The only thing truly predictable about the stock market’s current volatility is its unpredictability. The fast-moving shifts in prices have prompted spurts of both selling and buying – you can’t have one without the other – that have left some stocks oversold, and trading much lower than they should.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Wall Street’s analysts make all sorts of stocks picks, and they don’t shy away from tapping oversold stocks as positive choices. We’ve used TipRanks database to pull up the latest scoop on two such stocks. Both Strong Buys with substantial upside potential, according to the analyst community. Let’s get a look at the details.

Post Holdings (POST)

Let’s start in kitchen pantry, where most of us have some of Post Holdings’ products. This company owns a broad portfolio of consumer staple brands, including its eponymously branded breakfast cereals and well-known names such as Weetabix and Bob Evans. Looking at the discount side, Post shares are down ~17% from January’s peak and now sit near 52-week low.

The company has felt the effects of changing market conditions in the past two years. A consumer move toward home cooking benefited the company during the worst of the corona crisis, and the early stages of price inflation last year were also reflected in rising revenues.

In the company’s last quarter, fiscal 1Q22 which ended on December 31, the headwinds started to dominate. Top line revenues came in at $1.64 billion. While this was down 3% from the previous quarter, it was in-line with expectations – and was up nearly 12% year-over-year. Earnings, however, told a different story. The company reported a diluted loss per common share of 25 cents – an unfortunate turnaround from the $1.21 profit in the year-ago quarter.

Looking at the silver lining, Stifel analyst Christopher Growe writes: “This performance was encouraging in the face of heavy inflation, the challenging pandemic-related labor issues, and robust pricing taking hold.”

On a note of interest for investors, earlier this month Post completed its spinoff of BellRing brands, a maker of protein and nutrition supplements best known as the distributor of Power Bar. Post distributed its interest in BellRing to shareholders, who now control 57.3% of BellRing’s stock. Post retains a stake of 14.2% in the nutrition supplement company.

“The spin-off of the shares transfers the strong growth profile and outlook for BellRing to Post shareholders, reduces Post’s debt, and also reveals an undervalued company in “RemainCo”. We estimate a roughly 10x EBITDA multiple on the remaining Post EBITDA which we believe can grow at a mid-single digit rate (even faster in the near-term). With a much improved balance sheet (down to nearly 5x EBITDA), we believe Post can repurchase its shares and pursue acquisitions more aggressively,” Growe added.

To this end, Growe rates Post shares a Buy, while his $95 price target indicates ~47% upside potential for the coming year. (To watch Growe’s track record, click here)

Overall, the Wall Street analysts are lining up behind Post. The stock has 5 recent reviews on record, breaking down 4 to 1 in favor of Buy over Hold and giving the stock a Strong Buy consensus rating. POST is selling for $64.43, and its average price target of $91.52 suggests a further upside of ~42% over the next 12 months. (See POST stock forecast on TipRanks)

CareCloud (MTBC)

Let’s shift our focus to the healthcare niche, where CareCloud is a tech firm offering back office needs for health administration providers. CareCloud’s services include medical billing, practice management, transcription, electronic health records management, and telehealth support. The company is a leader in healthcare technology, and its proprietary cloud-based packages make administrative solutions available for more than 40K providers across all 50 states.

Shares in CareCloud are down 48% in the past year, even though the company has been delivering solid revenue numbers. The top line in 4Q21, at $37.5 million, was up 17% over the prior-year quarter, and the 2021 full-year revenue grew 33% year-over-year to reach $139.6 million. The company has also consistently been beating expectations on earnings; while CareCloud typically runs a net loss each quarter, that loss has been narrowing for the past year. In 4Q21, the EPS loss came in at 1 cent, far better than both the 17-cent loss expected and the 26-cent loss reported in 4Q20.

Analyst Allen Klee, watching CareCloud for investment firm Maxim Group, sees a path forward for the company – especially if it can continue posting solid quarterly numbers. He writes, “We believe as management continues to prove its business model on its record of execution and growth, the business model can justify a premium to peers. We believe CareCloud’s business is relatively immune to many of the key overhangs in the market today including supply-chain challenges, higher fuel and commodity prices, and geopolitical risks. The company should also get credit for operating a relatively stable business with a long track record of execution on acquisitions, and growing top and bottom-line results.”

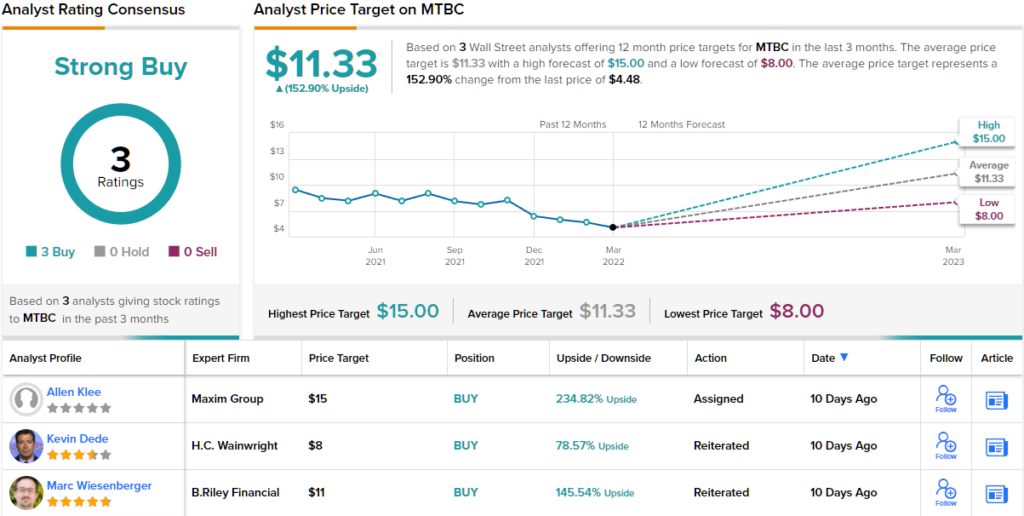

In line with these results, Klee puts a Buy rating on MTBC shares, along with a $15 price target that implies a robust one-year upside potential of ~235%. (To watch Klee’s track record, click here)

Klee is not the only one who sees profits in store for this company – the Strong Buy consensus rating is based on a unanimous 3 positive share reviews. MTBC has a current trading price of $4.49, with an $11.33 average price target to suggests ~153% upside from that level. (See MTBC stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.