The current market conditions – the NASDAQ is down 29% year-to-date, and the S&P 500 is down 21% – offer bargain hunters a target-rich environment. Plenty of sound stocks have seen their prices decline, pulled down by the general market headwinds and the overall stock trend, to levels that have left them too cheap to ignore.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

At this level, investors can find the benefits of cheap stocks, which offer both learning opportunities and strong upside potential. However, in evaluating stocks to buy, it is important to look at more than just the price.

Wall Street’s analysts are taking note, and are looking for the ‘Strong Buys’ among the market’s cheapest stocks. Some of their picks make interesting reading, and we’ve opened up the database at TipRanks to pull up the details on two of these stocks. Let’s take a closer look.

Azek Company (AZEK)

First on our list today is Azek, a company in the outdoor life niche. Azek manufactures decking and home exterior siding products, and in a unique twist, the company sources its building materials from providers of 100% recycled materials. Azek boasts of the ‘green’ nature of its business, and how it can potentially recycle 500 million pounds of waste and scrap materials annually. The company products are not only sustainably sourced, but also long-lasting – and capable of replacing traditional wooden home siding.

Azek presents investors with an interesting case to follow. Some recent data (declines in new home showings, for example) have indicated that the US real estate market is slowing down – but home improvement is a lagging indicator for that, and Azek reported strong results in its financial release for Q2 of fiscal year 2022. The quarter, which ended on March 31, showed $393.3 million at the top line, up 35% year-over-year – and the best top line result in over two years. The company adjusted net income jumped 29% y/y, to reach $50.8 million, and translated into a 33-cent adjusted diluted EPS, up 32% from the year-ago quarter.

Despite the overall positive results of the company’s recent performance, shares in AZEK are down 63% since the start of this year. However, Truist 5-star analyst Keith Hughes sees the fall in share price as an opportunity to get in on this stock.

“We believe the stock continues to price in a far worse downturn than is most likely realistically realized. The secular growth story remains unquestioned, and we believe that composite decking will retain price even in a weak demand scenario regardless of capacity adds in industry. We believe this point is a significant hurdle for many investors and realization could be a substantial AZEK catalyst at some point,” Hughes opined.

Hughes’ upbeat outlook informs his Buy rating on the shares, and his $30 price target implies a 12-month upside potential of 78%. (To watch Hughes’ track record, click here)

With 17 recent analyst reviews on record, this construction contractor firm has picked up plenty of attention – and the bulk is positive. The reviews break down 16 to 1 in favor of Buys over Hold, and support the Strong Buy consensus rating. Shares are priced at $16.86 and have an average target of $26.93, indicating room for ~60% growth ahead. (See AZEK stock forecast on TipRanks)

Cars.com (CARS)

Now we’ll switch gears to Cars.com, one of the tech world’s truly durable names. This company got its start in 1998, as part of the late-90s dot.com bubble, and it survived the crash that followed when the bubble burst. Cars.com, which has since emerged as one of the leaders in the online automotive digital marketplace, gives car buyers the resources, data, and digital tools they need to navigate the car dealers and find the right vehicle at the right price.

Cars.com boasts a $692 million market cap today, along with more than $620 million in annual revenues and $189 million in annual adjusted income. The cars.com website had 592 million visits last year, 25.1 million monthly active users, and the company’s network included over 19,000 auto dealers. Cars.com, in its most recent quarter, 1Q22, showed top line sales of $158.2 million, in line with last six quarterly results. EPS slipped by 25% year-over-year, from 8 cents to 6 cents.

The company saw a decline in cash flow y/y, with free cash flow dropping from $44.1 million in 1Q21 to $26.4 million in 1Q22. Management attributed the decline mainly to a one-time tax refund received last year, of $9.1 million. Looking ahead to Q2, Cars.com is expected revenue to reach the range of $161 million to $163 million; at the midpoint, this would provide y/y growth of 5%.

CARS stock is down 42% so far this year. That can be attributed, in part, to the general market downturn. However, the drop in share price has not deterred Craig-Hallum’s 5-star analyst Steve Dyer from taking an optimistic view of the stock.

“Trading at 7x EBITDA with a double-digit FCF yield, we believe CARS represents an attractive way to play a gradual rebound in auto sales through this year and next. CARS is one of two broad-based marketplaces that continues to add services and functionality for dealers, who continue to move their marketing spend on-line. Given these tailwinds, we like the CARS risk/reward going forward,” Dyer wrote.

Dyer’s view backs up his Buy rating on the shares, and his $17 price target suggests it has a 82% upside to look forward to. (To watch Dyer’s track record, click here)

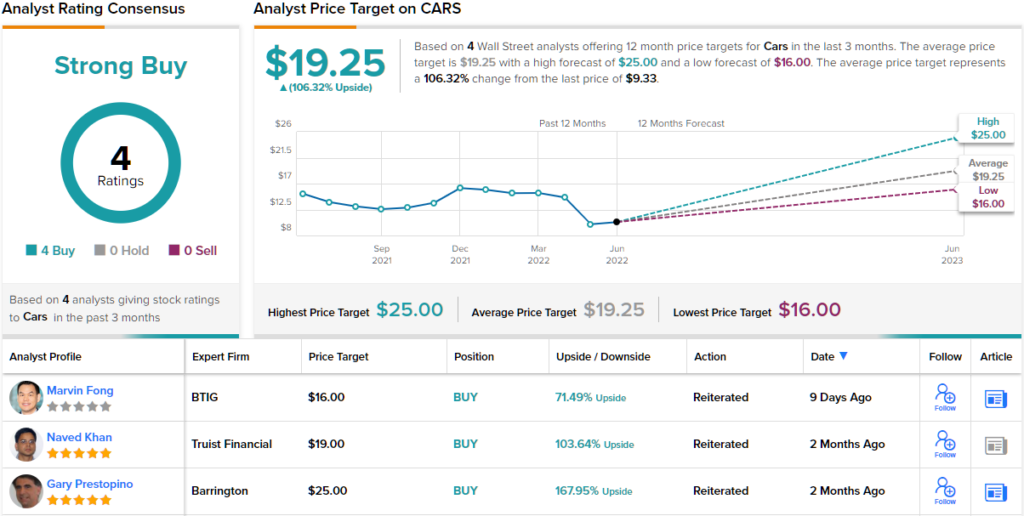

While Cars.com may be a holdout from the 90s, Wall Street still likes it. The stock has a unanimous Strong Buy analyst consensus rating, based on 4 positive reviews set in recent weeks. The shares are trading for $9.33 and their $19.25 average price target implies a one-year gain of ~106%. (See CARS stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.