Stocks are swinging wildly this month, as President Trump’s latest tariff moves continue to send shockwaves through the markets. His across-the-board policy shifts have rattled investors and put heavy pressure on equities, with the S&P 500 down by 8.5% and the NASDAQ by 9% in April.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

But even when the broader market stumbles, momentum can still drive individual names higher. Ask any pro athlete – momentum is everything. A pitcher hits a rhythm and racks up strikeouts. A point guard gets hot and suddenly can’t miss. A quarterback starts seeing plays before they happen. The same principle applies to stocks: when a name starts moving, it can build serious steam.

The key is recognizing the true momentum stocks and separating them from the fads or the flashes in the pan. The true momentum stocks will hit several themes, including strong gains, a solid upside potential, and plenty of love from the Wall Street analysts.

Against this backdrop, we’ve used the TipRanks platform to seek out stocks that fit this profile and have found two such ‘Strong Buy’ tickers that jumped over 30% this month despite the broader market’s retreat. Let’s give them a closer look.

Simulations Plus (SLP)

The first momentum stock we’ll look at here, Simulations Plus, fills a fascinating niche in the fields of software and medicine. The company develops software packages for modeling and simulation systems, targeting its packages toward the pharmaceutical and biotech industries. The company’s software is used to support drug discovery and development, and to back up regulatory submissions, by providing virtual models of drug effects. Simulations Plus offers solutions that make use of AI and machine learning to give researchers the best possible simulations of physiologically based pharmacokinetics, quantitative systems pharmacology/toxicology, and population PK/PD modeling.

Simulations Plus uses licensed technology, and puts it at the service of major pharma, biotech, chemical, and consumer goods firms, as well as regulatory agencies, around the world. The company’s services include consulting, to back up early drug discovery and medical communications, with the aim of reducing costs in R&D and allowing clients to make better decisions on their projects.

On the financial side, Simulations Plus beat expectations in its most recent quarterly results, covering the second quarter of fiscal year 2025 (February quarter) and released earlier this month. The company’s revenue, at $22.4 million, was up 22.6% from the prior-year period, and exceeded the estimates by a half-million dollars. The firm’s earnings figure, at 31 cents per share in non-GAAP measures, was a nickel better than the forecast. The software segment made up 60% of the total revenue, $13.5 million, and was up 16% year-over-year; the services segment, at $8.9 million, was 40% of the total and was up 34% year-over-year.

We should note here that this tech firm has, recently, been translating its success to its stock performance. Shares in Simulations Plus are up 39.5% so far for April.

Strong quarterly performance, an essential set of products and services, and a sound position in the AI and software sectors have caught the attention of Craig-Hallum analyst Matt Hewitt, who writes of Simulations Plus, “We continue to believe that SLP is well positioned to grow revenues and profits. With increasing interest in AI (SLP has been incorporating AI into their software long before it became a buzzword) and simulation (whose use is supported by the FDA) we expect continued adoption by the pharma industry as they continue to seek ways to bring drugs to market faster and cheaper… The company delivered a solid Q2 performance and reaffirmed its guidance for the year… Considering the crucial role the company plays in the development of drugs, as well as the pharmaceutical industry as a whole being unaffected by the new tariffs, we see SLP as a stock investors should own.”

A ‘stock that investors should own’ is a recipe for a Buy rating, which Hewitt backs up with a $45 price target that implies a one-year upside potential of 33%. (To watch Hewitt’s track record, click here)

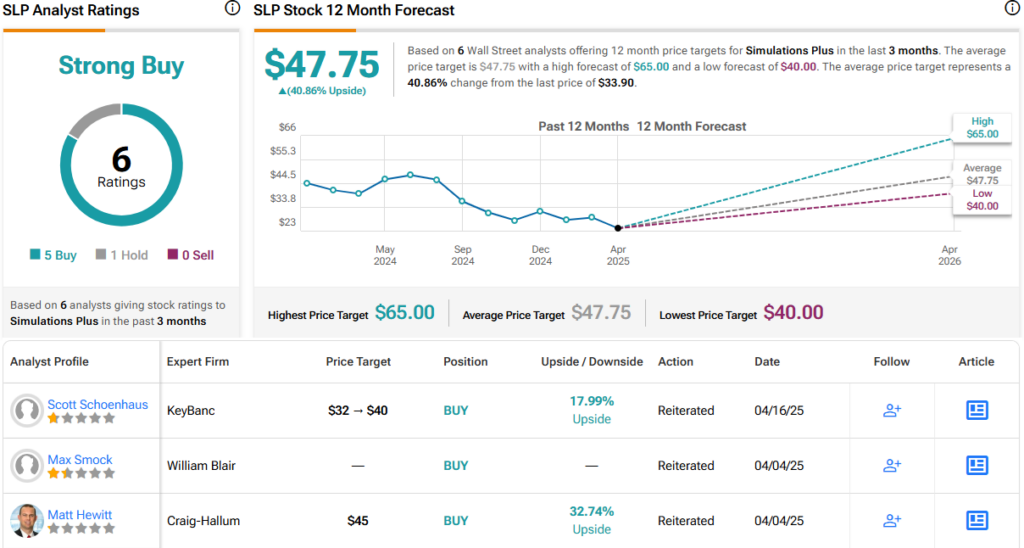

The Strong Buy consensus rating here is based on 6 recent analyst reviews that are lopsidedly split between 5 Buys and 1 Hold. The stock’s $47.75 average target price and $33.90 current trading price together point toward a one-year gain of 41%. (See SLP stock forecast.)

Schrodinger (SDGR)

Next on our list is another software company with links to the pharmaceutical industry. Schrodinger has created a proprietary computational platform designed to aid in the development of new molecular compounds. These are the very building blocks of the pharmaceutical industry, the basic components of new therapeutic agents. They’re based on multiple scientific fields, including chemistry, physics, and predictive modeling, and Schrodinger’s platform offers researchers a way to design new molecules while realizing savings in both time and money.

The company’s software systems allow researchers to create new compounds and materials at the molecular level, bringing digital tech and high-end computations to bear on practical chemistry. While Schrodinger’s platform can be used in multiple fields, its application to the pharmaceutical industry has generated the most attention. Schrodinger’s platform, in the pharma field, has yielded a strong pipeline of new molecular compounds, including three that have reached the human clinical trial stage. Shifting attention to the field of materials science, the company has developed compounds for a wide range of fields, including specialty chemicals, oil & gas, aerospace, and semiconductors.

Turning to Schrodinger’s financial results, we find that the company brought in $88.3 million in 4Q24, for a 19% year-over-year increase – and that it beat the forecast by $5.1 million. The company operates at a loss, and recorded a non-GAAP EPS of negative 24 cents in Q4, although we should note that the net loss beat expectations by 14 cents per share. We should also note that shares in SDGR are up 33% for the month of April, the stock’s surge following the FDA’s move to phase out animal testing, a development that favors its computational drug discovery platform.

Brendan Smith, of TD Cowen, covers this stock – and he is impressed by Schrodinger’s strong business growth as well as the boost it can expect from successful trials of its pharmaceutical compounds. He says of the company, “Continued growth in Schrodinger’s proprietary software business gives us confidence in management’s ability to execute and recent sector-wide tailwinds from increased demand for computational modeling/AI-powered software offerings could drive meaningful upside to current valuation over time. Upcoming clinical catalysts will be key opportunities to further validate the company’s physics-based platform and drive renewed interest in the company’s internal clinical pipeline as well.”

These comments support Smith’s Buy rating on SDGR, while his $33 price target suggests that the shares will post a 26% gain in the year ahead. (To watch Smith’s track record, click here)

There are 7 recent analyst reviews on this stock, with a breakdown of 6 Buys and 1 Hold giving a Strong Buy consensus rating. The shares are currently trading for $26.19 and the $34 average price target points toward share appreciation of 30% over the one-year time horizon. (See SDGR stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.