It isn’t all about chip stocks when it comes to the early innings of the artificial intelligence (AI) boom. Undoubtedly, 2024 has seen everything tech take a subtle jab to the chin so far. But just because tech is having a mild pullback does not mean the rise of AI is about to take a breather. Indeed, many big names want AI’s progress to pause or, at the very least, slow down. However, such a pause would be hard to enforce, and, at this juncture, it doesn’t seem to be happening.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

As AI hype begins to cool off with every sell order in AI-driven tech stocks, the AI innovators themselves are still hungry to go full speed ahead. Indeed, there’s a lot on the line in the AI race. So, don’t count on firms pulling back on AI spending, even if budget cuts carry over into 2024.

In this piece, we’ll check out an overlooked area of the tech scene that stands to benefit a lot from continued advancements in AI. The dating app market has been quite rocky through 2023, with industry juggernaut (and current heavyweight champ) Match Group (NASDAQ:MTCH) finishing the year in the red.

Meanwhile, things haven’t been much better for rival Bumble (NASDAQ:BMBL), which is hovering around its all-time lows of $13 and change, down more than 80% from its Wall Street debut peak back in early 2021.

AI + Dating Apps: The Perfect Match?

Undoubtedly, dating apps aren’t exactly what you’d consider cutting-edge or high-tech. Furthermore, every local single that’s matched represents two “customers” taken off the market.

Indeed, if Match and Bumble are too good at what they do, it could be very difficult to find repeat customers. In any case, matching can be a very complicated and difficult problem, one that could be made easier and simpler with the rise of next-generation AI algorithms.

Arguably, people are already being matched by some form of AI. As the technology advances, though, I do believe firms that get it right could dominate in the dating app scene, a market that I view as a “winner takes most” kind of battleground.

When it comes to finding dates, there is no loyalty. The firm that can get the job done better, faster, and cheaper will probably win out. In that regard, I believe Fortune favors the heavier weights, given their resources and budget for AI spending.

That’s not to say Bumble and other rivals can’t put up a good fight with Match Group. However, I believe Match Group has yet to meet its match (pardon the pun), given its wealth of brands, including the incredibly popular Tinder app.

Match Group (NASDAQ:MTCH)

Match Group is probably the go-to play for investors seeking exposure to matching (or dating). The company’s decision to offer an invite-only $499 monthly subscription tier for Tinder has drawn a lot of attention. Now, that’s a considerable sum for a monthly membership.

However, if it pays itself off in helping one find the perfect match promptly (time is, in fact, money), the price is arguably not as absurd as it seems. Only time will tell how much demand there will be for the product. My guess is it’s a genius move by Match, one that could help the firm really push toward profitability in a market it continues to dominate. Additionally, Match Group is hard at work on AI technologies behind the scenes.

Reportedly, Tinder already has an AI tool that helps users pick their best photos. Though such AI-driven tools are hardly an AI “wingman,” I wouldn’t be too surprised if further advancements move in that direction. Either way, I’m bullish on Match Group and believe most investors overlook AI’s potential in driving profitability and share-taking potential.

Is MTCH Stock a Buy, According to Analysts?

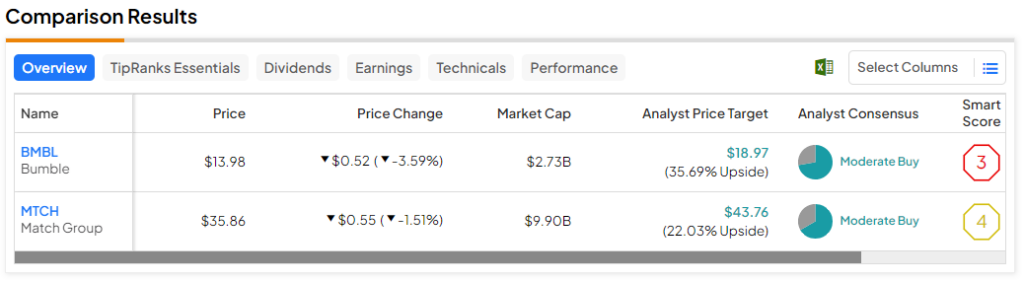

Match stock is a Moderate Buy, according to analysts, with 12 Buys and six Holds assigned in the past three months. The average MTCH stock price target of $43.76 implies 22% upside potential.

Bumble (NASDAQ:BMBL)

Though Match is my top pick to play the space, Wells Fargo (NYSE:WFC) views Bumble as a better match for portfolios, initiating coverage on the stock with a Buy rating. Wells Fargo gave it a $19.00 price target, entailing around 36% upside from here.

As a smaller player, Bumble has more market share to grab from the likes of Match, even amid the “slowing online dating market.” Ken Gawrelski of Wells Fargo stated his belief that Bumble’s app could gain 500,000 payers per year. That’s a big deal. Still, while Bumble may have more room to fly, I’m not so sure that much buzz (again, forgive the pun) is warranted as we enter the AI age.

Either way, it’s hard not to be intrigued by the rise of Bumble’s AI-generated icebreakers for “Bumble for Friends.” It’s a big step towards having an autonomous and effective AI wingman, but only time will tell if it’s enough to crush the moat of its bitter rival, Match. I think there’s a chance it could, and for that reason, I’m inclined to be mildly bullish on Bumble as well.

Is BMBL Stock a Buy, According to Analysts?

Bumble stock is a Moderate Buy, according to analysts, with 13 Buys and five Holds assigned in the past three months. The average BMBL stock price target of $18.97 implies 35.7% upside potential.

The Bottom Line

The race to dating dominance likely lies in AI. For now, Match and Bumble have been investing in intriguing tools. But which will have the better AI “wingman” in five years? I’m not so sure, but whichever firm perfects it may finally get to rise out of their multi-year funks. Personally, my bet is on Match, but I’d not be afraid to own shares in both companies, as they both have upside potential.