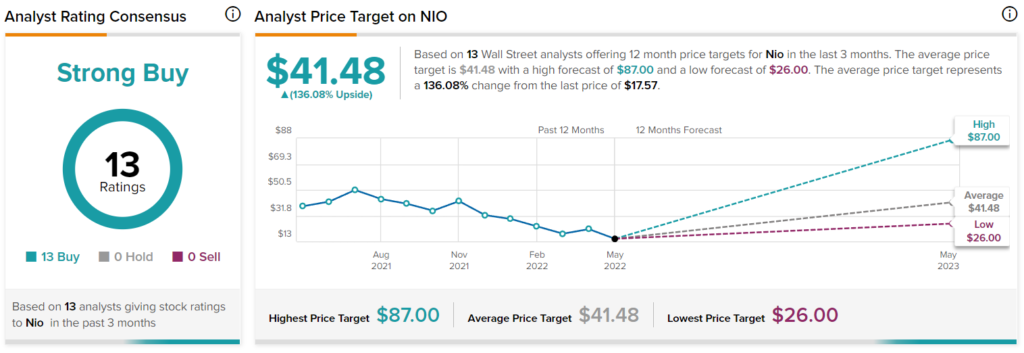

Turning to Wall Street, NIO earns a Strong Buy consensus rating based on 13 Buy ratings assigned in the past three months. The average NIO stock price target of $41.48 implies 136.08% upside potential.

Concluding Thoughts

There are a lot of risks linked to Chinese equities and Chinese depositary receipts. Nevertheless, it seems as though risk/return prospects could be positively skewed as many Chinese assets are trading below their fair value. In addition, the bullish rhetoric from multi-strategy hedge funds suggests that Chinese stock prices may have finally bottomed out. Thus, we could see a surge in many of the big names soon.