Every investor knows that you can’t look to a stock’s past performance as predictor of future gains. It’s become axiom, even, one of the stock phrases that we all learn about in Econ 101: ‘Past performance does not guarantee future returns’ is common formulation. But that simple phrase, while true, raises a tough question: How should an investor judge a stock?

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The truth is, past is prologue, not prophet, and investors can profit by taking past performance as one of many factors in evaluating a stock. There’s no one sure path to success here, and every stock should considered as a unique individual – which makes past performance a useful indicator, even if it’s not the only one.

Investors should also look for Wall Street’s view – are the analysts impressed by the stock? And in addition to that, how does the upside potential look like?

Now we have useful profile for monster growth stocks: gangbusters gains, Buy ratings from the Wall Street analyst corps, and considerable upside for the coming year. Two stocks in the TipRanks database are flagging all those signs of strong forward growth. Here are the details.

BELLUS Health (BLU)

The first stock we’ll look at is BELLUS Health, a clinical-stage biopharmaceutical firm with a research focus on an area that most of us probably never think about: hypersensitivity. This is a condition in which the patient is excessively sensitive to some stimulus – dust, or pollen, or chemicals – which can cause a range of symptoms, including chronic cough. BELLUS is working on a new treatment for just that, chronic cough. The company sees both an unmet medical need and a potentially significant addressable market.

BELLUS has one prime drug candidate in the clinical program, BLU-5937, a P2X3 receptor agonist, which has completed Phase 2 studies and has a Phase 3 trial planned to start in Q4 of this year. In July, BELLUS announced a positive result from meetings with the FDA regarding end-of-Phase-2. The FDA meetings included planning for the CALM Phase 3 pivotal trials, which will include two studies. The first, CALM 1, is set to enroll its first patient in 4Q22, and topline data from the CALM studies is expected to available in 2H24. BLU-5937 has shown good pharmacokinetic characteristics during earlier phases of testing with healthy volunteers.

So BELLUS holds an enviable position for a clinical-stage biotech – and it’s no wonder that the company’s shares are up a whopping 252% in the past 12 months, far outperforming the overall markets.

Among the bulls is RBC analyst Gregory Renza who lays out a clear case for buying in.

“We continue to like BLU shares going into the registrational ph.III (CALM-1 and CALM-2) initiation of BLU-5937 in 2H2022 to generating topline data in 2H2024 following a successful EOP2 meeting, as well as data from their device validation study… We continue to see BLU with best-in-class profile with a competitive position with key differentiation in favorable tolerability in the P2X3 space and peak global sales potential of over $1.4B with more than $900M revenue potential in RCC with upside from potential label expansion into indications linked to P2X3 hypersensitivity,” Renza opined.

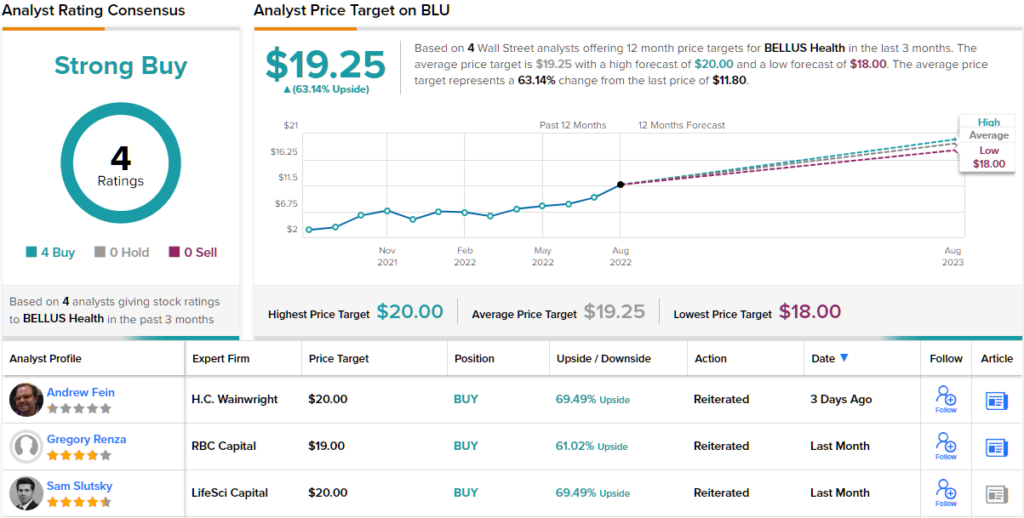

These comments come along with an Outperform (i.e. Buy) rating, and Renza’s price target, at $19, implies an upside of 61% for the coming year. (To watch Renza’s track record, click here)

The RBC view is hardly the only bullish take on BLU; the stock has 4 recent analyst reviews, and they are all positive, supporting the Strong Buy consensus rating. Shares are priced at $11.80, and their $19.25 average price target suggests a 63% one-year upside. (See BLU stock forecast on TipRanks)

Cogent Biosciences (COGT)

The second stock we’re looking at is Cogent Biosciences, another clinical-stage biopharmaceutical researcher. Cogent has one drug candidate at the clinical trial stage, bezuclastinib, and several research tracks at the pre-clinical stages.

Bezuclastinib is a kinase inhibitor, a precision medicine designed to target a particular genetic mutation, KIT D816V, which lies behind systemic mastocytosis. This is a serious, rare, condition that affects multiple organ systems of the body. In addition, the drug candidate can target and inhibit exon 17 mutations, which have been associated with gastrointestinal stromal tumors (GIST). Earlier stage testing, at Phase 1/2 has shown bezuclastinib to be safe and to display promising clinical activity.

Currently, Cogent has three trials underway to further evaluate the efficacy of bezuclastinib: PEAK is a Phase 3 trial against GIST; SUMMIT is a Phase 2 trial against nonadvanced systemic mastocytosis; and APEX is another Phase 2 trial, against advanced systemic mastocytosis. In June of this year, Cogent released positive clinical data from the APEX trial, including >50% reduction in serum tryptase and bone marrow mast cells – important clinical indicators in the condition.

In a point of interest to investors, COGT shares have been soaring since mid-May, gaining about 260%. Analyst Christopher Raymond, in coverage of Cogent for Piper Sandler, sees the company is a strong position to continue its gains.

“As we continue to see bezuclastinib’s mutational selectivity and safety profile as differentiated versus competitors, our thesis on this name remains unchanged and we believe that bezuclastinib may emerge as the preferred KIT-targeting agent across the SM disease spectrum. We continue to see a positive setup for the stock, and this name remains a 2022 top small cap pick,” Raymond wrote.

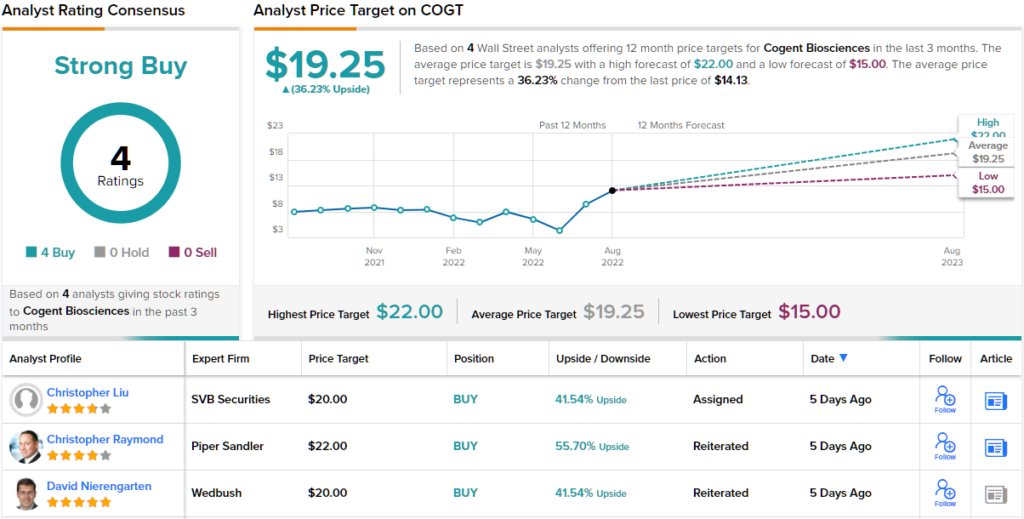

Following from these comment, Raymond rates COGT shares an Overweight (i.e. Buy) and sets a $22 price target – enough to imply a further ~56% upside after recent gains. (To watch Zhu’s track record, click here)

Overall, this small-cap biotech has picked up 4 recent analyst reviews – and they are unanimously positive, giving the shares a Strong Buy consensus rating. The average price target of $19.25 suggests a solid 36% upside from the current trading price of $14.13. (See COGT stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.