Wall Street observers hoped recent gains signaled the arrival of blue skies, but the COVID-19 storm is thundering on. Stocks started shedding gains this week on fears of a possible second wave of coronavirus infections and a grim forecast for the economy from the Federal Reserve.

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks' Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

A situation like this is tailor-made for defensive stock plays – and that will naturally bring investors to look at high-yield dividend stocks. But not all dividend stocks are created equal. Top analysts from Oppenheimer have chimed in – and they are recommending high-yield dividend stocks for investors looking to find protection for their portfolio.

Using TipRanks database, we’ve pulled up the details on some of Oppenheimer’s recommendations. These are stocks with a specific set of clear attributes, that frequently indicate a strong defensive profile: a high dividend yield, over 8%; a Moderate Buy consensus view; and a considerable upside potential — over 20%. So let’s take a closer look at three of Oppenheimer’s picks.

Monroe Capital (MRCC)

We’ll start in the financial sector, with Monroe Capital. This private equity firm invests in the healthcare, media, retail, and tech sectors. These companies promote demographics that have less access to traditional capital resources; Monroe has stepped in to address the need.

The company’s earnings took a hit in Q1, which was no surprise. The coronavirus economic hit was broad based and deep, so it was no surprise that MRCC reported 33 cents per share, or 5.7% below the forecasts. Revenue, at $16.2 million, was 2.5% below estimates, but up 8% year-over-year.

Through all of that, Monroe has maintained its dividend payment. The company has an 8-year history of keeping the dividend reliable – an enviable record. Current earnings were not enough to keep the dividend at its 35-cent quarterly level; the next payment, due out on June 12, will be 25 cents per share. The downward adjustment is to keep the dividend in line with earnings. Even with the reduction, the dividend gives an annual yield of 12.2%, which is just plain stellar.

Oppenheimer’s Chris Kotowski sees plenty of reasons for optimism in MRCC’s long-term prospects. The 5-star analyst writes of the company, “We see relatively comfortable coverage in the next several quarters, a ~$10 NAV by year-end 2021 and see the stock as oversold relative to those expectations.”

“…management expects payment in 2Q20 on its $19M Rockdale Blackhawk position (currently in bankruptcy) following a favorable judgment. Proceeds will boost investment income once rotated into yielding assets or paying down debt. In addition, MRCC had ~$82M of liquidity at 3/31 across cash on balance sheet and its SBIC and the remaining draw on its credit facility, exceeding the unfunded commitment balance of $38.3M,” the analyst added.

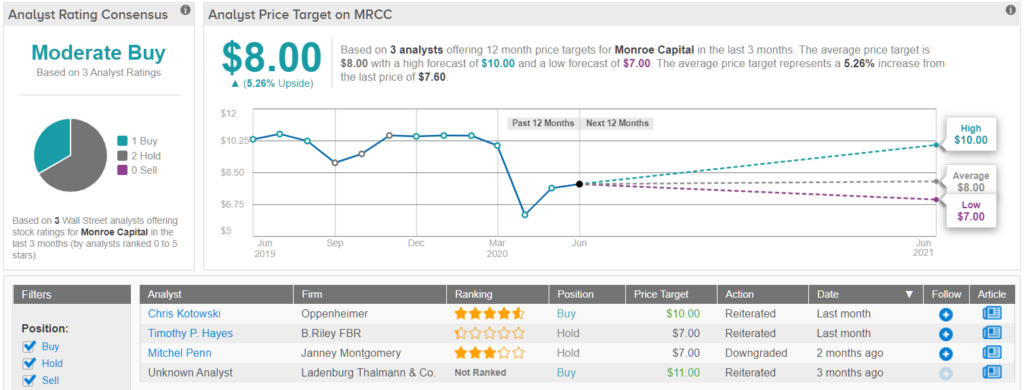

Kotowski gives MRCC a Buy rating, and his $10 price target suggests an upside of 31% for the coming year. (To watch Kotowski’s track record, click here.)

Overall, MRCC shares have a Moderate Buy rating from the analyst consensus, based on 1 Buy and 2 Holds set in recent months. Rapid appreciation in the last couple of sessions has pushed the stock price near the $8 average price target. (See Monroe Capital stock analysis on TipRanks)

Solar Senior Capital (SUNS)

Next up is another finance company, Solar Senior Capital. SUNS is management investment company, in the externally managed non-diversified segment. Its primary investments are senior secured loans in mid-market companies with credit ratings below investment grade. Solar Senior invests first and second lien debt, as well as unitranche instruments.

Solar avoided the big earnings hit that pummeled so many companies in Q1, and reported 35-cents EPS for the fifth quarter in a row. Along with the positive earnings, SUNS reported $234.1 million in net assets for the quarter, and $220 million in available capital.

In area, SUNS did respond to the coronavirus epidemic. Starting in May, the company reduced its long-time stable dividend from 12 cents monthly to 10 cents. Management announced that the June payment will also be 10 cents per share. The reduced dividend payment annualizes to $1.20, and gives a yield of 9%.

SUNS was reviews by Oppenheimer’s Chris Kotowski, who saw reasons for buying in now. “The good news,” he wrote, “is that starting with an underlevered balance sheet and $21M of net repayments in the quarter and a well-priced debt issuance, SUNS has ample capital and liquidity to take advantage of the current market dislocation.”

Kotowski rates SUNS a Buy and maintains a $15 price target, which implies a 21% upside potential. (To watch Kotowski’s track record, click here)

SUNS has just two recent analyst reviews, but both are Buys, making the Moderate Buy analyst consensus rating unanimous. Shares are priced at $12.40, and the $16 average price target indicates room for 29% upside growth over the next 12 months. (See Solar Senior stock analysis on TipRanks)

Outfront Media, Inc. (OUT)

Last on our list is Outfront Media, a marketing company with a specialty in billboards and posters. The company uses electronic tech to update these traditional marketing staples, which remain an important part of urban marketing; billboard and posters, especially transit posters, have potential audiences in the millions. Outfront is, technically, a real estate investment trust – it owns advertising location properties, and leases them to the marketers.

The economic slump in Q1 was hard on Outfront. The combination of social lockdowns and business and travel restrictions prevented normal operations, and outdoor advertising – which in these conditions did not pay for itself – took deep cuts.

Even with that, OUT beat the Q1 earnings estimates. The company reported 28 cents per share, down 62% sequentially but beating the forecast by 33%. Looking ahead, however, analysts see SUNS entering a trough, with Q2 earnings estimated at a 21-cent net loss per share.

On the dividend front, OUT paid out 38 cents per share in March, increasing the dividend from its long-term value of 36 cents. The new payment makes the yield 8.76%, a strong attraction for any income-minded investor.

Covering this stock for Oppenheimer, analyst Ian Zaffino believes that Outfront holds a good position for long-term recovery, writing, “We continue to view June/July as the bottom and estimate a return to near preCOVID-19 levels sometime in 4Q20. Given OUT’s heavy exposure to the larger markets and national advertisers, it should enjoy a more aggressive recovery than its more local-focused peers.”

Zaffino puts a $20 one-year price target on OUT, indicating a 32% upside to go along with his Buy rating. (To watch Zaffino’s track record, click here)

What do other analysts say about the ad firm? It’s almost split. TipRanks analytics shows out of 5, 3 analysts are bullish on OUT stock, while 2 are sidelined. The consensus price target of $17.40 shows a potential upside of 14%. (Click here to see OUT’s price targets and ratings)

To find good ideas for dividend stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.